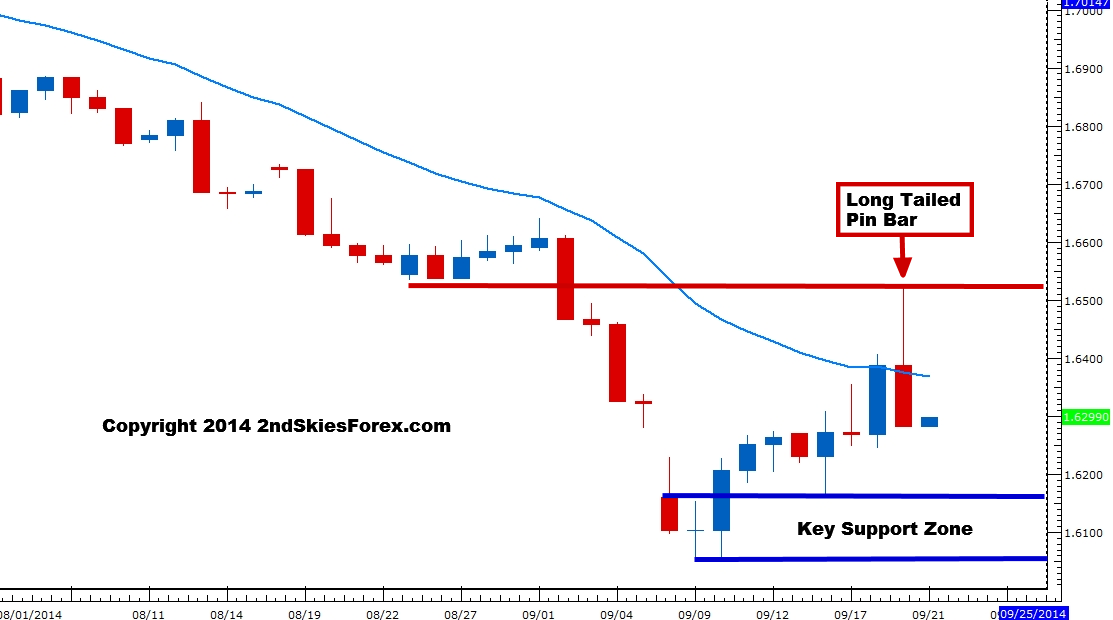

GBPUSD – Pushes Lower After Scottish No Vote

As we talked about last week, we suspected a ‘No’ Scottish Independence vote as the price action was building up ahead of time. We wrote in our daily market commentary that if 1.6440 was broken, expect 1.6500 and 1.6540 to be attacked.

As you can see from the chart below, 1.6440 was broken and the pair hit a high of 1.6527, just shy of our second intra-day target.

What is most interesting, is instead of continuing the bullish move after the No vote, the cable sold off heavily for the next 16+ hours, closing over 230 pips lower and forming a long tailed pin bar in the process. This is showing you how the large players are still looking to sell the pair on rallies (daily chart below).

For now, we’ll remain bearish while below 1.6520, and will be open to selling on a corrective pullback into this level. The downside support zone where bulls are likely to step in is between 1.6060 and 1.6160.

NZDUSD – Possible Early Reversal

Looking at the 4hr chart below, unlike most other pairs vs. the USD which are sitting on the lows of last week, the Kiwi formed a HL (higher low) and is showing some signs of a possible reversal. Notice how the pair tried to sell lower, but ended with some decent buying strength.

For now, watch for a possible reversal signal if the lows continue to build. The pair has to clear .8185 and then 9207. A move below 8075 means an attack on the big figure at 8000.

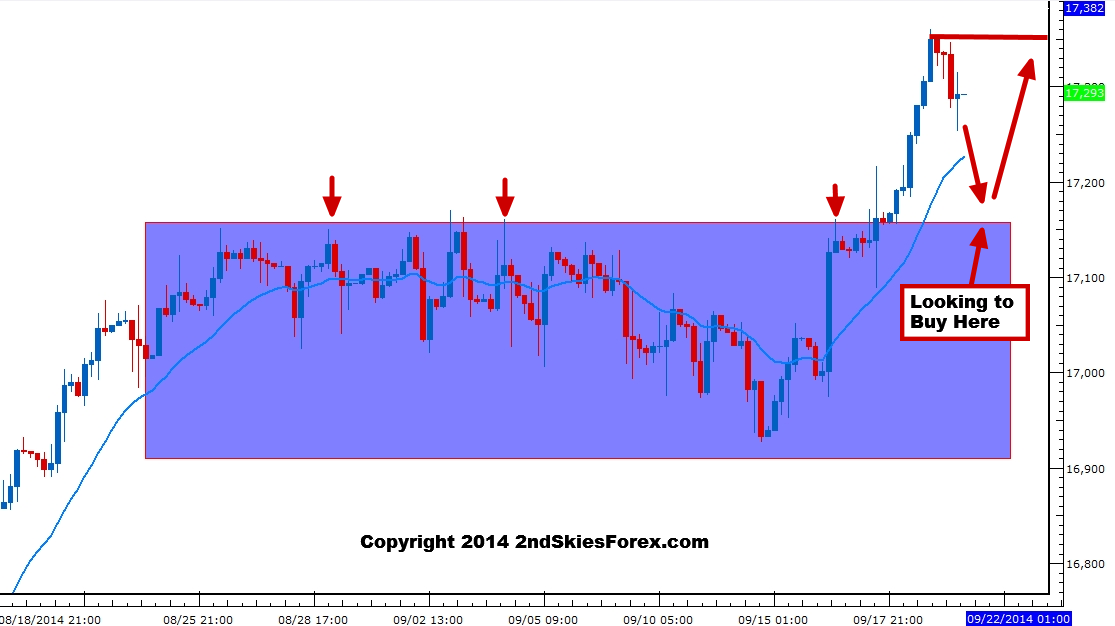

Dow Jones – Bullish Above 17150

After consolidating for almost a month between 17150 and 16950, the Dow Jones Index broke out higher to end last week, hitting a new all time high above 17350. After some mild profit taking to end last week, we expect pullbacks to be bought while above the former resistance which should now become support (thus be a role reversal level).

Hence, I’ll look to buy on corrective pullbacks into 17150 with a first target of 17290, 17350 and an eventual move towards 17500 barring any major reversals.

Notable Mention:

1) USDJPY – remain bullish and look to buy on prior pullback levels mentioned