By Jesse Cohen

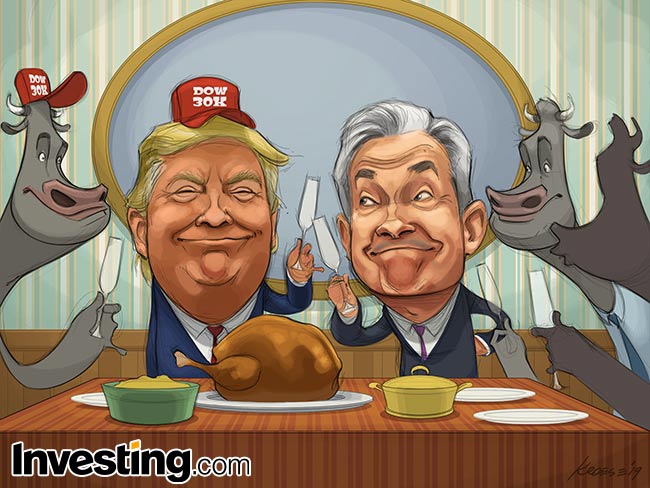

Investing.com - The market bulls have a lot to be thankful for on Thanksgiving Day this year, as hopes for a U.S.-China trade truce and a dovish Federal Reserve have combined to push stocks to fresh highs.

Wall Street’s main indices closed at record levels for a third straight day on Wednesday.

The major averages have been on fire this month, repeatedly reaching all-time highs, buoyed by U.S.-China trade deal hopes, while expectations the Federal Reserve will keep rates low further underpinned sentiment.

U.S. markets are closed for Thanksgiving on Thursday. The stock market will close early on Friday.

On Tuesday, President Donald Trump said negotiators were close to reaching an initial trade deal. Trump’s upbeat comments on trade followed a phone call between officials from the U.S. and China. The negotiators agreed to keep working on remaining issues.

Those comments came after Trump said last month that a “phase one” trade deal was in the works.

The market also took a cue to move higher from expectations that the Federal Reserve will keep rates low in order to support the economy. Fed Chair Jerome Powell said on Monday monetary policy was "well positioned" to support the strong U.S. labor market.

So far this year, the S&P 500 is up 25.8%, with the Nasdaq up 31.2% and the Nasdaq 100 up 33.4%. The Dow is up a more modest 20.7%.

That alone should inspire gratitude amongst investors.

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics

-- Reuters contributed to this report