Ten days ago, 129 lives were brutally cut short when assailants affiliated with the terrorist group ISIS, also known as the Islamic State, stormed Paris in a series of coordinated attacks. Along with the rest of the world, we were shocked and saddened as the tragic news unfolded, worsening as the night progressed. Our thoughts are with the victims’ families and friends.

For us, the atrocity struck especially close to home, as one of our portfolio managers, Xian Liang, was in the city at the time of the attacks. We’re extremely grateful he and his wife returned home safe and sound. I wish the same could be said for the victims in Paris that day, the 224 on the Russian jet brought down by an ISIS-built bomb, the hostages in Mali Friday, and many others whose lives have been affected by the global scourge of terrorism.

We Take Our Role as Fiduciaries Seriously

As money managers, it’s our duty and responsibility to be cognizant of such geopolitical events—large and small, good and bad—and to consider all of the possible ramifications. The consequences often reach far and wide, and can be felt in the short-term (changes in investor confidence) as well as the long-term (changes in government policy).

Early last year, for instance, we were quick to adjust asset allocations when Russia invaded and annexed Crimea. We anticipated that sanctions would be imposed on the country, and indeed they were, by the U.S., European Union, Australia and other international organizations. These sanctions, coupled with falling oil prices, contributed to the Russian ruble’s dramatic breakdown.

Against these challenges, I’m impressed by how strongly Russian stocks have performed lately. Last Tuesday, the MICEX Index jumped to an eight-month high in ruble terms. This is especially interesting since both Brent oil and the ruble are way down. It suggests that investors are showing approval of President Vladimir Putin’s involvement in Syria.

Putin is also benefiting from a strong public relations push. The Daily Mail writes: “Russia has shown its solidarity with the people of France in an unusual way—by donating a new puppy to carry on the memory of Diesel, the police dog killed by a suicide bomber.”

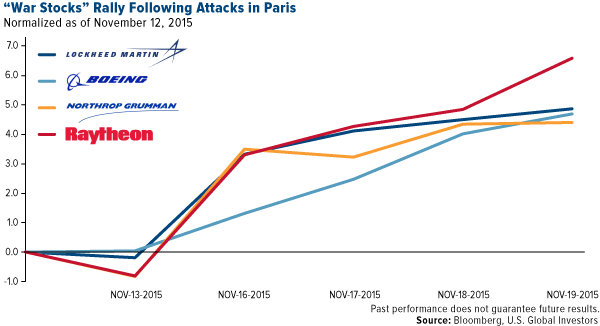

It should come as a surprise to no one that, following the tragedy in Paris, defense spending will likely increase. French President François Hollande has already told Parliament that France is at war and will “be merciless” in its pursuit of justice. The country wasted no time in striking back against ISIS and has begun bombing raids in Syria.

As early as last Monday, stocks of companies that manufacture weapons and fighter jets traded up.

We own Lockheed Martin (N:LMT), manufacturer of the F-35, F-22 and F-16 fighters; Boeing (N:BA), manufacturer of the Tomahawk cruise missile, F-18 fighter and more; and Northrop Grumman (N:NOC), which was recently awarded the contract to build America’s next generation of long-range strike bombers. Raytheon (N:RTN) develops and manufactures guided missiles.

International Travel to Be Hit

Understandably, the terrorist attacks will have an impact on international travel, immigration and border security. France immediately tightened its borders, and other European countries quickly followed suit. Meanwhile, Poland’s newly-elected government rejected the European Union’s quotas for accepting refugees from Syria, an attitude that’s echoed by more than 30 U.S. states. The House of Representatives just passed legislation to suspend the admittance of 10,000 Syrian refugees, though it’s likely to be vetoed.

This is the climate we find ourselves in right now. It has a huge effect, at least in the near-term, on perceptions of international travel.

“Most people are risk-averse,” Xian says. “When my wife and I left for the airport by taxi the morning after the Paris attacks, we agreed not to travel to Europe again any time soon.”

Others share Xian’s attitude. Paris has for years been the world’s top tourist destination, but the City of Lights has already seen a huge drop-off in tourists as people have delayed or cancelled travel plans. Hotel stocks were up 10 percent in October but will likely face headwinds as a result of Paris and Mali.

Gold, Diamond and Oil Declines Good for Manufacturers

Xian stresses the importance of having gold exposure as diversification. A good diversifier is any investment that’s expected to have a low correlation with the rest of your portfolio, and gold historically has little to no correlation with equities.

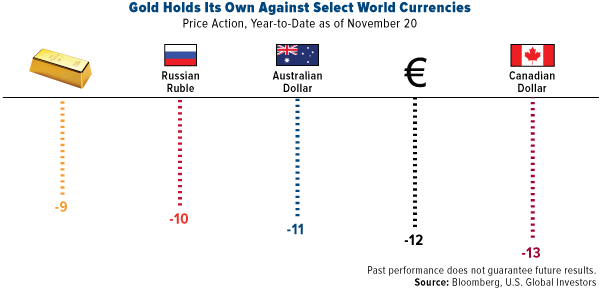

The yellow metal has traditionally been seen as a safe haven in times of war, but so far we’ve seen little movement. Year-to-date, gold is down nearly 9 percent, and it could possibly end 2015 in negative territory for the third straight year.

Even so, the yellow metal has performed better than other select world currencies for the year, including the Russian ruble (-10 percent), Australian dollar (-11 percent), euro (-12 percent) and Canadian dollar (-13 percent).

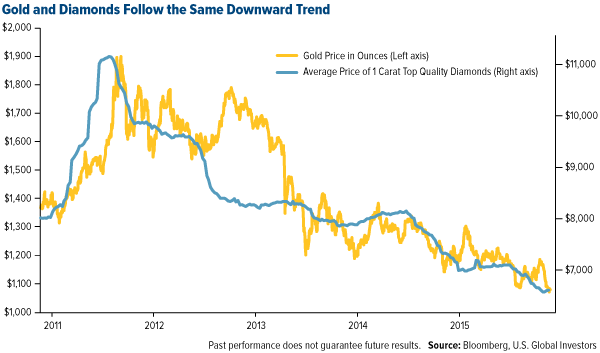

Diamonds have likewise struggled over the past four years, but with the recent news that Canadian miner Lucara (TO:LUC) discovered the largest diamond in 100 years, investors might show renewed interest. The massive 1,111-carat diamond was unearthed in Lucara’s Botswana project. Although the stone has yet to be assessed, it’s worth noting for comparison that a 100-carat diamond sold at Sotheby’s in April for $22 million.

These declines over the past three and four years have been good for jewelry companies such as Tiffany (N:TIF), which I wrote about last December. Gold and diamond supply is now less expensive, so the company has margin expansion.

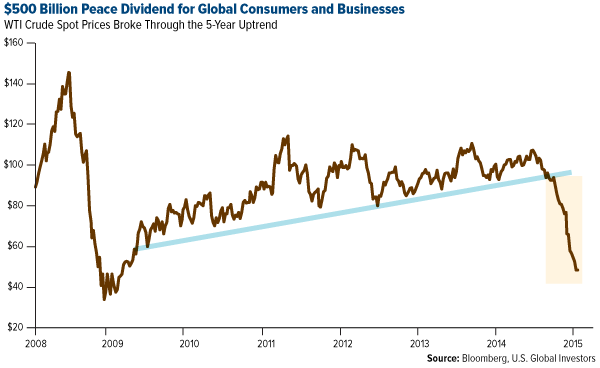

The same can be said of oil. Low prices have hurt South Texas, the Middle East, Russia and Colombia, not to mention drillers and explorers, but they’ve been a windfall for the end consumer, including manufacturers and airlines. Falling energy prices are finding their way into the global engine of growth.

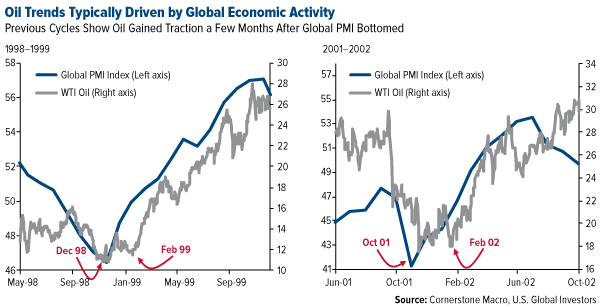

Many analysts expect to see crude oil prices tick up on mounting tension in the Middle East. During past military engagements, oil has typically performed well since a lot is required to fight a war. We haven’t seen prices move just yet—oil still sits at $40 per barrel—but it’s something we’ll monitor closely. As I said earlier this month, the global purchasing managers’ index (PMI) turned up in October after bottoming in September, and in the past this has been followed by a jump in oil prices.

Inflation Rousing from Sleep

We learned this week that the consumer price index (CPI) rose 0.2 percent in October, suggesting that inflation is finally picking up steam in the U.S. and giving the Federal Reserve further excuses to raise rates next month.

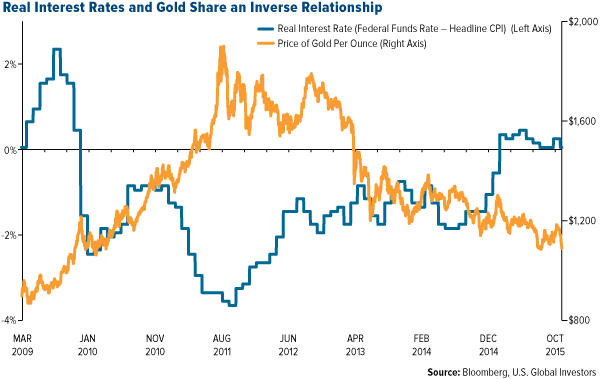

Based on the U.S. 2-Year Treasury yield (0.89 percent) and the headline CPI (0.20 percent), real rates now stand at 0.69 percent. (Real interest rates are what you get when you subtract the CPI from the Federal funds rate.) I’ve often explained that gold responds positively when real rates turn negative, as you can clearly see in the chart below, so we’re eagerly awaiting stronger inflation.

In a note this week, Drew Matus, an economist at UBS, wrote that inflation in the U.S. is poised to jump in the next couple of months. The CPI measures the price of a basket of goods to the price of the same goods a year ago, so inflation fell dramatically between November 2014 and January 2015 as energy prices plunged.

But “absent a similar move this year, those sharp price declines will drop out of the year-over-year data, resulting in a rapid, technical acceleration in overall inflation measure,” Matus says.

If such inflation occurs—possibly as soon as January or February, Matus points out—real rates could have a better chance of dipping into negative territory, which would be constructive for gold prices.

Thanksgiving is this week, and in light of recent events, I think we all have ample reason to express gratitude to friends and loved ones. Everyone have a blessed week!

Disclosure and Disclaimer: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.