Here are four stocks with buy rank and strong income characteristics for investors to consider today, September 9th:

The Buckle, Inc. (BKE): This retailer of apparel, accessories and footwear has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.9% over the last 60 days.

Buckle, Inc. (The) Price and Consensus

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 5.02%, compared with the industry average of 0.00%. Its five-year average dividend yield is 3.95%.

Buckle, Inc. (The) Dividend Yield (TTM)

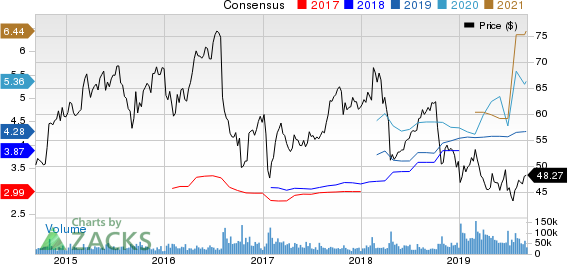

Bristol-Myers Squibb Company (NYSE:BMY) (BMY): This biopharmaceutical company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.9% over the last 60 days.

Bristol-Myers Squibb Company Price and Consensus

This Zacks Rank #2 (Buy) company has a dividend yield of 3.40%, compared with the industry average of 2.84%. Its five-year average dividend yield is 2.67%.

Bristol-Myers Squibb Company Dividend Yield (TTM)

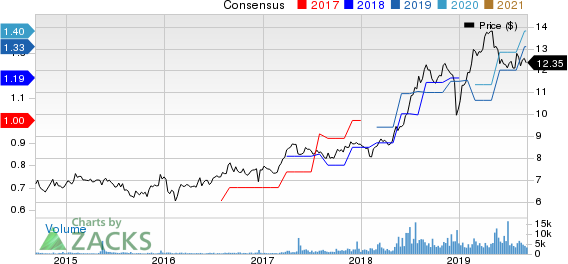

Arbor Realty Trust, Inc. (ABR): This real estate investment trust and national direct lender has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.1% over the last 60 days.

Arbor Realty Trust Price and Consensus

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 9.39%, compared with the industry average of 4.34%. Its five-year average dividend yield is 8.61%.

Arbor Realty Trust Dividend Yield (TTM)

The AES Corporation (NYSE:AES) (AES): This diversified power generation and utility company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.8% over the last 60 days.

The AES Corporation Price and Consensus

This Zacks Rank #2 (Buy) company has a dividend yield of 3.57%, compared with the industry average of 2.92%. Its five-year average dividend yield is 3.58%.

The AES Corporation Dividend Yield (TTM)

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Buckle, Inc. (The) (BKE): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

Arbor Realty Trust (ABR): Free Stock Analysis Report

Original post

Zacks Investment Research