Technical Outlook:

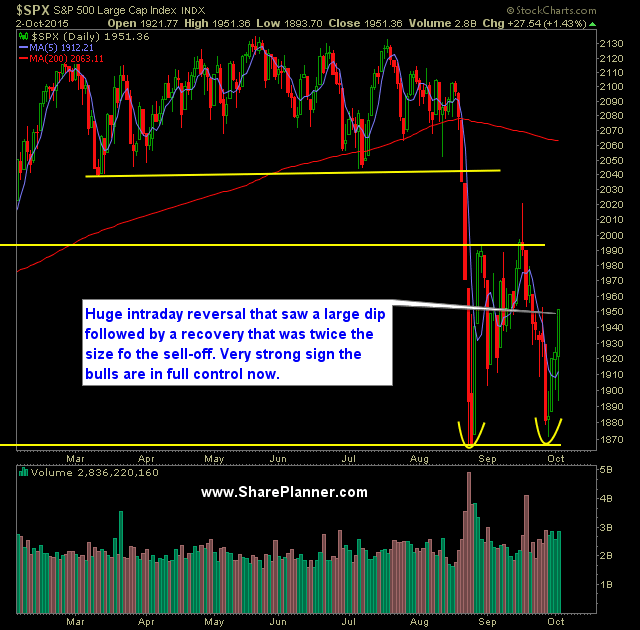

- S&P 500 on Friday sold off hard at the open, but traders managed to buy the dip and turn -1.5% loss into a +1.4% gain.

- The reversal on Friday, was one of the biggest reversals seen out of the market going all the way back to 2011.

- If SPX finishes higher today, it would be the first time this year, it has managed trade higher five days in a row in 2015.

- On the daily chart, SPX managed to close above the 20-day moving average.

- Volume on SPDR S&P 500 (NYSE:SPY) was very strong on Friday and well above average.

- The employment report initially sold the market off hard and fast, but wasn't enough to keep the market down.

- VIX dropped 7.1% down to 20.94.

- The possibility exists that the VIX could close below 20 for the first time since the rally began back on 8/20/15.

- There is a very good chance, as we enter into a historically strong Q4, that the lows for the year have been established.

- If the lows for the year are in, there is a nice double bottom chart that is forming on the daily SPX.

- 30-minute chart of SPX shows a that a break of 1950 has occurred, and now needs to see some follow through at this point.

- In the final hour of trading on Friday, SPX managed to rally 20 points into the close. A strong sign of short-covering taking place, considering there wasn't a single pullback of any kind.

- The huge miss in the employment report likely insures that there won't be a rate hike in October.

- After trading lower for two straight quarters (a rarity that hasn't been seen since 2011), I wouldn't be surprised to see quarter four turn out to be very bullish for the market.

- The Fed has never raised interest rates at a point where the market was trading lower on the year.

- The large gaps in the market, the record number of stock buybacks, and ETFs that are constantly accumulating/dumping large chunks of stocks, and most importantly the high frequency trading, shows just how illiquid this market has become in recent years. These entities are the most responsible for the massive market swings that stocks incur each day.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

My Trades:

- Added two new long positions to the portfolio Friday.

- Did not close out any swing-trades yesterday.

- 40% Long / 60% Cash

- Remain long: (NYSE:SSO) at $55.07, (NYSE:HRB) at $36.23.

- Will continue to play this market long while the market bounce persists.