The XXXI Olympics in Rio, Brazil begin this week, but stocks in 2016 have already won a gold medal for their stellar performance.

The S&P 500 index has already triumphantly sprinted to new, all-time record highs this month. A significant portion of the gains came in July (+3.6%), but if you also account for the positive results achieved in the first six months of 2016, stocks have advanced +6.3% for the year. If you judge the 2%+ annualized dividend yield, the total investment return earns an even higher score, coming closer to +8% for the year-to-date period.

No wonder the U.S. is standing on the top of the economic podium compared to some of the other international financial markets, which have sucked wind during 2016:

- China Shanghai Composite Index: -15.8%

- Japan Nikkei Index: -12.9%

- French Paris CAC Index: -4.3%

- German Dax Index: -3.8%

- MSCI Europe Index: -3.5%

- Hong Kong Hang Seng Index: -0.1%

While there are some other down-and-out financial markets that have rebounded significantly this year (e.g., Brazil +61% & Russia +23%), the performance of the U.S. stock market has been impressive in light of all the fear, uncertainty, and doubt blanketing the media airwaves. Consider the fact that the record-breaking performance of the U.S. stock market in July occurred in the face of these scary headlines:

- Brexit referendum (British exit from the European Union)

- Declining oil prices

- Declining global interest rates

- More than -$11,000,000,000,000.00 (yes trillions) in negative interest rate bonds

- Global terrorist attacks

- Coup attempt in Turkey

- And oh yeah, a contentious domestic presidential election

With so many competitors struggling, and the investment conditions so challenging, then how has the U.S. prospered with a gold medal performance in this cutthroat environment? For many individuals, the answer can be confusing. However, for Sidoxia’s followers and clients, the strong pillars for a continued bull market have been evident for some time (described again below).

Bull Market Pillars

Surprising to some observers, stocks do not read pessimistic newspaper headlines or listen to gloomy news stories. In the short-run, stock prices can get injured by emotional news-driven traders and speculators, but over the long-run, stocks and financial markets are drawn like a magnet to several all-important metrics.

What crucial metrics am I referring to? As I’ve reiterated in the past, the key drivers for future stock price appreciation are corporate profits, interest rates, valuations (i.e., price levels), and sentiment indicators (see also Don’t Be a Fool).

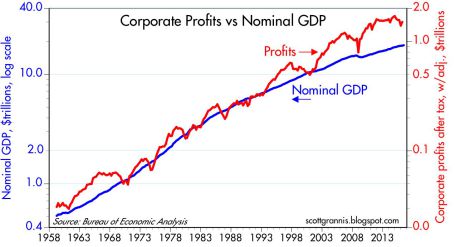

Stated more simply, money goes where it is treated best, and with many bonds and savings accounts earning negative or near 0% interest rates, investors are going elsewhere – for example, stocks. You can see from the chart below, economy/stocks are treated best by rising corporate profits, which are at/near record high levels.

With the majority of stocks beating 2nd quarter earnings expectations, this shot of adrenaline has given the stock market an added near-term boost. A stabilizing U.S. dollar, better-than-expected banking results, and firming commodity prices have all contributed to the winning results.

Price Follows Earnings…and Recessions

What history shows us is stock prices follow the direction of earnings, which helps explain why stock prices generally go down during economic recessions. Weaker demand leads to weaker profits, and weaker profits lead to weaker stock prices. Fortunately for U.S. investors, there currently are no definitive signs of imminent recession clouds.

Scott Grannis, the editor of Calafia Beach Pundit, sums up the relationship between recessions and the stock market here:

“Recessions typically follow periods of excesses—soaring home prices, rising inflation, widespread optimism—rather than periods dominated by risk aversion such as we have today. Risk aversion can still be found in abundance: just look at the extremely low level of Treasury yields, and the lack of business investment despite strong corporate profits.”

Similar to the Olympics, achieving success in investing can be very challenging, but if you want to win a medal, you must first compete. If you’re not investing, you’re not competing. And if you’re not investing, you have no chance of winning a financial gold medal. Just as in the Olympics, not everyone can win, and there are many ups and downs along the way to victory.

Rather than focusing on the cheers and boos of the crowd, implementing a disciplined and diversified investment strategy that accounts for your time horizon, objectives, and risk tolerance is the championship approach that will increase your probability of landing on the Olympic medal podium.

Disclosure: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.