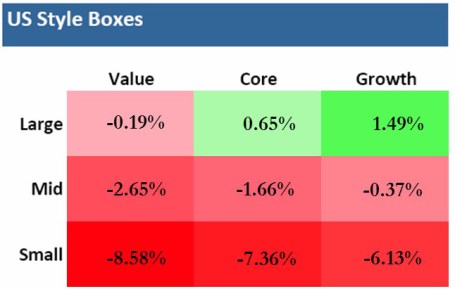

The oft-quoted tenet that diversification should be the cornerstone of any investment strategy has come under assault in the third quarter. As you can see from the chart below, investors could run, but they couldn’t hide.

The Large Cap Growth category was the major exception, thanks in large part to Apple Inc.’s (NASDAQ:AAPL) +8% appreciation. More specifically, seven out of the nine Russell Investments style boxes were in negative territory for the three month period. The benefits of diversification look even worse, if you consider other large asset classes and sectors such as the Gold/Gold Miners were down about -14% (Market Vectors Gold Miners (ARCA:GDX)/SPDR Gold Trust (ARCA:GLD)); Energy -9% (SPDR Energy Select Sector Fund (ARCA:XLE)); Europe-EAFE -6% (iShares MSCI Eafe Index Fund (ARCA:EFA)); Utilities -5% (SPDR Select Sector - Utilities (NYSE:XLU)); and Emerging Markets -4% (iShares MSCI Emerging Markets (ARCA:EEM)).

*Results are for Q3 – 2014 (Source: Vanguard Group, Inc. & Russell Investments)

On the surface, everything looks peachy keen with all three major indices posting positive Q3 appreciation of +1.3% for the Dow , +0.6% for S&P 500, and +1.9% for the NASDAQ. It’s true that over the long-run diversification acts like shock absorbers for economic potholes and speed bumps, but in the short-run, all investors can hit a stretch of rough road in which shock absorbers may seem like they are missing. Over the long-run, you can’t live without diversification shocks because your financial car will eventually breakdown and the ride will become unbearable.

What has caused all this underlying underperformance over the last month and a half? The headlines and concerns change daily, but the -5% to -6% pullback in the market has catapulted the Volatility Index (VIX or “Fear Gauge”) by +85%. The surge can be attributed to any or all of the following: a slowing Chinese economy, stagnant eurozone, ISIS in Iraq, bombings in Syria, end of Quantitative Easing (QE), impending interest rate hikes, mid-term elections, Hong Kong protests, proposed tax inversion changes, security hacks, risingUS dollar, PIMCO’s Bill Gross departure, and a half dozen other concerns.

In general, pullbacks and corrections are healthy because shares get transferred out of weak hands into stronger hands. However, one risk associated with these 100 day floods is that a chain reaction of perceptions can eventually become reality. Or in other words, due to the ever-changing laundry list of concerns, confidence in the recovery can get shaken, which in turn impacts CEO’s confidence in spending, and ultimately trickles down to employees, consumers, and the broader economy. In that same vein, George Soros, the legendary arbitrageur and hedge fund manager, has famously written about his law of reflexivity (see also Reflexivity Tail Wags Dog). Reflexivity is based on the premise that financial markets continually trend towards disequilibrium, which is evidenced by repeated boom and bust cycles.

While, at Sidoxia, we’re still finding more equity opportunities amidst these volatile markets, what this environment shows us is conventional wisdom is rarely correct. Going into this year, the consensus view regarding interest rates was the economy is improving, and the tapering of QE would cause interest rates to go significantly higher. Instead, the yield on the U.S. 10-Year Treasury Note has gone down significantly from 3.0% to 2.3%. The performance contrast can be especially seen with small cap stocks being down-10% for the year and the overall Bond Market (Vanguard Total Bond Market (NYSE:BND)) is up +3.1% (and closer to +5% if you include interest payments). Despite interest rates fluctuating near generational lows with paltry yields, the power of diversification has proved its value.

While there are multiple dynamics transpiring around the financial markets, the losses across most equity categories and asset classes during Q3 have been bloody. Nonetheless, investing across the broad bond market and certain large cap stock segments is evidence that diversification is a valuable time-tested principle. Times like these highlight the necessity of diversification gain to offset the current equity pain.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in AAPL, BND, and certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in EEM, GDX, GLD, EFA, XLE, XLU, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.