An Alert for the Global Posse of Liquidity Junkies

In the summer of 2015 and again in December-February this year, global stock markets were rattled by weakness in the yuan’s exchange rate vs. the US dollar. Yuan weakness is widely held to exacerbate pressures on other (already weak) emerging-market currencies and, more importantly, it is seen as a symptom of accelerating capital flight from China.

Note that a rising price denotes yuan weakness. Resistance is between 6.60 and 6.65 and we suspect that if that level is exceeded, things could get ugly.

Why is it considered important whether or not China’s foreign exchange reserves are increasing or declining? Similar to Japan, China has become a major cog in the global fiat money Ponzi game, in which foreign central banks monetize US treasury bonds by recycling dollar-denominated trade surpluses.

Now, it should be clear that the term “monetization” does not refer to the creation of additional US dollars in this case – those can only be created by the Fed and the US banking system. Rather, foreign CBs are boosting their domestic money supply when they buy dollars from their exporters – since they are paying for these dollars with domestic currency they create out of thin air.

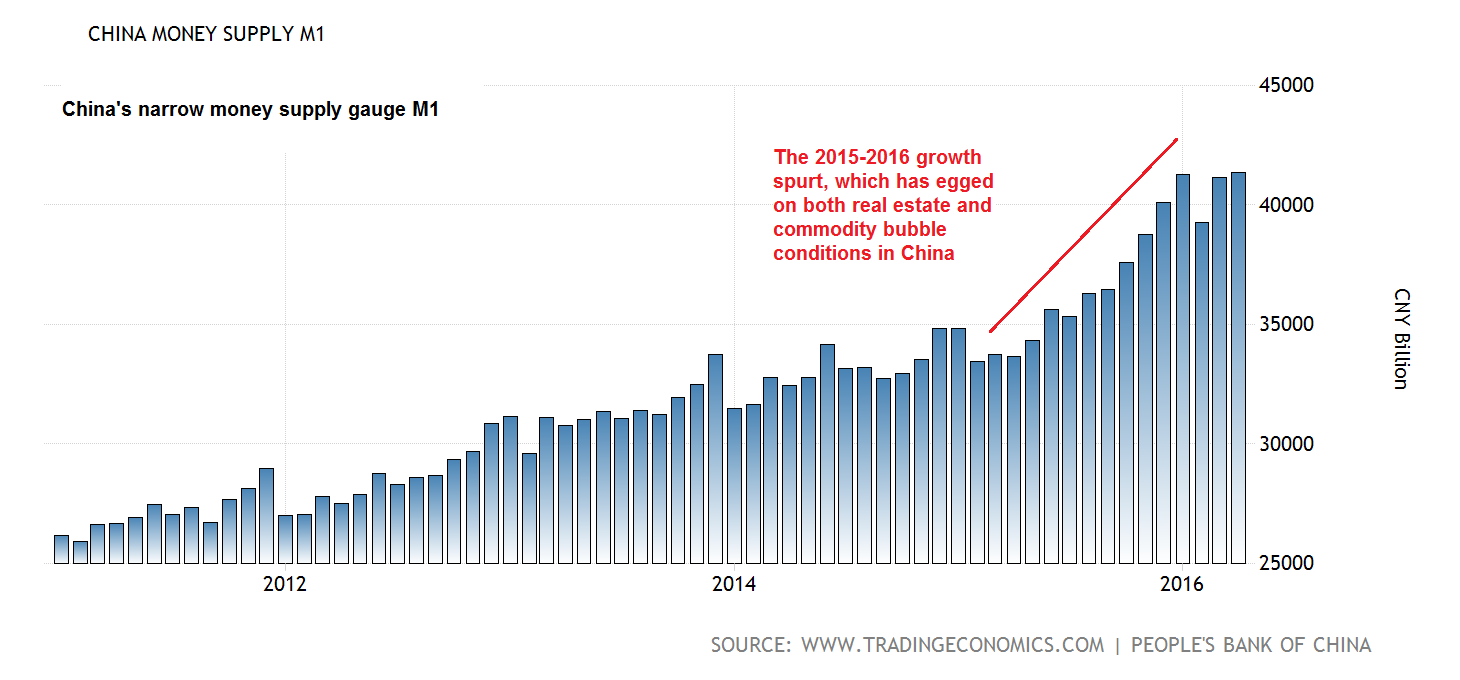

In China, the effect of dollar inflows on the domestic money supply is especially pronounced. In fact, in order to stem the pace of money supply and credit growth lest it get out of hand, the PBoC has imposed one of the highest minimum reserve requirements in the world and is regularly altering it to influence credit and money supply growth in the country.

By way of the minimum reserve requirement, the PBoC intends to at least brake additional growth of the yuan money supply (beyond the growth caused directly by its USD purchases) to some extent, i.e., money supply growth, which its fractionally reserved banks are generating by granting ever more inflationary credit.

It should be obvious, though, that the PBoC has remarkably little control over inflationary credit growth through its official “toolkit”, as the effect is only indirect. Luckily (from the perspective of the central planners), it can also simply issue orders to the (largely state-owned) big banks and can generally be certain that it will be obeyed.

Achilles Heel

Market participants worry, though, about capital flows. Assorted liquidity junkies rightly see China’s forex reserves as an Achilles heel. The reason is that a decline in these reserves hampers the PBoC’s ability to manipulate money supply growth in an upward direction. This is regarded as very important in order to keep various bubble activities intact – not only in China, but also in the rest of the world, e.g. through the effects China exerts on commodity prices.

This may be one of the most important data points for liquidity junkies.

As we noted in “The Pitfalls of Currency Manipulation”, China’s authorities have recently resorted to all sorts of tricks in order to mask the pace of the outflow of foreign exchange from China – primarily with the help of derivatives transactions (yuan forwards have been employed to surreptitiously support the exchange rate).

Such manipulations tend to work well in the short term, but can be dangerous in the long term.

So Far, The Seas Remain Calm

Although there has been a sharp pullback in some commodity prices of late -- see chart of steel rebar futures -- there are no signs of concern in other asset markets yet. Particularly stocks and junk bonds have held up quite well so far, although various stock markets have drifted even further apart in terms of performance. Traditionally this tends to be a warning sign (compare e.g. the Euro Stoxx 50 to the S&P 500).

The Shanghai Composite has essentially done nothing since its December-January nosedive. However, it was quite strong overnight, rebounding from a slightly higher low. This may be a tentative sign that speculators in China are shifting back from commodities to stocks – although definitive conclusions would be premature at this stage.

In the US, stock investors have completely ignored weakening corporate earnings, the looming threat of another rate hike, as well as weak data points. Despite a recent uptick, the US manufacturing sector appears to be in recession.

As Lance Roberts explains here, the temporary improvement was very likely due to a mixture of seasonal adjustments and a very mild winter. The most recent data releases are actually confirming this, as the downtrend in manufacturing survey data has resumed.

Still, given the recent calm in markets, one has to be open to the possibility that the previous correlation between the the yuan-dollar exchange rate and risk assets is fading and is therefore no longer as meaningful as it once was. However, we actually doubt that this conclusion is warranted.

The basic problem that declining forex reserves in China pose to the markets remains the same after all – there is no obvious reason why markets should react differently to noticeable movements in the yuan exchange rate.

Conclusion

We are closely watching USD/CNY, along with other “commodity currencies” such as the Australian and Canadian dollars as well as South Africa's rand, which have been weakening again.

If these trends continue, they will definitely be reflected in commodity prices at some point, and this effect could then propagate to other markets – i.e., the opposite of the chain reaction that could be observed between early February and today.

We suspect that if the yuan breaks to a new low for the move (i.e., if USD/CNY breaks above lateral resistance in the 6.60 to 6.65 area), concerns about China’s reserves and exchange rate policy will be rekindled. The relative calm in “risk asset” markets could then very quickly give way to panic again.

Charts by: BarChart, TradingEconomics, BigCharts