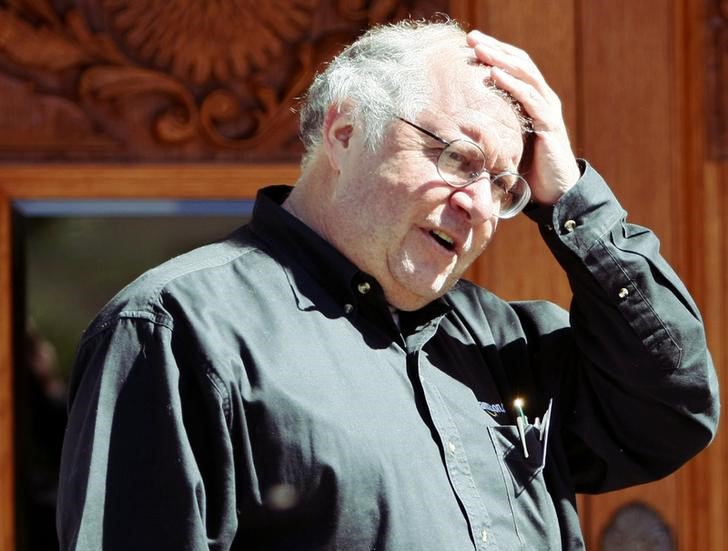

NEW YORK (Reuters) - Noted value investor Bill Miller said on Tuesday that Valeant Pharmaceuticals International Inc (NYSE:VRX), the troubled Canadian drugmaker, is one of his top holdings, with the company's expected cash flows making the stock attractive.

Valeant's market value has fallen by some 90 percent in the last year as the company's drug pricing and other business practices prompted investigations by multiple U.S. government agencies and by Congress.

"We think with Valeant right now, it's a completely different company," Miller said at the CNBC Institutional Investor Delivering Alpha Conference in New York. "It's just a slow-growth specialty pharma company that will generate a lot of free cash and you should be able to make, I think, 25 to 30 percent on Valeant over the next five years."

Miller, the founder and chairman of LMM, said he sees no realistic probability of government action to control drug pricing, saying there are just "lots of hearings, lots of headline risk."

Valeant came under fire after it raised the price of two heart medications, Isuprel and Nitropress, by about 720 percent and 310 percent, respectively, after acquiring the drugs in 2015.

Miller estimated Valeant's free-cash flow yield at 25 to 30 percent. "The market believes the risk is super high and I just think the free cash flows will be there."

Valeant first came under scrutiny from New York prosecutors last October over its drug pricing and distribution. Media also reported at the time that it used pharmacy Philidor Rx Services to overcome insurer rejections to reimbursing its medications, with Philidor resubmitting claims to insurers until they were approved.

On the broader stock market, Miller said his so-called best idea was to go long on the Standard & Poor's 500 and short on the 10-year Treasury note.

"You're talking a 6 percent rate of return on stocks versus 1.5 percent return on the 10-year Treasury," Miller said. "It strikes me that as I think (hedge fund investor) Paul Singer said, 'Treasuries are hardly a risk-free asset,' and I think the environment right now is the exact opposite of September 1987."