Has the USD bottomed?

Equity market sentiment seems to be rolling over globally as the wind begins to come out of the oil price rally. For Australia, even the recently announced RBA rate cut and the Federal budget’s promise of a 25% corporate tax rate may not be enough to help the market hold on to yesterday’s gains. The US dollar also broke its six session losing streak overnight, gaining 0.4% in the DXY dollar index and 0.7% in the Bloomberg dollar index. The US dollar has dropped to some of its lowest levels seen since January 2015, but two Fed speakers came out last night and were very keen to talk up the possibility of rate hikes in June. While a Fed rate hike in June seems unlikely, it is perfectly sensible for them to talk up the possibility to prepare markets for a potential rate hike in 3Q.

If this is the Fed’s game plan and we begin to see a slew of Fed speakers getting more hawkish, the US dollar may start to gain from its very low levels. This may mark the turning point for the mid-February rally in commodities. WTI oil has already lost 5.1% over the past three sessions, and the CFTC report is showing net futures positions in oil last week reached their most bullish in two years, which is a pretty strong signal that a reversal is on the cards. Although the slightly smaller than expected US inventories build in the API report produced a temporary bounce. Iron ore and copper followed oil down overnight losing 4.3% and 2.1%, respectively, as momentum came out of China’s most recent PMIs.

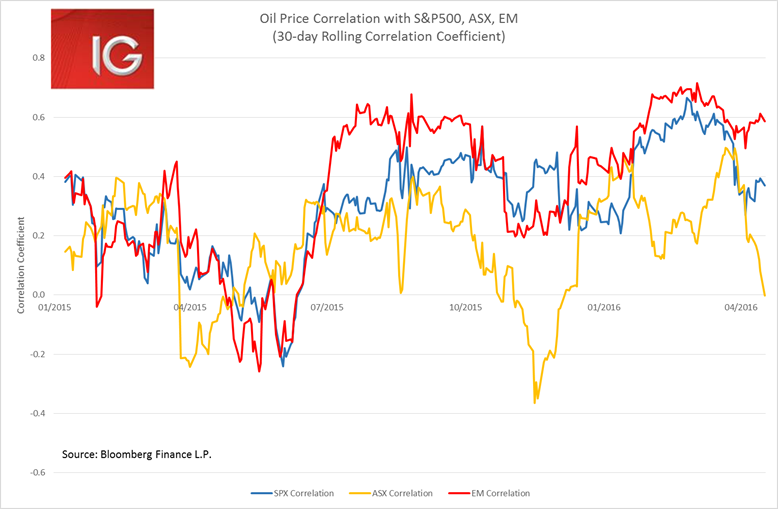

Given the very close correlation between oil price movements and equity markets, this should be a concern for near-term performance. Although it is the MSCI Emerging Markets index that has the closest correlation to the oil price, and over the past four sessions it has already dropped 4.5%. Overnight we also saw a noticeable increase in credit spreads in fixed income markets, often a clear sign of nervousness in markets. iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG), the main high yield bond ETF, lost 0.7% over, another market closely correlated with oil.

The combination of the RBA rate cut, bounce in the US dollar, and wilting commodity prices is setting the Aussie dollar up for a fairly sustained drop. The Aussie dollar lost 2.3% overnight, and crucially broke through its key support level at US$0.75. If we do start to see consistent momentum behind this selloff, a move down to US$0.72-$0.73 could happen within a week.

Aussie banks’ American Depositary Receipts (ADRs) had a good session overnight, and any hope that the ASX will manage to hold onto yesterday’s gains will largely rest with them. Given the move in commodity prices, the materials and energy sectors are set for a difficult session. We are calling the ASX to open 0.7% lower.