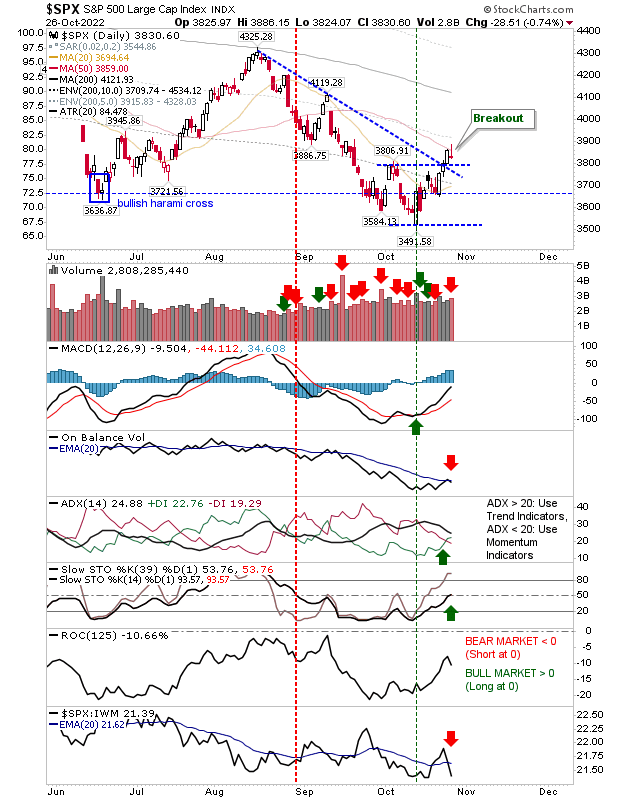

It was a mixed day. Much of what happened yesterday started positively, but by the close of business, indices were back where they started the day.

The S&P 'gravestone' doji could be considered a bearish 'harami cross', with stochastics [39,1] on the mid-line and standard [14,3] stochastics overbought. if this proves to be true (and bearish 'harami crosses' tend to be reliable reversal patterns), then today will be a down day. Add to this, On-Balance-Volume has returned to a 'sell' trigger, with a sharp loss in relative performance to the S&P.

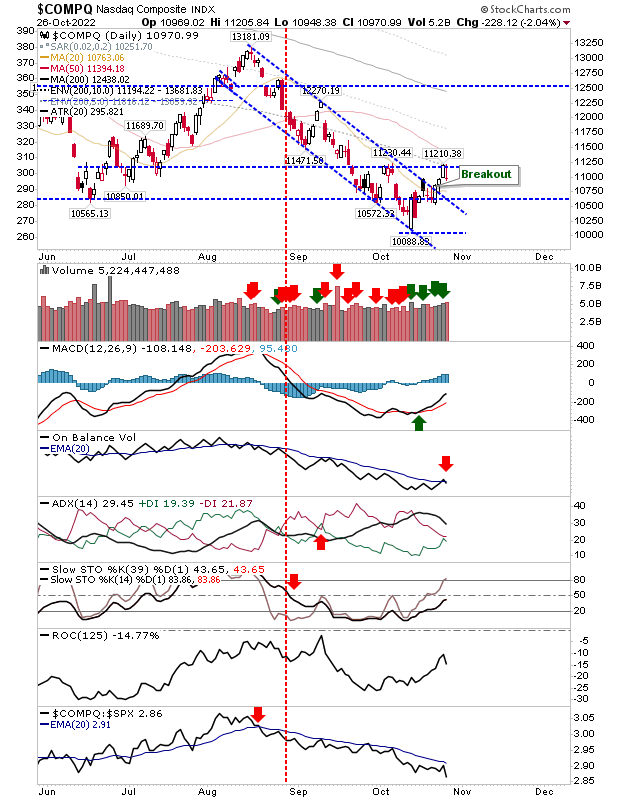

The Nasdaq has remained pegged by October 5 resistance, and yesterday's doji marked a new 'sell' trigger in On-Balance-Volume with a confirmed distribution day to boot. Relative performance against the S&P has been in freefall since mid-August, but price action is more bullish. If there is a push above 11,200, then I would expect many of the 'bearish' technicals to switch bullish in quick order.

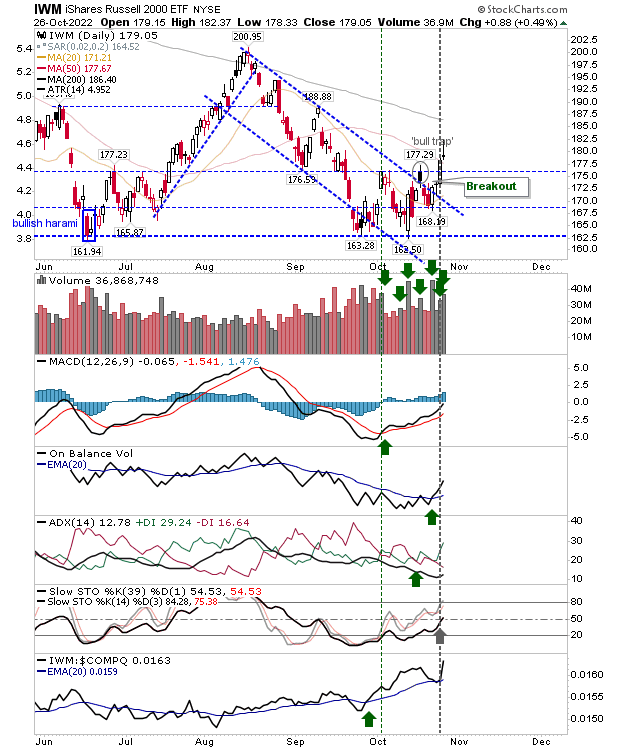

The Russell 2000 is the most bullish index with technicals net bullish. However, it couldn't escape the bearish `gravestone doji` either, which tagged its 50-day MA. If sellers do make an appearance tomorrow it will quickly encounter support. I don't expect sellers to dominate as there has been a marked shift in favor of accumulation but let's see what the market delivers.

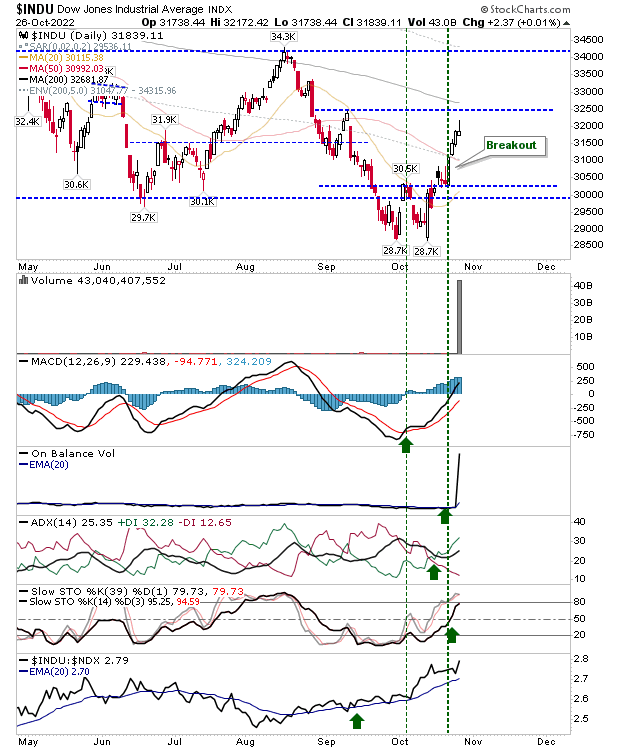

If there is a bearish reversal to happen, then look to the Dow Jones Industrial Average. It has banked the most gains since the October double bottom, but the bearish 'inverse hammer' on overbought stochastics offers bears the best chance to profit from a short trade.

The easy option is for sellers to follow through on yesterday's late day selling, what happens next will depend on where indices finish. The flip-side is that a close above yesterday's highs will negate the bearish implication of the various bearish gravestone doji / inverse hammer.