London Forex Report: USD/JPY Breaches Key Technical Levels

London Forex Report: USD/JPY breaches key technical levels overnight as liquidity seems to be exacerbating moves with China out for the week. Equities finished sharply lower driven by the painful price action in European credit markets. Treasuries continued their rally as global markets sold off. Much of the Treasury demand was driven by fears about the health of European banks amid negative interest rates and slowing economic growth.

Yields in both Europe and the US fell as market participants fear the possible effects and spillovers of turmoil in the European banking sector. Crude stayed below $30 a barrel as equities tumbled and the oil supply glut continues. Venezuela’s tour of oil-producing nations was unsuccessful as no steps to curb supply were announced after Saudi Arabian Oil Minister Ali al Naimi met his Venezuelan counterpart Sunday in Riyadh.

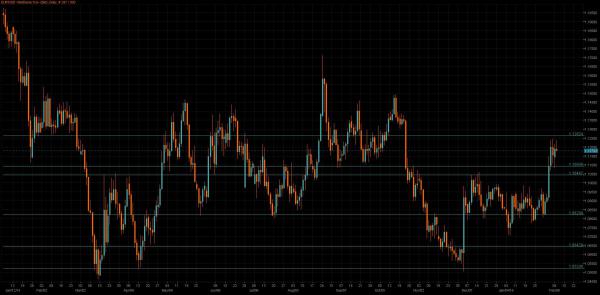

EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: ECB’s Coeure: ECB aims to protect EZ from being the victim of global slowdown, will do more if we need to get inflation higher. EUR is caught between the ‘safety bid’ and ECB rhetoric. Market expects the ECB to continue to attempt to cap EUR/USD topside, but that still leaves the pair vulnerable to risk sentiment flows.

Technical: While 1.1050/30 remains intact as support expect rotation through last weeks highs en route to test 1.14 symmetry objective. Below 1.0950 suggests false upside break and opens retest of range lows.

Interbank Flows: Bida 1.11 stops below. Offers 1.1250 stops above

Retail Sentiment: Bearish

Trading Take-away: Long

GBP/USD

Outlook: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP remains weak as markets speculate about any central bank with a hiking bias turning to an easing bias. Polls also suggest that British voters might vote to exit the EU. Front end rates have fallen substantially over the last month as weaker risk sentiment combined with moves to negative rates from the ECB and BoJ. Upward sloping curves in the US and UK had the most room to reprice lower, hurting USD and GBP.

Technical: Testing base support of last weeks advance failure at 1.4350 suggests false upside break and resets bearish trend to attack and break 1.40 as the primary downside objective. Over 1.45 re- establishes bullish bias and targets retest of last weeks highs

Interbank Flows: Bids 1.4350 stops below. Offers 1.45 stops above.

Retail Sentiment: Neutral

Trading Take-away: Neutral

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY has broken important technical levels, and, bar a BoJ ‘intervention’, markets will be wary of further downside, which keeps pressure on the USD/JPY bounces are very limited, as broader market trades poorly, and sentiment hit as attention refocuses on signs of stress across certain products. The inability to hold key support despite IOER move, Kuroda comments on further easing stance, was a sign in itself and clearly reflects instability and unforeseen concerns.

Technical: USD/JPY breaches major neckline support overnight. While 116.70 caps intraday upside reactions expects a grind lower to test 113.90 as the next downside objective.

Interbank Flows: Bids 114 offers below. Offers 116 stops above

Retail Sentiment: Bullish

Trading Take-away: Short

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Poor German industrial production out of Germany this morning coupled with broader weak risk sentiment sees continued pressure on the cross. Widening core-peripheral eurozone interest rate spreads a new EUR negative also weighing on the cross.

Technical: While 130 continues to cap upside reactions expect tests of 127.70 bids next, failure through this level opens 126 as the next downside objective. Only a close over 130 eases immediate downside pressure.

Interbank Flows: Bids 128 stops below. Offers 130 stops above.

Retail Sentiment: Bullish

Trading Take-away: Short

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: NAB business survey today in Australia demonstrates softening in commercial conditions as renewed concerns of global growth / China and financial market volatility begin to be borne out in the data.

Technical: AUD is testing pivotal .7000 support a failure here resets the bearish bias and targets a test of .6950 en route to a retest of year to date lows. Only a close over .7150 eases immediate downside pressure

Interbank Flows: Bids .70 stops below. Offers .7150 stops above.

Retail Sentiment: Bullish

Trading Take-away: Neutral