Weekly MOF data shows that Japanese investors have remained net buyers of foreign bonds in recent months. After a weak start to the year that saw Japan investors shed nearly $58 bln of foreign bonds in the 16 weeks through mid-April, the flows have largely reversed.

In the 23 weeks since then, there have only been 6 weeks of foreign bond sales. Total net foreign bond purchases in those 23 weeks stand at $75 bln through the week ended September 26, and have more than fully offset the bond sales seen through mid-April.

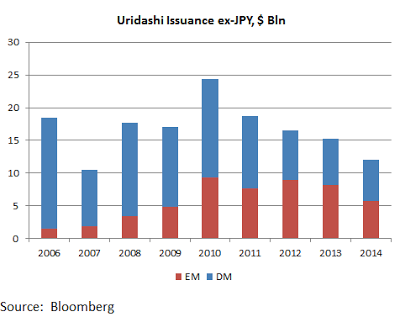

It is also worth noting that Uridashi issuance is on pace this year to pick up modestly from 2013. As always, we net out JPY-denominated issues in order to focus on the foreign currency aspects of the Uridashi market. Foreign currency-denominated issuance peaked at $24.4 bln in 2010 before falling three straight years to $15.3 bln in 2013, which was the lowest annual total since 2007. So far in 2014, we are on a $16 bln annualized pace of non-JPY issuance for the entire year. A Q4 pickup could see the full year total potentially eclipse the $16.5 bln seen in 2012.

Marketed to retail investors, Uridashi bonds represent a small slice of the FX market, but we believe that the observed trends in this segment can reflect those of the larger Japan investment community as well. Given that near-zero rates in much of the DM should persist well into 2015, and given relatively high interest rates still in EM, we think that the Japanese flows into EM bonds should continue in the coming months, albeit modestly. While the global backdrop should remain conducive to higher yielding currencies, the looming Fed tightening is already causing disruptions across most financial markets.

The share of EM-denominated Uridashi bonds increased steadily from less than 10% in 2006 to nearly 55% in both 2012 and 2013. So far in 2014, that EM share has fallen back under 50% to around 48%. If sustained, this would be the first sub-50% reading since 2011. The 2006-2013 growth in EM Uridashi issuance really came at the expense of DM stalwarts AUD and NZD. The share of these two currencies of total non-JPY Uridashi issuance was nearly 80% in 2006, but fell steadily to just under 30% in 2013. This share has rebounded to nearly 40% so far in 2014, helped in part by the start of the RBNZ tightening cycle as well as expectations that the next RBA move will be a hike, not a cut.

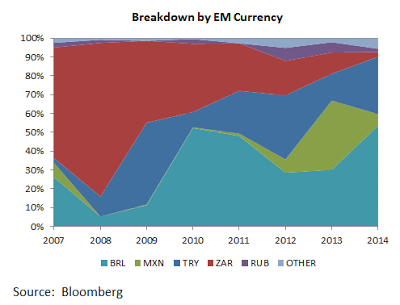

BRL has increased its share sharply so far in 2014 to 53% of total EM issuance. The BRL share of total EM Uridashi issuance was 30% in 2013 vs. 29% in 2012. Its average share from 2007-2013 was 29%, peaking at 52% in 2010. As Brazil local rates headed higher in the fight against inflation, BRL has regained its prior attractiveness. Policymakers have also worked to repair the damage to investor sentiment.

Banco de Mexico’s easing cycle over the course of 2013 and 2014 has lessened the peso’s yield advantage, and so the MXN share has fallen back to 6% so far this year. The MXN share of total EM Uridashi issuance was 37% in 2013 vs. 7% in 2012 and only 1% in 2011. Its average share from 2007-2013 was about 8%. Fundamentals remain good, but the peso will likely have trouble gaining traction after Banco de Mexico’s easing cycle.

The TRY share has, surprisingly, rebounded nicely to about 30% so far this year in the wake of the emergency January rate hike. The TRY share of total EM Uridashi issuance was 14% in 2013, down sharply from nearly 35% in 2012. Its average share from 2007-2013 was 19%. While the easing cycle has started (and was later paused), still-high rates could help support the lira until fundamentals improve. We suspect Prime Minister Erdogan will continue his efforts to strong-arm the central bank into cutting rates faster, which could damage the lira’s outlook.

The ZAR share of total EM issuance has plunged to around 3% so far this year. The ZAR share of total EM Uridashi issuance was 11% in 2013, down from 18% in 2012 and is the lowest in recent years. Its average share from 2007-2013 was nearly 40%. SARB has started a tightening cycle but rates are still near historically low levels. Despite SARB talk about normalizing rates, we think that the poor growth outlook will likely prevent aggressive tightening.

The ruble share has fallen to about 2% so far in 2014. The increasing RUB share of total EM Uridashi issuance has stalled in the wake of Ukraine tensions. In 2013, the RUB share was 5% vs. 7% in 2012. Its average share from 2007-2013 was 3%. The ruble should remain on the defensive due to falling oil prices as well as the ongoing Ukraine-related sanctions. The central bank’s rate hike back in March has not had any long-lasting impact, as the ruble continues to make new record lows.

Taken together, these five EM currencies make up 94% of the EM Uridashi issuance so far in 2014. From 2007-2013, these five have never accounted for less than 95% of the total EM Uridashi issuance, and are typically more in the 98-99% range.

Clearly, high yielding ZAR is no longer as attractive as it once was due to deteriorating fundamentals and has fallen well below its longer-term average share. RUB too has suffered in 2014. On the other hand, TRY has seen its popularity rebound this year despite ongoing political uncertainty. Brazil has tightened aggressively and has seen demand for BRL-denominated Uridashi bonds return. Both TRY and BRL are above their longer-term averages so far in 2014. MXN remains close to its long-term share of 8%, while ZAR and RUB are below their long-term averages so far this year.

Strangely, USD/INR has not seen much of a boost in demand despite aggressive tightening in 2013 by the RBI. On the other hand, IDR issuance appears to finally be getting some traction. Both had a 1% share of total EM Uridashi issuance in 2013, and INR still accounts for 1% so far this year. However, IDR has increased its share to 4% compared to its long-run average of 1%. This puts IDR ahead of both RUB and ZAR this year, making it the fourth most popular Uridashi issue in 2014.