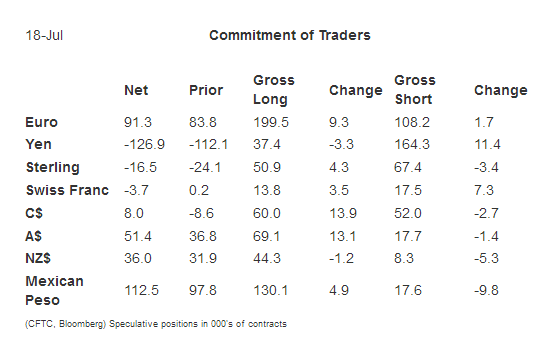

Since the beginning of May the Canadian dollar has been the strongest of the major currencies. However, until the most recent CFTC reporting week ending July 18, speculators in the futures market were net short. The persistent buying has seen the speculative gross long position rise to 60k contracts (adding nearly 14k contracts during the latest reporting period. The gross short position was trimmed by 2.k contracts, leaving 52k. The net long position rose to 8k from -8.6k. It is the first time since the end of Q1 that speculators have a net long Canadian dollar futures position.

Speculators also continue to amass a large Australian dollar position. They added another 13.1k contracts to lift the gross long position to 69.1k contracts. The gross shorts were trimmed by 1.4k contracts, leaving a 17.7k contracts. The net position rose to 51.4k contracts up from 36.8k and the largest since March.

The other substantial position adjustment, by which we mean 10k or more contracts was in the Japanese yen. Speculators continue to build a large gross short position. They sold another 11.4k contracts to bring the gross short position to 164.3k contracts. The gross long position was pared by 3.3k contracts, leaving 37.4k. The net short position rose to 126.9k contracts from 112.1k. Since the middle of June the net short position has doubled.

Speculators remained bearish toward the US dollar. They added to the gross long currency futures positions except for the yen, as we have seen, and the New Zealand dollar. Speculators covered short the dollar-bloc currencies and the Mexican peso. They mostly added to the gross shorts of the other currency futures but sterling.

The net long Swiss franc position last one week. The bulls added 3.5k contracts to the gross long position, but the bears were more aggressive. They added 7.3k contracts to the gross long position. This resulted in a net short position of 3.7k contracts. Previously they were long about two hundred.

The bulls dominate the 10-year Treasury futures market. They added 29.7k contracts so that the gross long position stood at 852.5k contracts. The record set in May 07 was nearly 100k contracts higher. The bears added 4.4k contracts, lifting the gross short position to 570.1 contracts. The net long position rose to 282.3k contracts. The record net long position was also set in 2007 near 610k contracts.

The net long speculative crude oil position rose 38.4k contracts to 396.5k. The bulls added 23k contracts to the gross long position. It stands at 652k contracts. The bears covered 15.4k previously sold contracts, giving them a gross short position of 255.6k contracts.