- Investors should brace for sharp swings in the weeks ahead as the stock market faces a trio of headwinds.

- Growing fears over the Federal Reserve’s higher-for-longer policy outlook, U.S. Q2 earnings seasons, as well as extreme sentiment and positioning have left stocks vulnerable to a pullback.

- As such, I used the InvestingPro stock screener to identify high-quality shares that are showing strong relative strength amid the current market environment.

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

- Monthly: Save 20% and gain the flexibility to invest on a month-to-month basis.

- Yearly: Save a jaw-dropping 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Yearly (Web Special): Save an astonishing 52% and maximize your returns with our exclusive web offer.

Investors should brace for fresh turmoil in the weeks ahead as the stock market faces a growing risk of a near-term pullback.

Cracks are widening in the year-to-date rally on Wall Street, with the blue-chip Dow Jones Industrial Average now up +2.4% on the year. Meanwhile, the benchmark S&P 500 and the tech-heavy Nasdaq Composite have trimmed their year-to-date gains to +14.1% and +30.2%, respectively.

With the market facing a trio of headwinds, the weeks ahead will likely be more volatile than usual.

Hawkish Fed

Fed Chair Jerome Powell on Wednesday affirmed that more interest rate hikes are likely ahead as inflation is “well above” where it should be, pouring cold water on investors who had hoped the central bank was close to the end of its tightening cycle.

Powell stuck to his hawkish stance on interest rate hikes in his congressional testimony, reiterating the fact that the central bank remains "strongly committed to bringing inflation back down to our 2% goal."

“Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go,” he said in his remarks to lawmakers in Washington.

Powell noted that even as the Fed held off raising interest rates last week, "nearly all" participants expect further rate increases will be appropriate by the end of the year.

The Fed kept rates steady at last week’s policy meeting after 10 consecutive hikes and signaled there could be two more quarter-percentage-point increases this year.

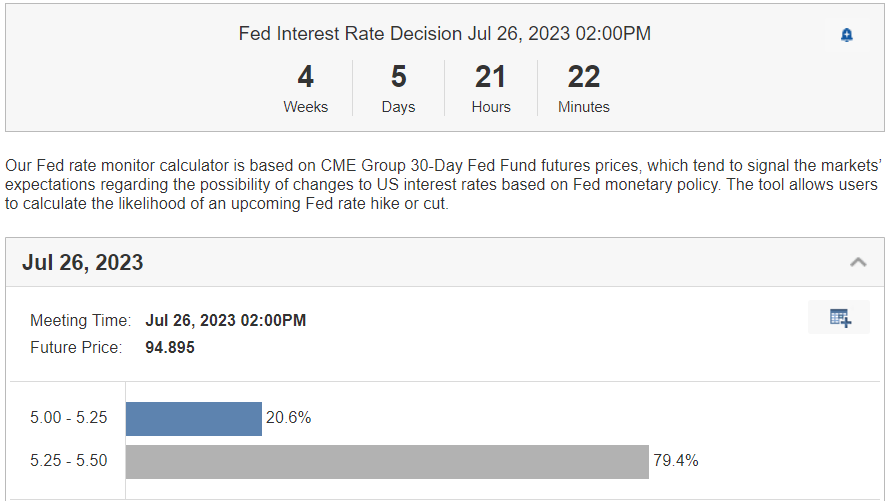

However, financial markets are currently pricing in a 25-basis point rate increase in July and no further hikes after that, according to Investing.com’s Fed Rate Monitor Tool.

Source: Investing.com

Taking that into consideration, there appears to be a growing risk that the Fed could raise rates to levels above where markets currently anticipate, resulting in a correction over the near term.

Looming Q2 Earnings Season

Wall Street's second-quarter earnings season will begin in less than a month and investors are bracing for what may be the worst reporting season in three years.

After earnings per share for the S&P 500 fell -2.0% in the first quarter of 2023, earnings are expected to drop -6.4% in the second quarter when compared to the same period last year, according to data from FactSet.

If -6.4% is confirmed, that would mark the largest year-over-year earnings decline reported by the index since the second quarter of 2020. It will also mark the third consecutive quarter in which S&P 500 earnings have declined year-over-year, more than meeting the technical definition of an earnings recession.

Likewise, Q2 2023 revenue expectations are also worrying, with sales growth expected to decrease -0.4% from the same quarter a year earlier. If that is in fact the reality, FactSet pointed out that it would mark the first time the index has reported a year-over-year decline in revenues since Q3 2020.

Beyond the top-and-bottom-line numbers, investors will pay close attention to announcements on forward guidance for the second half of the year, given the uncertain macroeconomic outlook, which has seen recession fears mount lately.

My personal belief is that a higher percentage of companies will lower their outlook for earnings and sales growth for the months ahead considering the current economic climate.

Extreme Bullish Sentiment

Two of the most followed sentiment indicators show signs that the market is becoming increasingly frothy, melting up with the mega-cap tech stocks as investors chase the bull.

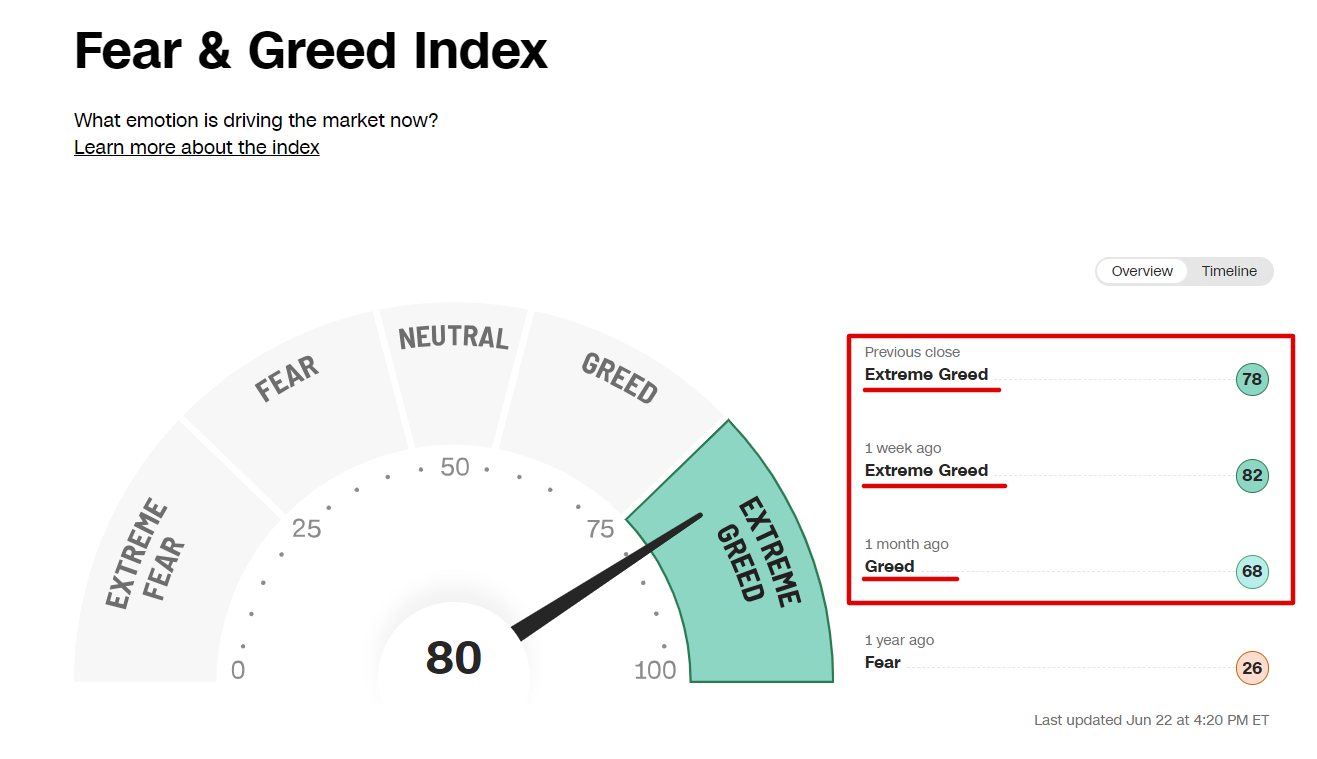

The CNN Fear & Greed Index, a sentiment gauge that combines seven different indicators to distinguish what “emotion” is driving the market, has flashed a ‘Greed’ signal for over a month, with sentiment even reaching ‘Extreme Greed' levels in recent sessions. Source: CNN

Source: CNN

The Fear & Greed index serves as a valuable tool for understanding investor sentiment and is often used as a contrarian indicator, flashing potential market turning points when sentiment reaches extreme levels of bullishness or bearishness.

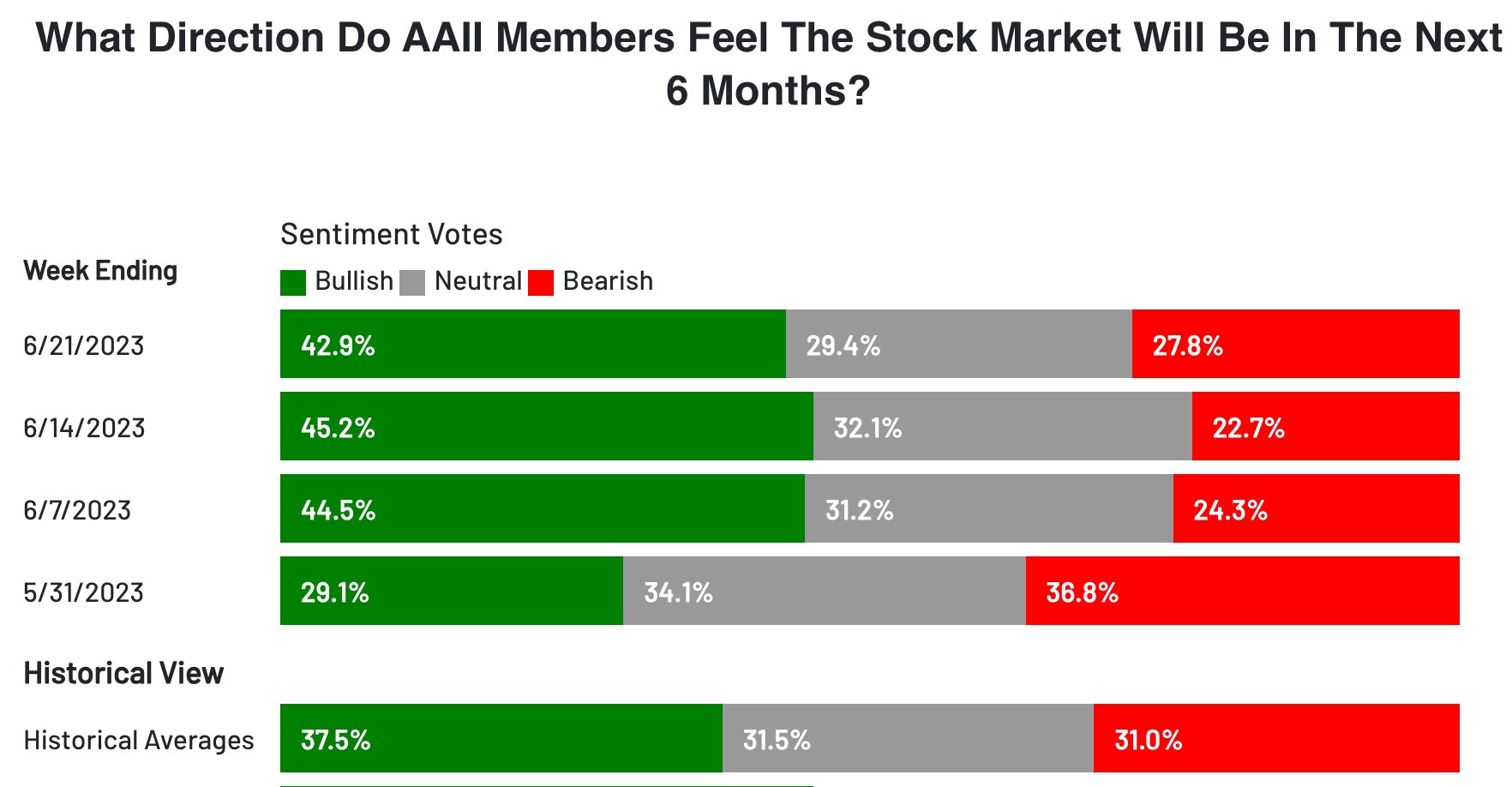

Meanwhile, individual investors are increasingly more bullish about the stock market, according to the latest American Association of Individual Investors (AAII) Sentiment Survey, which is another closely followed sentiment gauge.

According to the latest figure, the survey showed 42.9% of American individual investors expressed a bullish outlook for the next six months, not far from the highest level of bullish sentiment since November 2021. Source: AAII

Source: AAII

Only 27.8% of individual investors expressed a bearish outlook, marking the first time it has been below 30% for three consecutive weeks since November 2021.

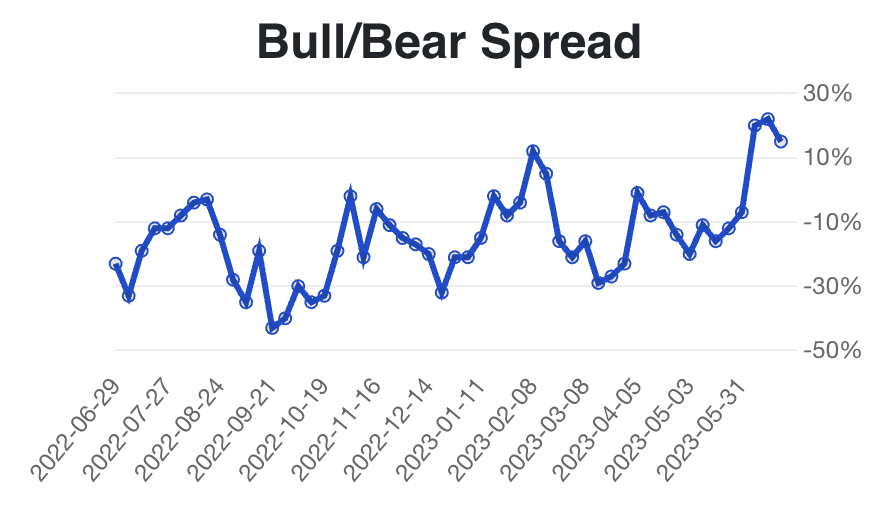

Source: AAII

Moreover, the AAII survey revealed that the bull/bear spread indicates that upside positioning is crowded, and downside protection is attractively priced.

What to Do Now

I have rebalanced my portfolio of individual stocks and ETFs in recent days to reflect a mostly bearish position and I have been cautious about making new purchases.

At the time of writing, I am short on the Dow, S&P 500, and Russell 2000 via the ProShares UltraPro Short Dow30 (NYSE:SDOW), ProShares Short S&P500 (NYSE:SH) and ProShares Short Russell2000 (NYSE:RWM).

Investors should be prepared for a scenario in the coming weeks which could see the S&P 500 fall to the 4,130 level - a decline of almost 6% from where it currently stands - before a more forceful plunge takes the index to a low of about 3,975 in the aftermath of the Fed’s July 25-26 policy meeting and the Q2 corporate earnings season.

Buying Opportunity?

Nonetheless, a pullback could create new buying opportunities in leading stocks in the red-hot tech and growth sectors.

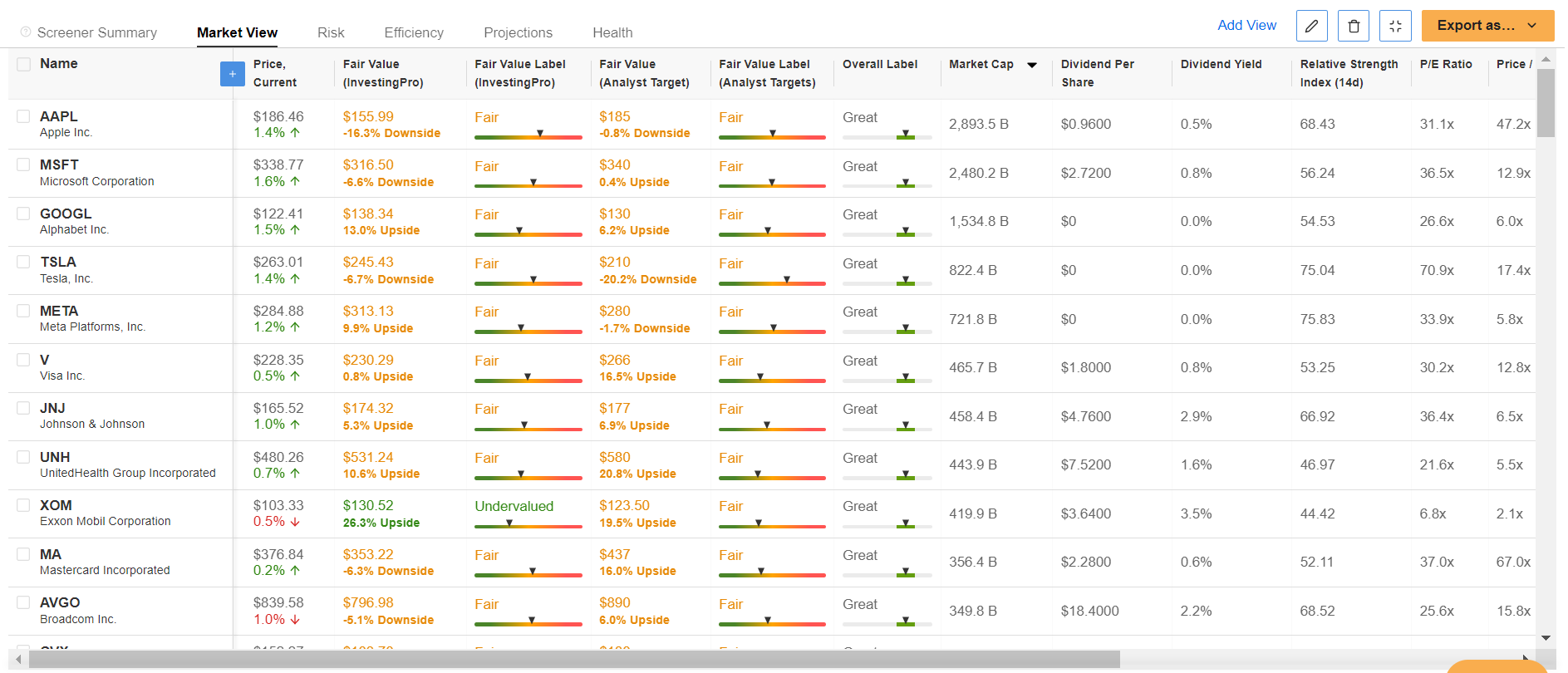

Taking that into consideration, I used the InvestingPro stock screener to build a watchlist of high-quality stocks that are showing strong relative strength amid the current market environment.

Not surprisingly some of the names to make the list include Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Tesla (NASDAQ:TSLA), Meta Platforms, Visa (NYSE:V), Johnson & Johnson (NYSE:JNJ), UnitedHealth (NYSE:UNH), Exxon Mobil (NYSE:XOM), Mastercard (NYSE:MA), Broadcom (NASDAQ:AVGO), Chevron (NYSE:CVX), Merck (NYSE:MRK), AbbVie (NYSE:ABBV), and Costco (NASDAQ:COST) to name a few.

Source: InvestingPro

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

As of 06/20/2023, InvestingPro is on sale!

This is your chance to access cutting-edge tools, real-time market analysis, and expert opinions at a fraction of the price.

Don't miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, the Summer Sale won't last forever!

***

Disclosure: The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.