The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Thursday higher, low confidence.

- ES pivot 1947.17. Holding below is bearish.

- Friday bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Whoa! Looks like Halloween came early this year as Mr. Market started off the spooky month of October with a 238 point trick for the Dow, not treat. I'm glad I made Wednesday a conditional call. ES never made more than a token attempt on its pivot Wednesday and the end result was lower in a big way. But big moves make for interesting charts so now we've got some real meat to chew on. So let's chow down on Thursday - pass the hot sauce!

The technicals

The Dow: On Wednesday the Dow basically just fell out of bed and never got up with a 1.4% plunge that closed way below its lower BB®. We gave up support at 17K like it wasn't even there, then 16,950, then 16,890 and finally stopping at 16,805 only because the bell rang. That disconfirmed Tuesday's spinning top in a real big way, keeps us off the left side of the descending RTC and leaves all the indicators in confusion. With three down in a row now, there's really nothing bullish about this chart.

The VIX: Oddly, while the VIX advanced on Wednesday, it was only up 2.45%, not much considering the slaughter on the Street. And while we remain in a rising RTC, we now have something of a lopsided spinning top reversal warning and overbought indicators. Still, we closed above the upper B at 16.63 making this look a lot like the end of July when it took five whole days around that level before the VIX finally gave up. We've now got 7 out of 8, which I think is a record for the whole time I've been watching this, some 10 years now. This can't go on forever. Also note that VVIX put in a big gap-up evening star doji right to its upper BB and looks ready to move lower.

Market index futures: Tonight all three futures are actually higher at 12:25 AM EDT with ES up 0.12%. Like everything else, ES took a pounding on Wednesday with a big red candle that traded mostly below its lower BB and remained inside its descending RTC. But it was enough to finally drive RSI oversold. There's actually two pieces of good news right now - first, ES isn't falling in the overnight and second, OBV has turned higher for the first time in a week. It's not the greatest reversal sign, but it's better than nothing.

ES daily pivot: Tonight the ES daily pivot plummets from 1968.08 to 1947.17. And even with that giant fall and ES drifting a bit higher in the overnight, we're still below the new pivot, so this indicator remains bearish.

Dollar index: On Wednesday the dollar took a breather with a small red harami that was still good for a 0.03% gain. But there's nothing really new here - the unstoppable uptrend just goes on and on.

Euro: And the euro just continued its slide down the banister of the lower BB on Wednesday to close at 1.2614, a level not seen in just over two year. It's starting to look like the euro wants to have a go at its multi-year support of 1.2279 - we're not that far from it now.

Transportation: The Trans had an even worse day than the Dow on Wednesday (if that's possible), tanking 2.51% on a giant red marubozu that just blasted through support at 8377, the lower BB at 8333, then more support at 8291 before finally ending at the third level of 8239. That was enough to drive it oversold though (I should think!). But this isn't yet a reversal candle so we can't call a bottom here by any means.

The charts are looking pretty grim tonight. But I will point out a few things:

- First, the SPX Hi-Lo index fell back to 19 on Wednesday. It's only been lower three times in the last six months, and all of those marked significant bottoms.

- Second, the NYSE A/D line is now quite low, at -1566. It's more likely to go higher than lower from here.

- Third, bellwether IBM hit its 200 day MA on Wednesday and is quite oversold. If I was into IBM, I'd call this a nice buy point.

- Fourth, Dr. Copper is very close to year-long support.

- Fifth, I think the VIX is ready to move lower, and

- Sixth, the futures are actually running higher this evening.

Therefore, I'm going to go waaay out on a limb and call Thursday higher. I could be wrong. Lord knows I am often enough.

ES Fantasy Trader

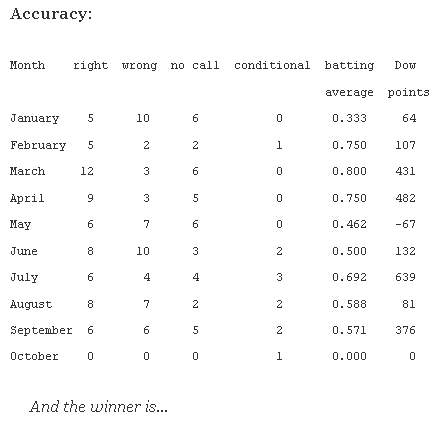

Portfolio stats: the account remains $114,250 after eight trades in 2014, starting with $100,000. We are now 6 for 8 total, 4 for 4 long, 2 for 3 short, and one push. Tonight we stand aside.