Arrow Electronics Inc. (NYSE:ARW) reported healthy third-quarter 2018 results. Both the top and bottom lines beat the Zacks Consensus Estimate and improved on a year-over-year basis.

Arrow’s non-GAAP earnings of $2.18 per share outpaced the Zacks Consensus Estimate of $2.16 and increased 19.8% from the year-ago quarter.

The company’s adjusted revenues were $7.49 billion, up 9.2% from the year-ago quarter. The top line also surpassed the consensus estimate of $7.38 billion.

The company’s focus on expanding engineering services and working capital to offer more complete solutions was reflected in its revenues. Arrow believes that its diverse portfolio spread across various regions globally insulates it against any unfavorable economic conditions such as currency fluctuations.

Segmental Details

Adjusted revenues from Global Components increased 10.9% to $5.38 billion. Geographically, the segment’s revenues from the Americas increased 12.3% and revenues from Asia climbed 7.8% year over year. Global components contribution from Europe rose approximately 13.1%.

Adjusted revenues from Global Enterprise Computing Solutions (ECS) came in at $2.11 billion, up 9.2% year over year. ECS revenues from the Americas were up 12.9% while that from Europe increased 1.7%.

The Global Components segment gained from design activity, which showed year-over-year growth of 15%. In the Americas, demand from industrial manufacturing and manufacturing customers during the quarter remained high. For Asia, the key growth drivers were transportation and IoT.

Among the various notable milestones achieved by the company this quarter was the expansion of its association with leading wireless carriers on industry-specific digital transformation solutions. With this, Arrow intends to tap the opportunities presented by 5G, artificial intelligence (AI), IoT etc. in various industries such as manufacturing, retail, finance, healthcare and the public sector.

During the quarter, Arrow continued to expand its efforts in AI by announcing the 2019 opening of its test center for edge computing and AI-based solutions — the Colorado Open Lab.

Moreover, the company announced that it is teaming up with Intel (NASDAQ:INTC) to launch Ambient Science, an IEEE global edge-computing standard, which is going to be showcased at Colorado Open Lab. The lab will serve as the proving ground for the new infrastructure.

In an attempt to fortify its foothold further in the booming AI space, Arrow has partnered with NVIDIA (NASDAQ:NVDA) to work on the latter’s AI computing platform — Jetson Xavier — to deliver advanced AI computing.

Management is optimistic about the increasing cross enterprise engagements, which are expected to continue boosting margins.

However, even though the backlog showed year-over-year increase, growth rate was slow, per the company’s expectations. Book-to-bill was 1.03 for the quarter, down from 1.07 in the prior-year quarter. This was because of lower demand for long-duration orders.

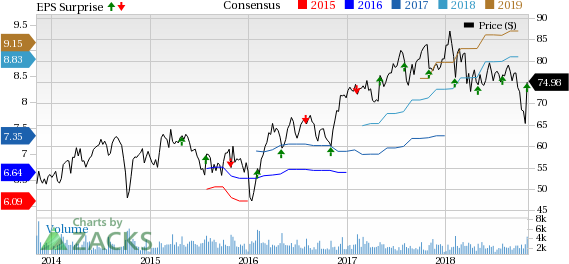

Arrow Electronics, Inc. Price, Consensus and EPS Surprise

Margins

Gross profit increased 9.6% from the previous year to $923.78 million.

Arrow’s non-GAAP operating income was up 19% to $314.12 million. Non-GAAP operating margin of 4.2% was up 30 basis points.

Balance Sheet and Cash Flow

Arrow exited the quarter with cash and cash equivalents of $474.19 million compared with $330.5 million in the previous quarter.

Long-term debt was $3.4 billion compared with $3.7 billion at the end of the previous quarter.

During the quarter, the company’s cash flow from operations was $494.4 million compared with an outflow of $410 million in the previous quarter.

Guidance

For the fourth quarter of 2018, sales are expected between $7.7 billion and $8.1 billion.

Global components sales are projected in the range of $5.18-$5.38 billion. Global ECS sales are estimated to be $2.53-$2.73 billion.

Interest expenses will presumably be about $57 million as a result of which the company projects non-GAAP earnings per share in the range of $2.46-$2.62. Average non-GAAP tax rate of 23.5-25.5% is included in the guidance.

The company also expects the demand for Global Components and growth in the engineering business to continue in the fourth quarter.

However, the company expects a decline in the ECS segment in the fourth quarter, post which, sustained growth is expected.

Zacks Rank and Stock to Consider

Arrow currently carries a Zacks Rank #3 (Hold).

A stock worth considering in the broader Computer and Technology sector is FireEye, Inc. (NASDAQ:FEYE) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth for FireEye is 16%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

FireEye, Inc. (FEYE): Free Stock Analysis Report

Arrow Electronics, Inc. (ARW): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research