Verizon Communications Inc. (NYSE:VZ) is the largest telecom operator in the U.S. providing high-end wireless and wireline services to individuals, business enterprises and government agencies.

Verizon plans to launch 5G wireless residential broadband services in three to five U.S. markets in 2018. Verizon is expected to launch its online TV streaming service by 2017-end, backed by the latest digital streaming deal with the National Football League (NFL). Verizon is targeting the SMB segment with Fios Current TV video services. Verizon and AT&T (NYSE:T) have inked a joint deal with Tillman Infrastructure to build cell towers in the United States. Verizon is teaming up with Amazon (NASDAQ:AMZN) to deliver virtual network services at a global scale. Verizon along with Ericsson (BS:ERICAs) and Qualcomm (NASDAQ:QCOM) achieved a download speed of 1.07 Gbps. Verizon has been aggressively forging ahead to expand its fiber optics networks (with new buyouts) to support 4G LTE and upcoming 5G wireless standards as well as wireline connections.

On the flip side, we remain concerned about Verizon’s continuous struggle in the highly competitive and saturated U.S. wireless industry. Spectrum crunch is a major issue in the domestic telecom industry. Moreover, the entry of major cable companies like Comcast (NASDAQ:CMCSA) and Charter Communications (NASDAQ:CHTR). Persistent losses in wireline access lines, marketing costs of promotional plans, competitive video market are other major risks.

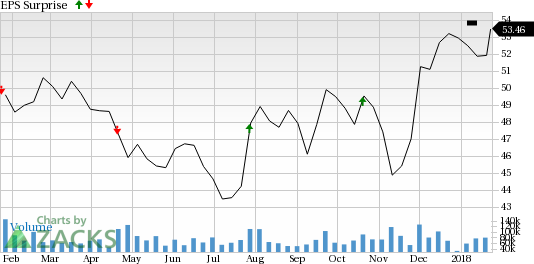

Zacks Rank: Verizon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. The company has generated negative average earnings surprise of 0.83% in the previous four quarters.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: Verizon lags fourth-quarter 2017 earnings. Our consensus called for an adjusted EPS (earnings per share) of 88 cents while the company reported an adjusted EPS of 86 cents.

Revenue: Verizon reported total revenue of $33,955 million outperforming the Zacks Consensus Estimate of $33,146 million.

Key States to Note: In the fourth-quarter 2017, Verizon gained net 1.147 million retail postpaid connections but lost 0.184 million prepaid customers. Retail postpaid churn was 1.00% compared with 1.10% in the year-ago quarter. At the end of the fourth-quarter of 2017, Verizon had 116.257 million total retail connections, up 1.8% year over year.

Check back later for our full write up on this Verizon earnings report later!

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Original post

Zacks Investment Research