Getting right to the point – there’s currently a big contrarian arbitrage opportunity available in the market.

And I believe it’s worth checking out. . .

But first – here’s some context: since the U.S.-China trade-deal blew up in early May – there’s been a wave of volatility in global markets.

And making matters worse – there’s been no shortage of disappointing data coming from major economies around the world.

(Such as European manufacturing orders contracting. Yield curves becoming deeply inverted. And sinking South Korean exports).

Thus – because of this global slowdown – investors have flooded into U.S. bonds (deeply inverting the yield curve).

But more importantly – the market’s now fully expecting the Federal Reserve to begin easing monetary policy rather aggressively. (The market’s pricing in the Fed to cut rates by 0.25% at least three times before the year ends).

Now – while I do believe the Fed will cut rates eventually (even into negative territory). I don’t think it will happen as quickly as the market’s currently pricing in.

And this is exactly where the opportunity comes from. . .

Remember – big gains are made when speculators bet against market expectations that end up being incorrect.

For instance – like the infamous macro-trader George Soros explained – when the market fully expects something to happen, it gets priced in immediately.

But if those expectations change – or were wrong to begin with – then prices violently adjust to reflect the new expectations (like a rubber-band snap).

Thus – just like I wrote back in March when I explained using Expected Value Analysis (EVA) for macro-speculating – it’s not about what you believe will probably happen. But instead what offers the best potential risk-reward.

Or otherwise said – it’s not the frequency of correctness that matters – but rather the magnitude of correctness that does. . .

That’s why we must ask ourselves a very important question:

‘What if the Fed doesn’t cut rates as much – or as soon – as the market’s expecting?’

It’s clear that the market’s fully-pricing in the Fed (with no room for error) to soon begin cutting rates by a large amount.

But the if Fed doesn’t cut – then prices will quickly change. . .

And according to UBS Group – speculators taking this contrarian route can potentially make ten-to-one returns (meaning 1,000% gains – or aka ‘a ten bagger’) with this ‘multi-asset derivative’ play (i.e. opening positions in two or more asset classes).

So – what exactly is this ‘multi-asset derivative’ play?

Well – putting it simply – it’s basically shorting treasuries (thus expecting yields to rise) while also shorting equities (such as the S&P 500).

The thesis is pretty simple – if the Fed doesn’t cut rates as much as the market expects (which is at least three times – totaling 0.75% – by the end of 2019), then the 10-year swap rate may rise. Which will most likely be followed with a ‘modest’ drop in equities?

(Note that rising interest rates have historically put pressure on equity prices).

But what I really like about this play is just how little bonds and stocks must move for it to yield significant upside.

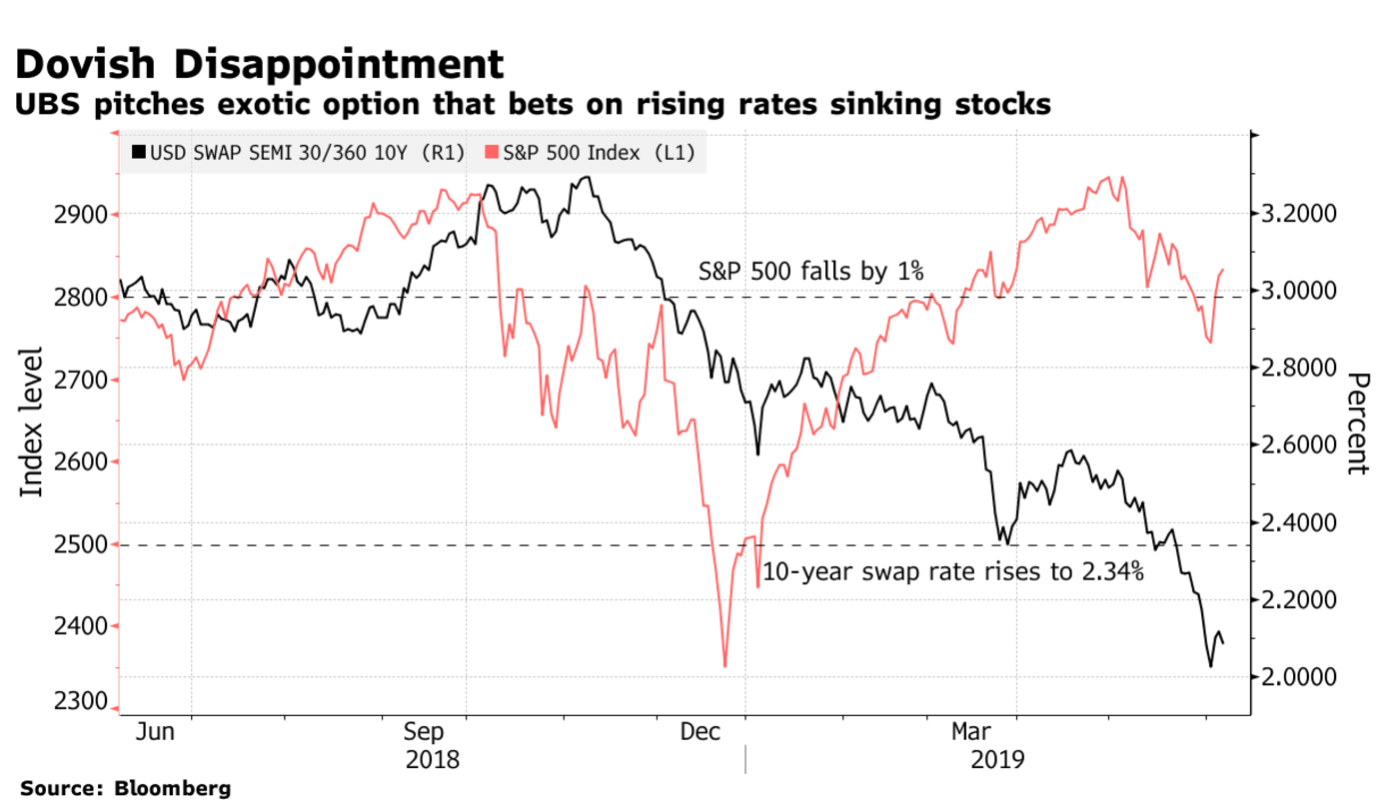

Take a look at the chart below. . .

For this to work – the 10-year bond yield must rise to 2.34% (which is only 20 basis points higher than today’s yield of 2.14%) – and the S&P 500 must drop just 1% (which is roughly $29) from the current levels before September 2019.

This makes it very attractive – even though it’s a higher risk (as it always is betting against the market).

So – in summary – there’s a huge potential payout available (a ten-bagger) for contrarian speculators that believe the market’s mis-pricing what the Fed will do next. (With all else being equal).

And although the market is usually efficient (90-95% of the time) – there’s always room for errors. Especially when it involves forecasting Fed policy.

Thus – look at it this in EVA terms.

Even if the Fed does cut rates just like the market expects, it’s already fully priced in. (Therefore limiting further upside).

But if the Fed is doesn’t cut. Or simply doesn’t cut as much as expected – the market will sharply re-price the new expectations. Potentially leaving those contrarian speculators with huge gains. And those who followed the crowd with big losses.

Remember – I’m not looking at the probability of being right or wrong. But what I stand to gain or lose from being right or wrong.

And in this case – I think it’s clear that a small contrarian bet can yield a significant gain without damaging the whole portfolio.

(For those traders that do believe the market’s correctly priced in – this exotic play offers huge upside with little cost – thus can be used as a cheap hedge).

I’ll keep readers up to date if other high-return contrarian opportunities like this appear.

So stay tuned.