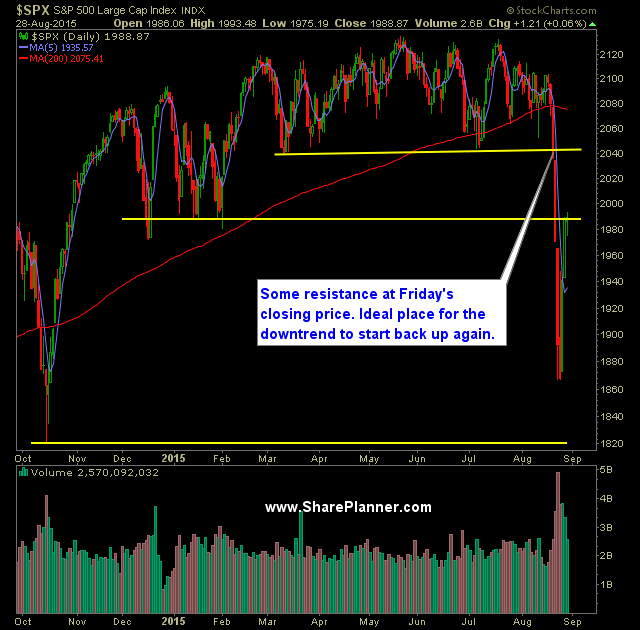

Technical Outlook:

- SPX has rallied three straight days and taken price all the way up to the 50% Fibonacci retracement level.

- Volume has returned back to average levels on NYSE:SPY, falling for a fourth consecutive day.

- Considering the 50% retracement, and if this truly is just a dead cat bounce, the resumption of the downtrend should begin here, but no later than 2048.

- With the gap down tomorrow, the bear's objective should be, at least, a push below Thursday's lows at 1942.

- The bulls will need to close the likely gap down the market is facing this morning, and push SPX closer to the 20-day moving average.

- VIX has leveled off some of late at the 26 level, only dropping 0.2% on Friday.

- T2108 (% of stocks trading above their 40-day moving average) has continued its rally, by moving up 16% to 18.5%.

- SPX 30 minute chart shows a nice level of consolidation at the bounce highs. A break below 1948, would confirm a double top in the pattern.

- Be very careful of the market levels here. The tendency is to start buying out of fear that the rally is being missed only to find out later this was a dead-cat bounce that you went long at the end of.

- End of day rally occurred on Friday in the last 15 minutes to actually push the market into the positive by a hair, rallying 13 points in the last 15 minutes.

- Here is what you should be asking yourself - in six days, SPX drops 234 points non-stop - over 10%. Are we really to assume the sell-off is now over in just six days and we are all going to be back on the road to new all-time highs? I think not.

- Trade nimble, be careful about holding positions overnight, because the volatility is still at extreme levels and much of the daily moves are happening before the market ever opens.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

My Trades:

- Added one new short position to the portfolio on Friday.

- Did not close out any positions on Friday.

- 10% Short/100% cash

- I am using a ultrashort ETF for my position.

- I am expecting to see the current rally run out of steam here at the resistance noted below and at the 50% Fibonacci retracement level.

Chart for SPX: