Following Japanese elections over the weekend, in which the party favoring additional monetary easing won a landslide victory, the JPY proceeded to tumble throughout the day yesterday. Meanwhile, speculations that US interest rates will remain at their current levels for the foreseeable future caused the dollar to maintain its bearish trend against its higher-yielding currency rivals. Today, traders will want to continue monitoring developments in the ongoing US budget negotiations. Any signs of progress in the talks to avoid the upcoming “fiscal cliff” of automatic tax increases and budget cuts could boost riskier assets.

Economic News

USD - “Fiscal Cliff” Talks May Impact Markets Today

After taking significant losses last Friday, the US dollar saw very little movement against its higher-yielding currency rivals to start off this week. The dollar was unable to recoup any of last week's losses, largely due to speculations that US interest rates would remain at their current levels for the next several years. That being said, a lack of significant US news prevented the greenback from extending its bearish trend. The USD/CHF traded between 0.9175 and 0.9190 for most of the day, while the AUD/USD bounced between 1.0527 and 1.0540.

Turning to today, dollar traders will want to monitor developments in the ongoing budget negotiations between President Obama and US Congressional leaders, who are meant to reach an agreement before the “fiscal cliff” of automatic tax increases and budget cuts take affect at the beginning of the year. While the negotiations have been deadlocked for some time, signs of moderate progress were seen yesterday. Positive developments today could lead to investor risk taking, which may result in the safe-haven dollar taking additional losses.

EUR - Euro Sees Moderate Losses in Slow News Day

A lack of significant international news yesterday resulted in the euro seeing relatively little movement when markets opened for the week. Still, speculations regarding interest rates in the US helped the EUR/USD stay within reach of its recent 7 ½ month high. During the European session, the pair fluctuated between 1.3164 and 1.3149. Against the British pound, the common-currency fell slightly more than 30 pips during Asian trading before stabilizing around the 0.8115 level during the mid-day session.

Today, another slow news day means that the euro may once again range-trade during the European session. That being said, traders will want to remember that announcements regarding the US “fiscal cliff” have the potential to generate significant volatility for euro pairs. Any positive developments in the ongoing budget negotiations are likely to encourage risk taking among investors, which could boost the euro as a result.

JPY - Japanese Election Results Weigh Down on Yen

The JPY started off the week on a decidedly bearish note, amid speculations that the newly elected Japanese government would initiate an aggressive monetary easing policy in the near future. After reaching 84.30 during the Asian session yesterday, an 18-month high, the USD/JPY saw a minor downward correction during the rest of the day before stabilizing at the 83.75 level. The EUR/JPY traded as high as 111.17 during the Asian session, its highest level since late March, before a downward correction brought the pair to 110.39.

Today, analysts are warning that the yen may be able to recoup some of its recent losses if there are any signs that the new Japanese government will not be able to ease monetary policy as forcefully as it campaigned that it would. Traders will want to pay attention to announcements out of Japan that could impact yen pairs throughout the day.

Crude Oil - Crude Oil Sees Gains amid Bullish Euro

The price of crude oil advanced more than $1 a barrel yesterday, as investor risk taking boosted higher-yielding commodities. While crude took slight losses during the beginning of European trading, eventually dropping some $0.50 to reach as low as $87.02, it was later able to bounce back to the $88 level by the afternoon session.

Today, oil traders will want to continue monitoring developments in the ongoing US budget negotiations. Any signs of progress in the talks between Congressional leaders and President Obama could lead to additional risk taking, which may give an additional boost to oil prices.

Technical News

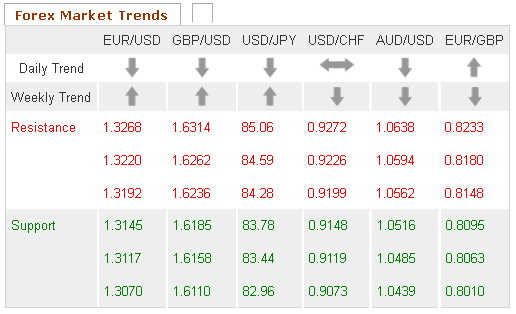

EUR/USD

The Bollinger Bands on the weekly chart are beginning to narrow, indicating that this pair could see a price shift in the coming days. Furthermore, the Williams Percent Range on the same chart has crossed over into overbought territory, signaling that the price shift could be bearish. Traders may want to open short positions for this pair.

GBP/USD

A bearish cross on the weekly chart's MACD/OsMA indicates that a downward correction could take place in the near future. Furthermore, the Relative Strength Index on the same chart appears close to crossing into the overbought zone. Opening short positions may be the best long-term choice for this pair.

USD/JPY

The Slow Stochastic on the weekly chart has formed a bearish cross, indicating that a downward correction could occur in the near future. Additionally, the Williams Percent Range on the same chart has crossed into overbought territory. Opening short positions may be the wise choice for this pair.

USD/CHF

The weekly chart's Williams Percent Range has crossed into oversold territory, indicating that an upward correction could occur in the near future. Furthermore, the Slow Stochastic on the same chart appears close to forming a bullish cross. Traders may want to open long positions for this pair.

The Wild Card

USD/PLN

The Bollinger Bands on the daily chart are narrowing, indicating that a price shift could occur in the near future. Furthermore, the Slow Stochastic on the same chart has formed a bullish cross and the Williams Percent Range has dropped into oversold territory. This may be a good time for forex traders to open long positions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Yen Remains Bearish Following Japanese Elections

Published 12/18/2012, 03:29 AM

Updated 02/20/2017, 07:55 AM

Yen Remains Bearish Following Japanese Elections

Forexyard

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.