USD/JPY near-term outlook:

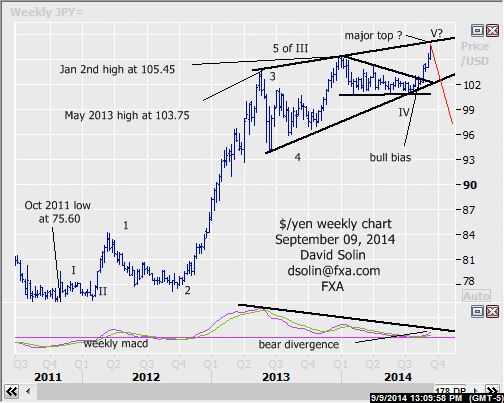

In the Sept 4th email, again affirmed the bullish view from the Aug 19th email (above bear trendline from Jan could trigger upside acceleration back to the Jan high at 105.45, and above). The market has indeed continued sharply higher since, taking out that 105.45 high, and on way toward potentially important resistance at the ceiling of the rising wedge/rising resistance line from May 2013 (currently at 107.40/65, see longer term below). At this point, the market is near term overbought after the sharp gains since July, but there is little else to suggest/confirm a nearer term top (never mind a more substantial one). However, would not be surprised to starting seeing some other negatives start to appear as the market approaches this longer term resistance area (slowing upside momentum, etc.). Nearby support is seen at 105.60/70 and the bullish trendline from Aug 18th (currently at 104.65/75). Bottom line : no top yet but further upside likely to start becoming more "difficult".

Strategy/position:

Was unfortunately just barely stopped on the Aug 5th long at 102.75 on Aug 28th (closed 15 ticks below that week long bullish, said to stop on close 10 ticks below) before resuming the upmove. At this point there is scope for further gains nearby, but with the market seen approaching that longer term resistance area and potential for an important top forming, not seen as a good risk/reward in chasing the market higher from here.

Long-term outlook:

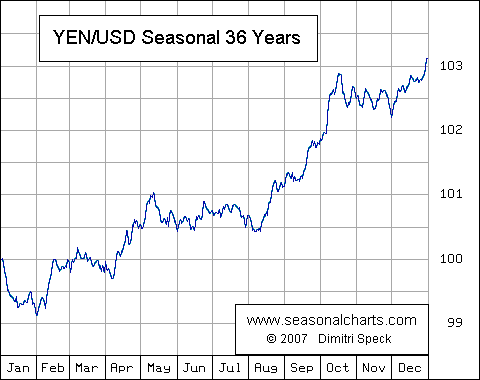

Long held view of eventual gains back to the Jan high at 105.45 and even above is playing out. Note however, that this upside may be part of a longer term topping and versus the start of a major, new upleg. As discussed above, may be forming a large rising wedge since May 2013, generally viewed as a reversal pattern and suggests an eventual (and potentially sharp) downside resolution of the base (currently at 101.75/00, see "ideal" scenario in red on weekly chart/2nd chart below). Additionally, the market is seen within the final upleg in the whole rally from the Oct 2011 low at 75.60 (wave V), technicals are not confirming the recent gains (see bearish divergence on weekly macd), the seasonal chart for the yen is higher through the end of the year (lower for $/yen, see 3rd chart below) and equities appear vulnerable for declines (potentially sharp) over the next few months (correlated to $/yen). But remember, this is the "ideal" scenario and with no confirmation of even a shorter term top (so far), the confidence is not yet extremely high. Bottom line : potential for a more major top to form ahead, but no confirmation of even a shorter term peak so far.

Strategy/position:

With no firm signs of even a shorter term top so far, would stay with the longer term bullish bias that was put in place on Aug 5th at 102.60. However, will be looking for such signs ahead to flatten and even reverse.