It’s been an abnormally slow week for economic data out of North America, but that will change for the better over the next two days. Tomorrow brings two readings on the US labor market: initial unemployment claims and JOLTS jobs openings. Both measures have been historically strong of late, with the 4-week moving average of initial jobless claims at just 279,000, its lowest level since April 2000 and JOLTS job openings at its highest level since January 2001! With the Fed’s recent pivot from focusing on jobs to focusing on inflation, any readings near the historically strong readings should keep the dollar rally intact (likewise for Friday’s US Retail Sales and Consumer Sentiment reports).

Above the 49th parallel, a couple of critical economic reports are expected from Canada as well. Canada’s New Housing Price Index for September will be released (expectations are centered on 0.2% growth m/m) followed by September Manufacturing Sales on Friday (1.3% m/m anticipated vs. -3.3% last month). With last Friday’s employment report showing continued stellar growth, traders are cautiously optimistic that economic activity as a whole is picking up in the Great White North.

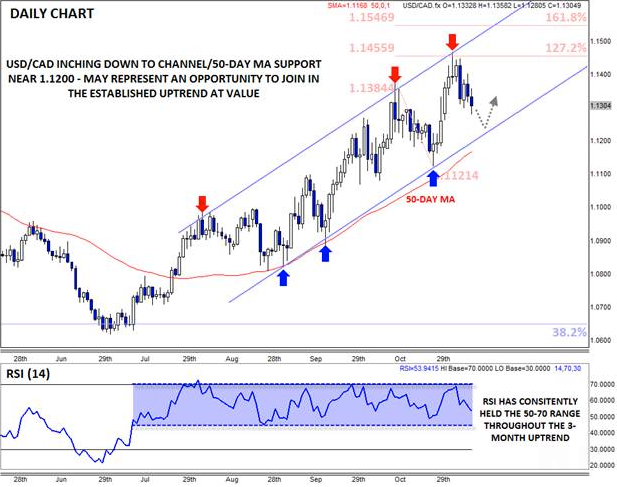

USD/CAD: Technical View

Turning our attention to the chart, USD/CAD has been rising within a clearly defined bullish channel for over three months now. After stalling out against the top of the channel (and 127.2% Fibonacci extension) at 1.1450 midway last week, rates have been pulling back toward the bottom of the channel since. As we go to press, the unit is nearing support at the bottom of the channel and the 50-day MA in the lower 1.12s, suggesting the scope for further losses may be limited.

Beyond the clear trend in the exchange rate itself, the RSI indicator has been bouncing around between 50 and 70 ever since the channel was formed. As we often note, a breakdown in a secondary indicator can be used as a leading or confirming indicator for a break in price itself, but for now, there are no signs that the channel is in imminent danger.

Moving forward, we expect economic improvement in the US to continue to outpace its northern neighbor, and continued strength in the USD/CAD as a result. Therefore, any short-term dips toward the bottom of the channel and the 50-day MA near 1.1200 may represent opportunities for long-term USD/CAD bulls to join the uptrend at value. Only a break below key support in the 1.1200 region, accompanied by a breakdown below 50 in the RSI indicator, would shift the medium-term bias back to neutral.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom).