Nearer term $ index outlook: USD

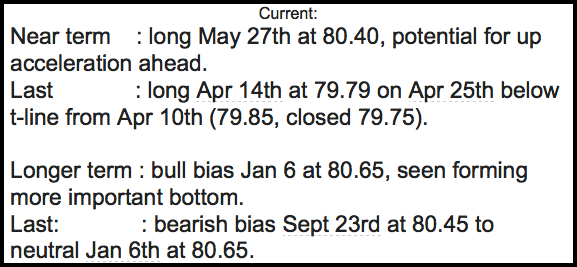

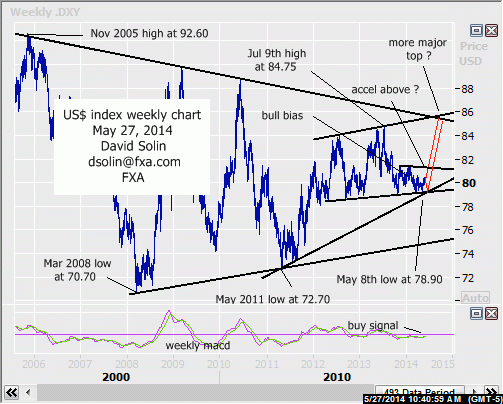

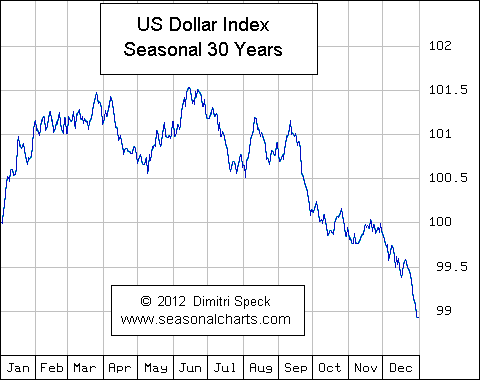

No change in the bigger picture bullish view, as the market is still seen likely completing an important low at the May 8th low at 78.90, with at least another month of upside (and likely longer), toward the bearish trendline since Nov (currently at 81.20/30) and potentially the July high at 84.75 (see longer term below). Note too the technicals are bullish (see buy mode on the daily macd), the seasonal chart is higher for at least the next few weeks (see 3rd chart below), and lots of long term support remains in the long discussed 78.60/00 area. Very near term the market is seen at a "pivotal" area after last week's slight break above the May 15th high at 80.35, with potential for a further upside acceleration directly ahead (within wave 3 in the rally from the 78.90 low). Also, EUR/USD has resolved lower from its multi-month rising wedge and gold has resolved lower from its triangle/pennant since April and both of these patterns often resolve sharply, adding to the potential for a surge directly ahead in the US$ index. But the longer the market goes without resuming the near term upmove, the less likely such a rally becomes and in turn starts to increase the likelihood for another week or 2 of a broader bottoming. Nearby support is seen at the bullish trendline from May 7th (takes out the May 8th spike, currently at 80.10/20).

Strategy/position:

With potential for sharply higher prices directly ahead, want to be long and would buy here (currently at 80.35). But as mentioned above, the inability to follow-through on the upside over the near term would quickly start to lower the likelihood of such a surge, and in turn argue another week or 2 of a broader bottoming. So would use an aggressive stop on a close 10 ticks below that bullish trendline from May 7th to maintain a good overall risk/reward in the position (and with the expectation of rebuying lower).

Long-term outlook:

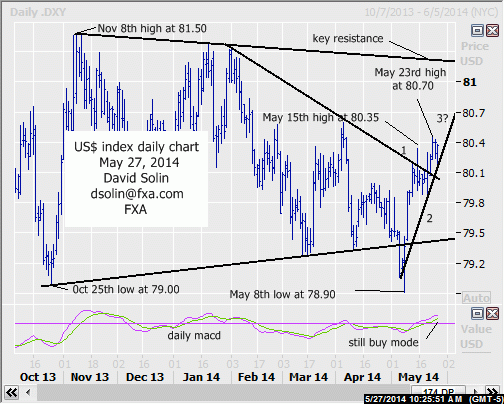

As discussed above, the market is also seen completing a potentially more important bottom, with scope for eventual gains all the way back to the July 2013 high at 84.75 (see weekly chart/2nd chart below). Lots of longer term positives are still in place as the market remains within the large triangle pattern that has been forming since Nov 2005. After the May 2011 low at 72.70 test of the base, gains toward the ceiling (currently just above that 84.75 high) are favored (within this larger triangle pattern). Additionally, the market remains supported by that key 78.60/00 area (bull trendline and 50% from that May 2011 low at 72.70), long term technicals are positive (new buy mode on the weekly macd), and the US$ is seen forming important lows versus a number of currencies (rising wedges/reversal patterns since Oct in both eur/$ and cable for example, see emails from last week). Key resistance is seen at that bearish trendline from Nov (currently at 81.20/35), as a break/close above would confirm that a more important low is indeed in place and potentially trigger a further, upside acceleration.

Strategy/position:

With lots of evidence of a more important bottoming (and potential for gains toward the July high at 84.75), would stay with the longer term bullish bias that was put in place on Jan 6th at 80.65.