- Salesforce: Stock up 3% with Q4 earnings surpassing forecasts, initiating a quarterly dividend and expanding buyback program.

- Zoom: Shares surge 8% on Q4 beat, buoyed by hybrid work demand and a $1.5 billion share buyback.

- eBay: Shares rise over 7% after Q4 results beat estimates, coupled with a share repurchase expansion and dividend increase.

- Subscribe to InvestingPro for under $9 a month and get 70+ AI-powered market-beating stock picks every month!

In this week's earnings recap, we delve into the latest quarterly reports from four industry giants— eBay (NASDAQ:EBAY), Zoom Video Communications (NASDAQ:ZM), Salesforce (NYSE:CRM), and Snowflake (NYSE:SNOW).

Salesforce

Salesforce experienced a 3% increase in its stock price on Thursday following the announcement of Q4 earnings that surpassed expectations, the initiation of its first quarterly dividend, and an increase in its stock repurchase program.

For Q4, Salesforce reported an EPS of $2.29, a significant rise from $1.68 the previous year, with revenue reaching $9.29 billion, up from $8.38 billion. These results exceeded analyst forecasts of $2.27 EPS on $9.22 billion in revenue.

Despite these strong results, Salesforce's projection for full-year revenue was below market expectations, hinting at a potential slowdown in cloud and tech spending amidst high-interest rates and inflation.

The company declared its first-ever quarterly dividend of $0.40 per share and increased its share buyback program by an additional $10 billion.

Post-earnings, several Wall Street firms raised their price targets on Salesforce, including BofA Securities, which adjusted its target to $360.00 from $350.00, noting that 'a multi-year AI growth cycle coming into view'.

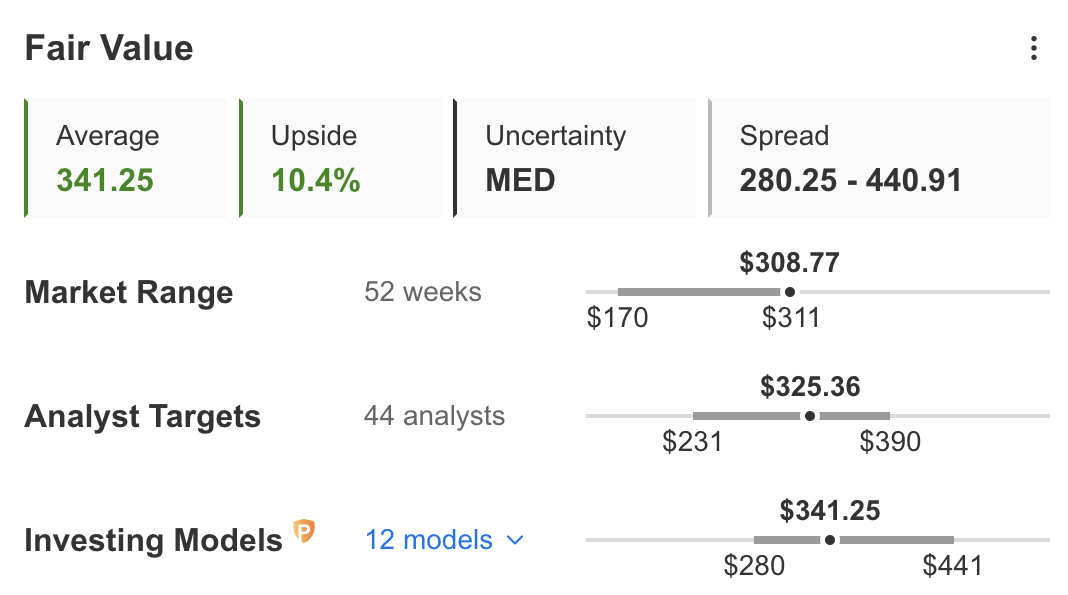

InvestingPro's Fair Value analysis suggests a 10.3% potential upside in Salesforce's stock price according to Investing Models, while analyst targets predict a more conservative 5.3% gain.

Source: Investing.com

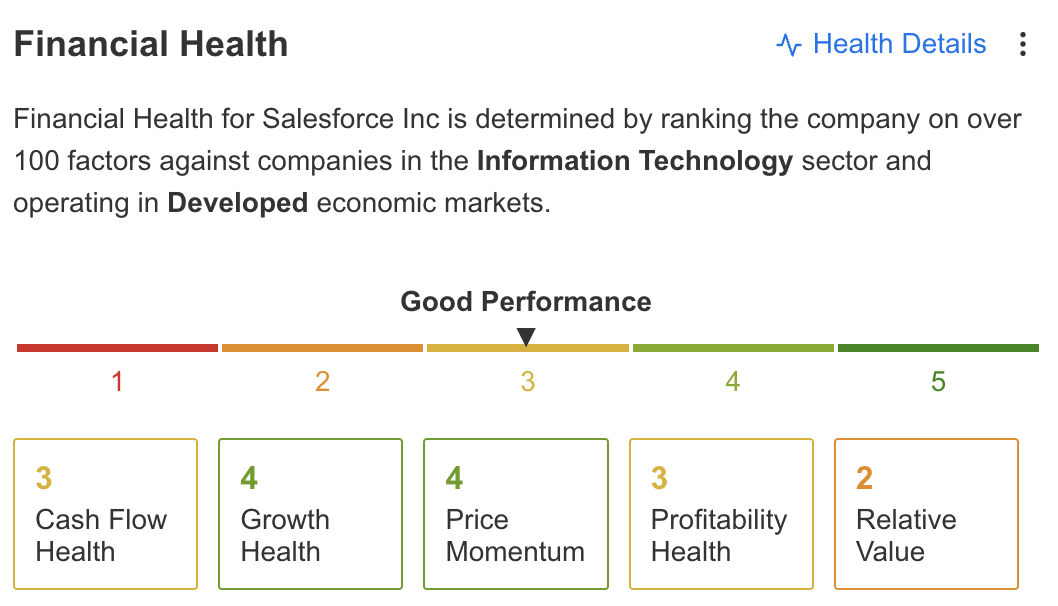

Salesforce is ranked for Good Performance in the Pro’s Financial Health, which is determined by ranking the company on over 100 factors against companies in the Information Technology sector and operating in Developed economic markets.

Source: Investing.com

Zoom

Zoom Video Communications stock surged nearly 8% on Tuesday following its announcement of stronger-than-anticipated Q4 results, propelled by robust demand for its products amid rising trends in hybrid work environments.

The company also declared a share repurchase program of up to $1.5 billion.

The company reported a Q4 EPS of $1.42, surpassing the expected $1.14. Revenue increased by 2.6% year-over-year to $1.15B, beating the consensus estimate of $1.13B, with enterprise revenue reaching $667.3 million, representing a 4.9% year-over-year increase.

For Q1/25, Zoom forecasts an EPS between $1.18 and $1.20, above the anticipated $1.13, and projects revenue to be around $1.126B, slightly below the consensus estimate of $1.13B. The company's full-year 2025 revenue is projected at $4.6B, compared to analysts' expectations of $4.66B.

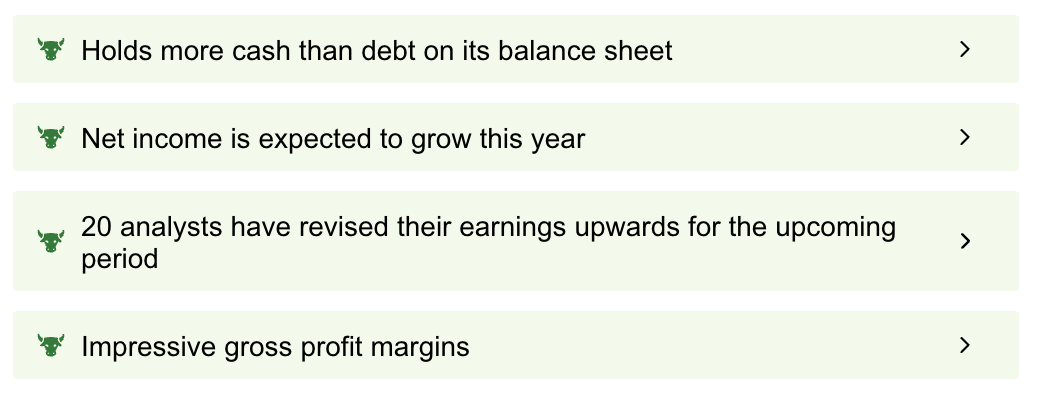

Our ProTips summary on the InvestingPro provides a quick company overview. It points out several strengths such as a solid cash position exceeding debt, anticipated net income growth, upward earnings revisions from 20 analysts, and impressive gross profit margins.

Source: Investing.com

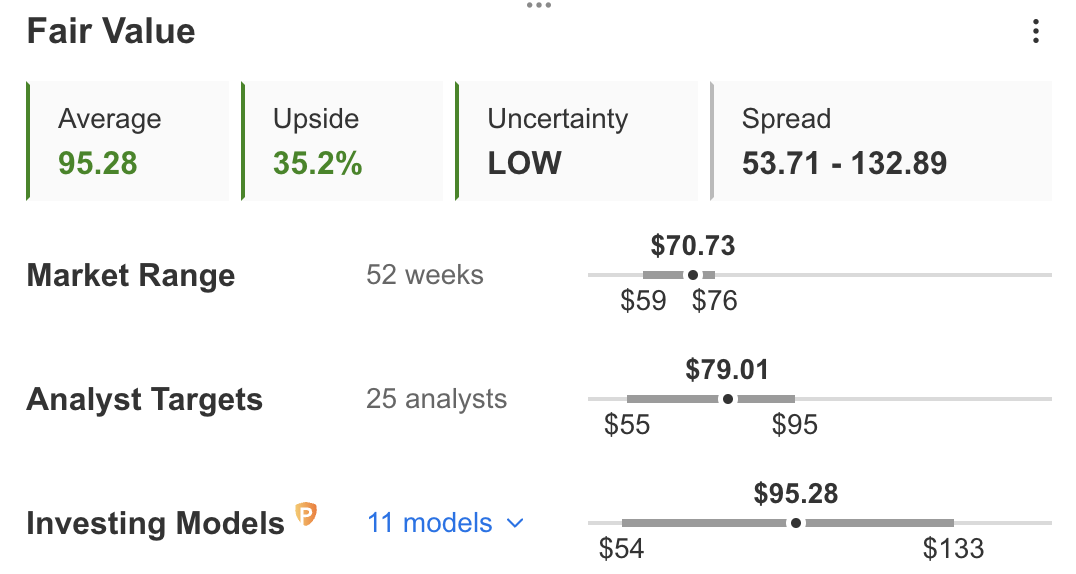

The Fair Value analysis on InvestingPro is also optimistic for Zoom, indicating a 35.2% potential increase in stock price according to Investing Models, with analyst targets suggesting an 11.7% upside.

Source: Investing.com

eBay

eBay saw its shares climb over 7% on Wednesday following the announcement of Q4 earnings that exceeded expectations, alongside news of a share repurchase program and a dividend increase.

In Q4, the e-commerce company posted an adjusted EPS of $1.07 and revenue of $2.56B, surpassing analyst predictions of an EPS of $1.03 and revenue of $2.51B. Despite a challenging economic landscape, gross merchandise volume reached $18.6 billion, marking a slight 2% decrease. This performance was buoyed by solid holiday spending and the company's strategic focus on categories like refurbished items and automotive parts.

Looking ahead to Q1, eBay forecasts an adjusted EPS between $1.19 and $1.23, with revenue projections ranging from $2.50B to $2.54B, contrasting with Wall Street's expectations of an EPS of $1.13 and $2.53 billion in revenue.

Additionally, eBay announced an additional $3B stock buyback program and a quarterly dividend increase of 8% to $0.27 per share.

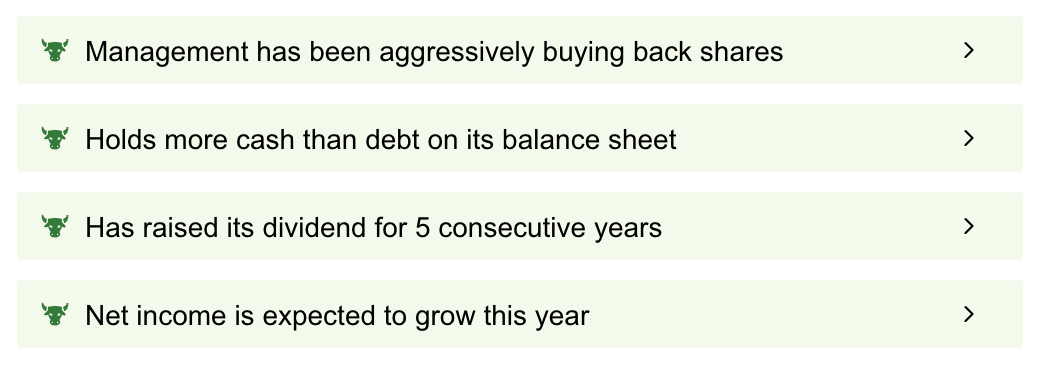

InvestingPro's ProTips summary sheds light on eBay's financial strengths, including aggressive share repurchases, a strong cash position relative to debt, consistent dividend growth over five years, and anticipated net income growth.

Source: Investing.com

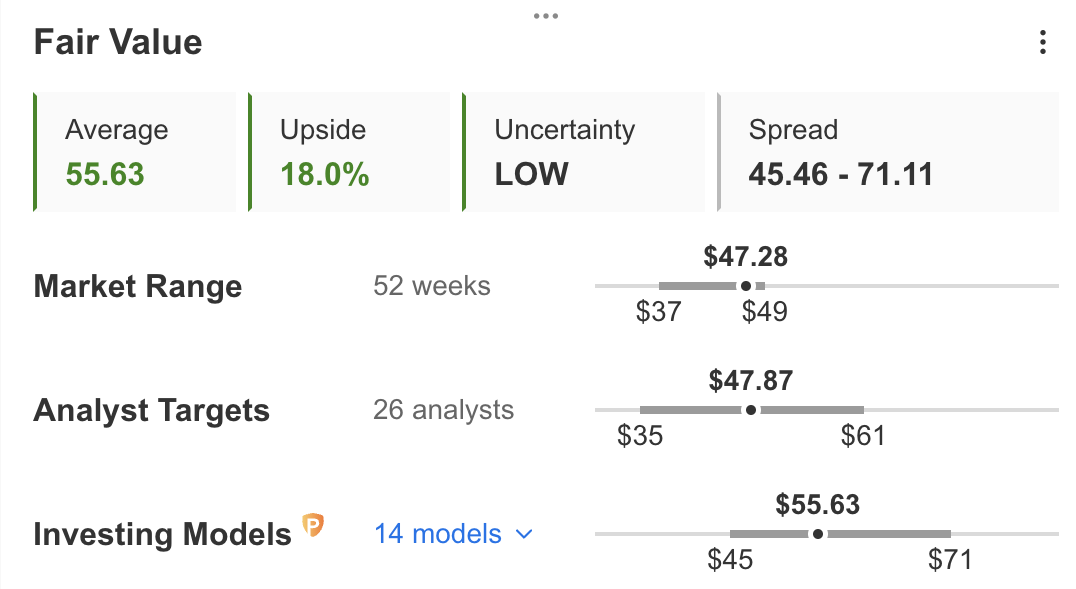

According to our Fair Value section, Investing Models suggest eBay's stock has an 18.0% upside potential.

Source: Investing.com

Snowflake

Snowflake shares plunged 18% on Thursday following its weak revenue guidance, which fell short of Wall Street predictions amid expectations of reduced customer spending due to economic challenges, and the unexpected announcement of CEO Frank Slootman's retirement.

In Q4, Snowflake outperformed expectations with an adjusted EPS of $0.35 and revenue of $774.7M, surpassing analyst forecasts of $0.18 EPS on $760.6M in revenue.

However, the company's outlook for Q1 product revenue between $745M and $750M, and a full-year revenue projection of $3.25B, did not meet analyst expectations.

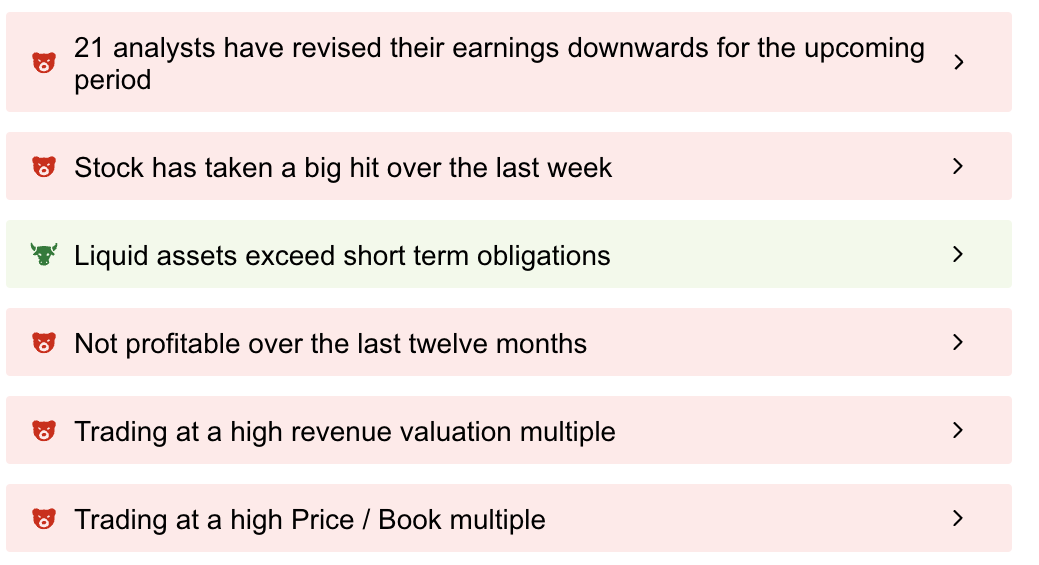

Our ProTips summary for Snowflake paints a predominantly negative picture, emphasizing concerns such as downward earnings revisions by 21 analysts for the upcoming period, lack of profitability over the past year, high revenue valuation multiples, and high Price / Book multiple.

Source: Investing.com

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

InvestingPro users got this news and reacted in real time! Join now and never miss out on another buying opportunity.

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.