It’s a question we have always been accustomed to: Where is the market going?

This question has always grabbed me on two fronts. First, the arbitrary nature of the question and second, it’s asking people to predict the future at a certain time point. We can look to value and we can look to investment grade opportunities, but a price at a certain point in time – not so much.

What adds a third layer to the question is whether or not you have a central bank economics major with honours in psychology so you can fully understand the mentality and actions of central banks around the world – clearly the market does not have this, which makes direction even harder to predict.

What is also more interesting is if you look at what we know now about macro direction compared to how the market predicted/reacted to those macro developments over the same time period, it still got its positioning and direction wrong. The clearest example of this statement is how macro funds are severely underperforming hedge fund peers.

That brings me to where we are in the cycle now. The monetary-policy-watcher world has now turned decidedly bearish after last Friday’s Fed meeting. The indecision and the lack of direction from the Fed means there are more questions than answers.

For example:

- Will there actually be a hike in 2015? The market pricing of a December hike fell from an 80% chance to a 50% chance after the meeting.

- Where is growth heading? The Fed downgraded its growth outlook, inflation forecasts and shifted the dot plots lower as well. Dovish as dovish gets.

- Does holding the line mean the Fed knows something we don’t? This is the biggest question to come out of last Friday’s announcement. The real dovish tone of the statement, press conference and the Q&A has led to the conclusion that the Fed is becoming increasingly concerned about the global backdrop. This will led to very open-ended interpretations.

If emerging market risk coupled with a low growth European environment is affecting Fed decision making, sentiment uncertainty will amplify – and it did during the US trading session, with a massive sell-off on Friday.

Fed members went into overdrive over the weekend with Lacker, Williams and Bullard all laying out cases for why a hike will happen in 2015. However, these three have being making that case for the past nine months and have so far been ignored. Until Chairperson Yellen herself states that the Fed is raising rates, the uncertainty will reign.

‘Where’s the market heading?’ The answer is becoming harder and harder to define.

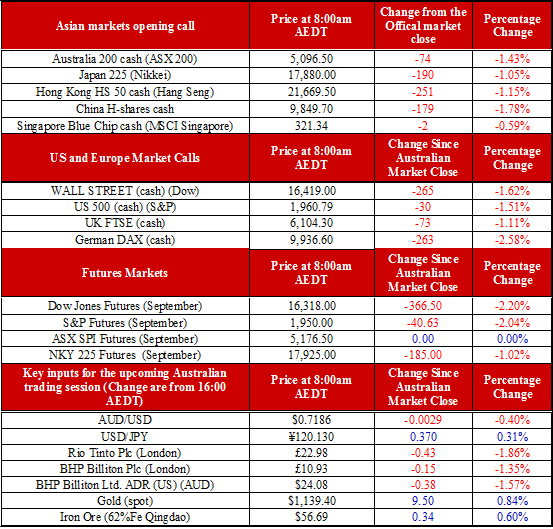

Based on the futures markets from Saturday we are calling the ASX down 74 points to 5096.