1. Emini S&P March futures recover as expected in the longer-term bull trend.

2. Emini Nasdaq longs at my buy level of 18000/17900 worked perfectly hitting all targets of 18100, 18160, and 18230, with a high for the day almost exactly here.

3. Emini Dow Jones March futures made a low for the day exactly at support at 38550/500 before a bounce to my upper target of 39000 for an easy 450-500 tick profit.

Emini S&P: bulls remain in control, with buying the dips still the winning strategy, despite the late sell-off on Friday.

- Beat 5155 for yesterday's buy signal targeting 5175 before a retest of 5190/95, which could be seen today.

- A break above 5195 this week can target 5210, perhaps as far as 5224/26.

- Minor support at 5145/35 but longs need stops below 5125.

- Support at 5090/80.

Nasdaq March futures made a low for the day exactly at good support at 18000/17900. Targets for the bounce are 18100, 18160 and perhaps as far as 18230.

- Likely to continue higher in the bull trend. Today's targets are 18260 and 18350/370.

- Bulls need a break above the all-time high of 18436 for the next buy signal.

- We should have good support again at 18000/17900, stop below 17800.

- On a break below 17800 however, this could turn the outlook more negative for me and we would of course expect to see 17900/18000 then act as resistance.

- If you reverse into a short on a break lower look for targets of 17600 and 17400.

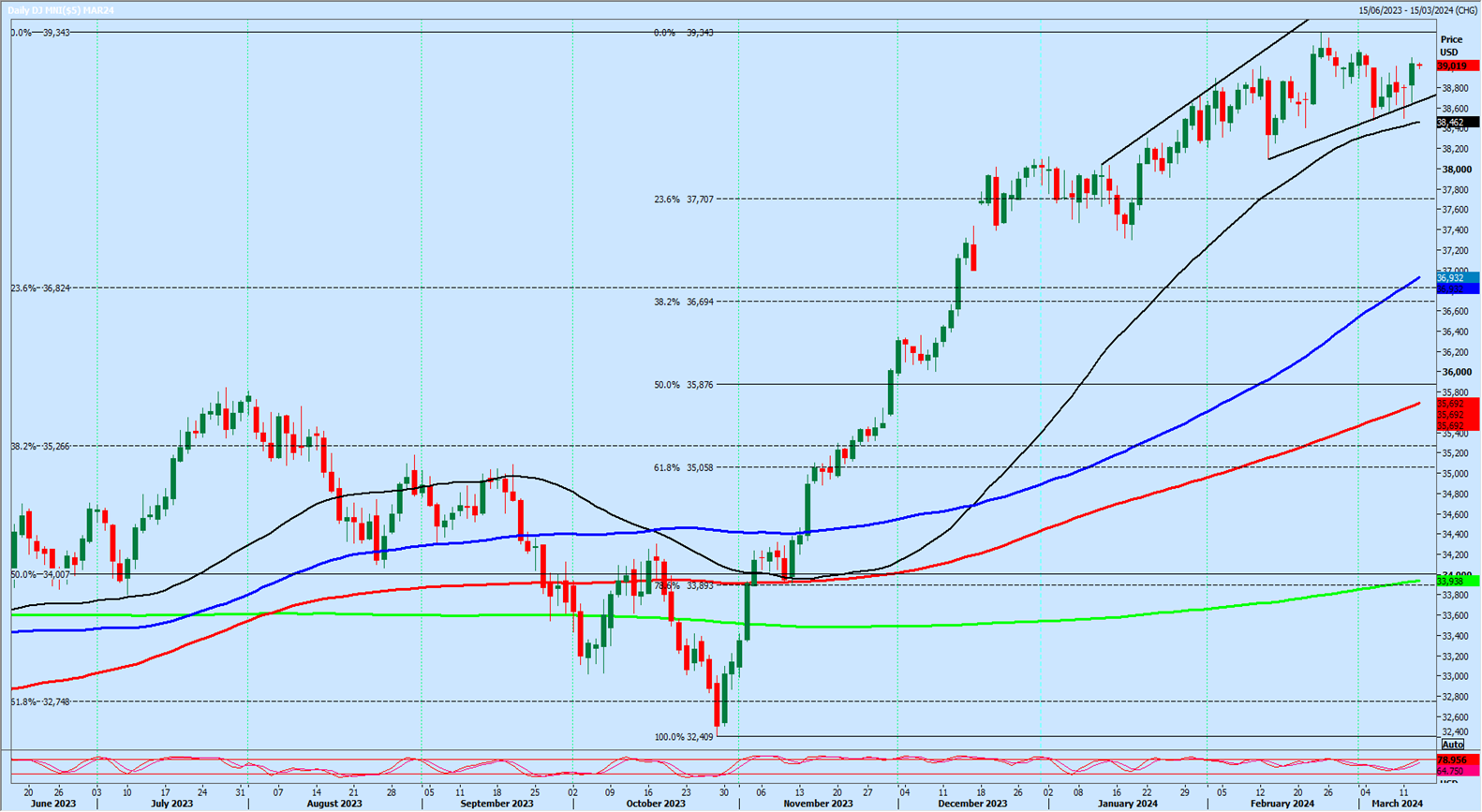

Emini Dow Jones March made a high for the day exactly at strong resistance at 38950/39000, again on Friday.

- We made a low for the day on Monday exactly at support at 38550/500. Longs here worked perfectly on the bounce to 39000 for profit taking. If we continue higher look for 39150 before a retest of the all-time high at 39290-39343.

- We have been in a sideways consolidation for a month and a half.

- Support again at 38550/500 but longs need stops below 38400. Targets for the bounce are 38900 and 39000 for profit taking.

- If we continue higher look for 39150.

A break below 38200 however targets 38200/100.