The risk rally that was born as a result of the central bank intervention in to the dollar-funding markets continued yesterday with the euro managing to strengthen once again versus the US dollar and the pound. Equities remained at the levels they had accelerated to, however, further gains were hard to come by. So now the central banks have bought the European politicians some time by unjamming the interbank lending markets and allowing them to focus on the deep-set issues that the European Union is experiencing

Yesterday we saw Nicolas Sarkozy make an impassioned speech to a crowd in Toulon about the dangers that the French economy faces. The contents of the speech were relatively simple: tighter fiscal discipline and a national oversight of budgets with penalties for countries that exceed them. Unfortunately for Monsieur Sarkozy, this was the only speech he could give and has pretty much guaranteed that he will lose next year’s French general

election.

In Germany we also have Angela Merkel addressing the Bundestag to set out proposals for a fiscal union i.e. centralised tax and spending policy and not merely centralised interest rate policy. The thing is that she is also very likely to give risky assets a kicking by once again emphasising that the ECB will not become the “Lender of Last Resort” and quantitative easing is not likely.

This stands apart from hints from Mario Draghi, ECB president, however. Yesterday in a speech to the European government he said that while strong rules on public finances will become the most important part of bringing credibility and stability back to the Eurozone, “other elements might follow, but the sequencing matters”. This has widely been interpreted as the ECB ramping up its bond programme of purchasing peripheral debt. One report I’ve seen believes that this may include the purchase of the debt from ALL Eurozone countries; another plan to institute quantitative easing by the back door.

On the subject of bonds, European bond yields fell yesterday on strong auctions from France and Spain. Although yields were higher than previous auctions they were lower than the market price at the time and strong demand was seen as well. Most of the demand will have come from banks who will wish to use that debt as collateral with the ECB against short term loans but this is good news all the same. What wasn’t good news was the broad slip in manufacturing PMIs seen in Europe and the UK yesterday. Both the UK and Euro-wide measures were below 50.0, showing that the manufacturing sectors are contracting and growth is now non-existent. The important services numbers are due on Monday.

Today is Non-Farm Payrolls day in the US and therefore we expect trade to be quiet in anticipation of the figure at 13.30. This is caveated by news from the Bundestag; - Angela Merkel always has the ability to throw things out of kilter.

Good luck and have a good weekend.

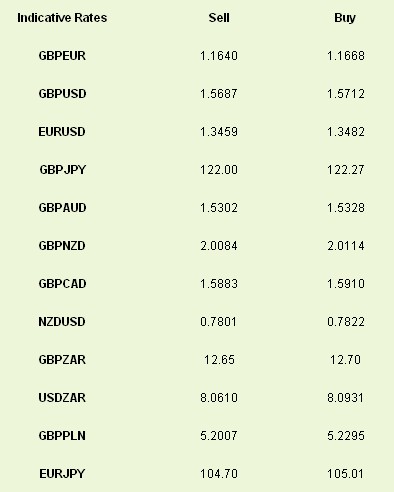

Latest

exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

World First Morning Update 2nd December: Over to you Merkozy

Published 12/02/2011, 08:36 AM

Updated 07/09/2023, 06:31 AM

World First Morning Update 2nd December: Over to you Merkozy

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.