Actionable ideas for the busy trader delivered daily right up front

- Wednesday uncertain.

- ES pivot 1636.67. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias lower.

- ES Fantasy Trader standing aside.

The debt ceiling, the latest Syrian crisis, the phase of the moon, whatever, all this "news" just gives me a pain. That's why I like technical analysis. I told you all last night the market was going lower on Tuesday without consulting any of that booshwa. And it did, with the Dow taking a 170 point dump. So there! Now let's see where Wednesday is headed.

The technicals (daily)

The Dow: Tuesday's big red marubozu was enough to derail the indicators and send them lower even though they were still oversold - that's pretty unusual. It also just formed a bearish stochastic crossover at a low level, also unusual. And it keeps us firmly inside a descending RTC. Next support is at 14,670, not too far away. Then note that the 200 day MA is finally coming into view, now at 14,404 - just three more days like Tuesday and we're there. So this chart continues to look bearish tonight.

The VIX: Last night I wrote "we could see a higher VIX again Tuesday" and we did, this time up nearly 12% on a big gap-up evening star. However, unlike last week's evening star this time we're not yet overbought and in fact just completed a bullish stochastic crossover. We did close above the upper BB though and like I always say, the VIX rarely spends more than a day or two at those levels before falling. But VVIX is looking even more bullish so I hesitate to call the VIX lower on the basis of an incomplete chart pattern. I'm afraid we need one more day here for confirmation.

Market index futures: Tonight all three futures are a just bit lower at 12:55 AM EDT with ES and YM both down 0.02%, and NQ down 0.03% On Tuesday, ES broke support at 1635 with a tall red marubozu to end at session lows just touching its lower BB and completing a bearish stochastic crossover. So although the downward momentum seems to have petered out at the moment, the night is yet young and this chart overall remains bearish.

ES daily pivot: Tonight the pivot plunges from 1658.33 to 1636.67. We were so far below the old number that even with ES flat in the overnight, we're still below the new pivot by a good nine points so this one remains bearish once again.

Dollar index: The dollar is now in a mini-downtrend within a longer-term downtrend. With a 0.30% loss on Wednesday on a bearish engulfing candle that formed a bearish stochastic crossover, more downside seems possible for Wednesday.

Euro: The triangle I wrote about last night kind of fell apart on Wednesday as the euro simply put in a hanging man type doji for a small gain. The overnight is wandering erratically so I won't hazard a guess as to where this currency is headed on Wednesday..

Transportation: The trans took a big hit on Tuesday, down 2.59% on a tall red marubozu that crashed out of their rising RTC for a bearish setup, confirmed Monday's gravestone doji, sent the indicators moving lower off overbought, broke support at 6331, and completed a bearish stochastic crossover. So this one continues to look nothing but negative for Wednesday.

Wednesday was pretty much a confirming day of Tuesday's sea change and it established some degree of momentum to the downside. That said, the SPX Hi-Lo index has not come off 100 and the AD line has now declined close to levels from which reversals occur. And Wednesday for some reason is also historically quite bullish. The charts show that there is still plainly at least some room to run lower and I'm not seeing any real bullish reversal signs yet, but if you look at the hourly chart of ES, you'll see that it seems to have found some support right at 1627, and it is in fact now on something of a mini-rally, going from down 0.03% to up 0.18% in the time it took me to write this post.

And I never like going against the futures, particularly when they start to diverge from the other technicals. This raises the possibility of a DCB or a doji on Wednesday. Therefore, unfortunately the only logical call is Wednesday uncertain.

ES Fantasy Trader

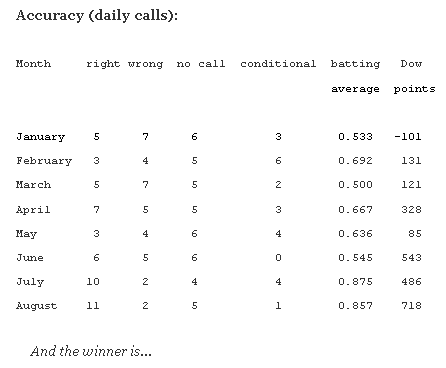

Portfolio stats: the account remains at $108,500 after 15 trades (11 for 15 total, 6 for 6 longs, 5 for 9 short) starting from $100,000 on 1/1/13. Tonight we continue to stand aside - while I again think we're going higher from here, I'm not sure how long this will last.