Pre-market update:

- Asian markets traded 0.6% lower.

- European markets are trading 1.0% higher.

- US futures are trading 0.1% lower ahead of the market open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), FHFA House Price Index (9), Richmond Fed Manufacturing Index (10)

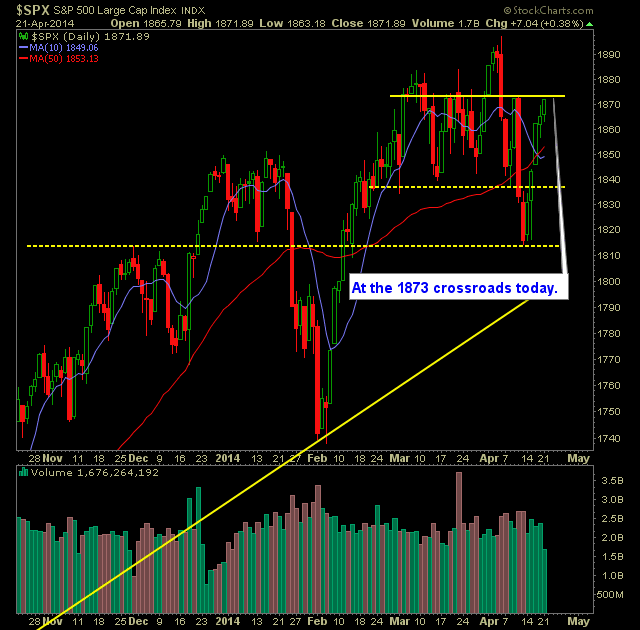

Technical Outlook (SPX):

- Fifth straight day in the green for the S&P 500 - the longest winning streak so far in 2014.

- Price action takes us right up to the 1873 mark which has acted as major resistance of late.

- Volume has been incredibly light of late, which calls into question whether buyers are running on fumes at this point in the rally.

- On SPY, volume was half of what it was last Wednesday.

- 55 point rally over the past 5 days of trading without any kind of pullback. SPX is quickly entering overbought territory.

- Dating back to the 7th of April, SPX shows a possible inverse head and shoulders pattern forming, in which it is currently starting on the right shoulder.

- VIX is all the way down to 13.25. It was trading above 17 last week.

- Two months of reversals have taken place at the 1873 price level.

- SPX needs to break and close above 1873 for this bounce to be taken seriously.

- Also, a break of 1873 would represent a new higher-higher, and break the downtrend of the past two weeks.

- It is very possible that much of this rally has been a result shorts being squeezed out of their positions.

- The Market doesn't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

My Opinions & Trades:

- Added two new short positions yesterday.

- Did not close out any positions yesterday.

- Will look to add 1-2 new positions today.

- Long 10% / Short 20% / 70% Cash

Chart for SPX: