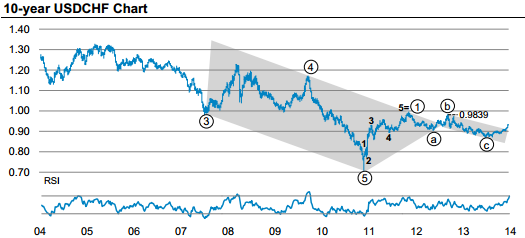

On the 10-year chart:

"USD/CHF completed a major 5-wave sequence that began in 2000, reaching a low of 0.7071. USD/CHF broke out of the historical trend channel in mid-2012 and has since been trading within another smaller channel. We recently wrote about how breaking the 0.91 level was key for our bullish USDCHF view. Having now broken this level, we would use any setbacks to enter long positions," MS projects.

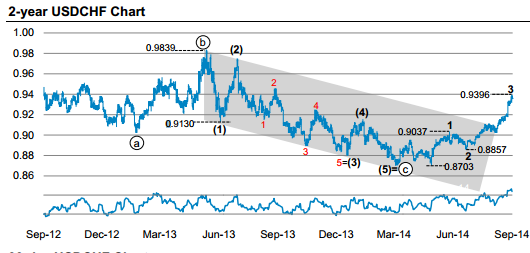

On the 2-year chart:

"Having broken out of the upper end of the trend channel around 0.91, USD/CHF has continued to accelerate. If the 0.9396 level was a high, then the 3 rd wave would have completed and USD/CHF would retrace. We look for a tretracement down to the 0.9150 area, where we would buy again. Over the longer term we would expect USD/CHF to exceed the b - wave top at 0.9839," MS adds.

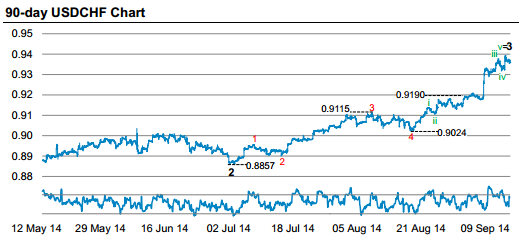

On the 90-day chart:

"In the short term, should 0.9396 be the high, USD/CHF could retrace the 3 rd -wave. The 38.2% retracement is at 0.9190 and the 50% at 0.9126. We recommend long USD/CHF positions from this area. The risk would be a move below the 2-wave bottom at 0.8857. Our fundamental view also supports this trade," MS advises.

MS booked around 300-pip profit on its last USD/CHF long and now runs a limit order to re-buy at 0.9260.