Talking Points

Foreign Exchange Price & Time at a Glance:

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY traded it its highes level in almost 6 years today before stalling near the 127% extension of the 1Q14 range

- Our near-term trend bias remains higher in the rate while above 104.70

- A close over 106.45 is need to set off the next leg higher in the advance

- An important turn window is eyed mid-month

- A close below 104.70 would turn us negative on USD/JPY

USD/JPY Strategy: Like the long side while above 104.70.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

*104.70 | 105.80 | 106.15 | *106.45 | 106.75 |

Charts Created using Marketscope – Prepared by Kristian Kerr

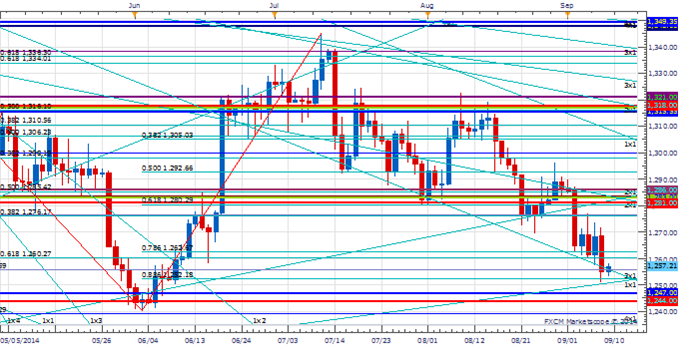

- XAU/USD has come under further pressure to trade at its lowest level since early June

- Our near-term trend bias is lower while below 1296

- The 1240 level remains a major downside pivot with weakness below needed to confirm the start of a more important decline

- A cycle turn window is eyed next week

- A move over 1296 would turn us positive on the metal

XAU/USD Strategy: Square.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

1224 | *1240 | 1256 | 1280 | *1296 |

Focus Chart of the Day:

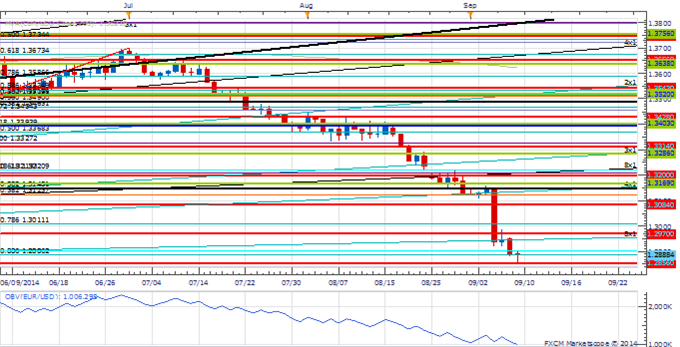

If you have worked in the financial markets long enough you will know that they have a funny way of sometimes making you look foolish. Last week’s acceleration lower in EUR/USD through key support at 1.3025 felt like one of those times. Accelerations in trend around key time periods are not unheard of, in fact, I would estimate they occur about 20% of the time. With respect to the euro I believed it was a much lower probability scenario given the sentiment profile heading into last week as the Daily Sentiment Index (poll of small futures traders) fell to just 6% euro bulls. I still think the sentiment situation remains a major overhang for EUR/USD going forward and at some point we will get a decent “shake of the tree”. The real question is when? With the acceleration through the last window cycle analysis favors weakness into the next important turn window around the end of the month. EUR/JPY might actually be the canary in the coalmine, however, as the middle of the month looks potentially important from a cycle perspective.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com