USD/JPY has posted losses on Monday, continuing the downward trend which marked the Friday session. The pair is trading slightly below the 102 level. The yen posted strong gains to end the week after the stunning Brexit vote in the UK. On the release front, it’s a very quiet start to the week, with no Japanese events. The US will publish Goods Trade Balance and Flash Services PMI, both minor events. There are no Japanese releases on Monday. On Tuesday, the US will release two key events – Final GDP and CB Consumer Confidence. Japan will publish Retail Sales.

Financial markets across the globe are still in shock after the stunning news on Friday that the UK had voted to exit the European Union. The markets had bet that the Remain camp would narrowly win the day, and the opposite result sent stock markets tumbling on Friday. The historic decision raises many questions and has resulted in political and financial instability in Europe and the UK. On Friday, the pound dropped as much as 11 percent, and Prime Minister David Cameron announced he would resign in a few months time. The safe-haven yen has taken advantage of the Brexit turmoil, gaining 3.2% against the dollar since Friday. The yen briefly broke below the 100 level on Friday, much to the consternation of the Bank of Japan, as the strengthening yen is hurting the fragile Japanese economy.

It’s difficult to gauge the extent of the economic and political fallout so soon after the historic EU referendum, but there’s no doubt that Brexit will have unpredictable economic and political consequences in the UK and Europe, perhaps for years to come. The UK economy of GBP 2.9 trillion is the fifth largest in the world and number two in Europe, after Germany. Even before the dust of Brexit has settled, there are signs that this divorce between Britain and the EU could be rancorous and messy. One British MP quipped that the EU referendum was the “divorce of the century”. British politicians have said there is no rush to implement the EU exit mechanism, while furious European lawmakers have called for the UK to leave as soon as possible. Britain may have voted “Leave”, but the timing and the type of exit plan remain unclear. The future framework of political and economic relations between the UK and the continent will have to be negotiated, and we will see plenty of uncertainty in the coming months.

Brexit has ushered in a period of instability and uncertainty across Europe, with Brexit seemingly the only certainty one can point to. On the EU side, the bloc has plenty of new headaches, as it must deal not only with the British exit but also from rejuvenated Euro-skeptics across Europe. The Brexit vote is likely to renew debate about EU membership in countries like the Netherlands and Denmark. Even in France, a staunch member of the club, EU membership could be revisited, as Jean-Marie Le Pen, head of the Front National party, has called for a EU referendum in France. The EU is under a real threat of destabilization and will have to figure out how to deal with the tremendous challenges suddenly brought on by Brexit.

Overshadowed by the Brexit vote, the US wrapped up last week with soft manufacturing and consumer confidence numbers. Core Durable Goods Orders came in at -0.3%, marking the third decline in the past four months. This figure was well short of the forecast of +0.1%. There was no relief from Durable Goods Orders, which posted a sharp drop of 2.2%, compared to forecast of a 0.5% decline. The UoM Consumer Sentiment report also missed expectations, with a reading of 93.5 points. The markets had expected a reading of 94.2 points. Next up is Final GDP on Tuesday, and the strength of the release could have major implications regarding a rate move during the second half of 2016.

USD/JPY Fundamentals

Monday (June 27)

- 8:30 US Goods Trade Balance. Estimate -59.5B

- 9:45 US Flash Services PMI. Estimate 52.0

Upcoming Key Events

Tuesday (June 28)

- 8:30 US Final GDP. Estimate 1.0%

- 10:00 US CB Consumer Confidence. Estimate 93.2

- 15:50 Japanese Retail Sales. Estimate -1.6%

*Key events are in bold

*All release times are EDT

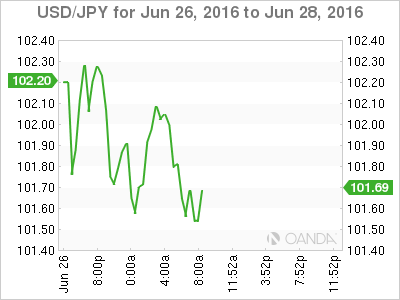

USD/JPY for Monday, June 27, 2016

USD/JPY June 27 at 12:10 EDT

Open: 102.18 Low: 101.36 High: 102.46 Close: 101.70

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.9888 | 0.9971 | 101.07 | 102.36 | 103.73 | 104.99 |

- USD/JPY has shown limited movement in the Asian and European sessions

- 101.07 is providing support

- There is resistance at 102.36

- Current range: 101.07 to 102.36

Further levels in both directions:

- Below: 101.07, 0.9971 and 0.9888

- Above: 102.36, 103.73, 104.99 and 105.87

OANDA’s Open Positions Ratio

The USD/JPY ratio is showing slight gains in short positions on Monday. Long positions have a strong majority (70%), indicative of trader bias towards USD/JPY reversing directions and moving higher.