- Wall Street's second-quarter earnings season unofficially kicks off on Friday, July 14.

- Analysts expect a -6.8% yearly profit decline and a decrease of -0.4% in revenue growth.

- If confirmed, that would mark the third consecutive year-over-year decrease in earnings and the first drop in sales since Q2 2020.

- As such, I used the InvestingPro stock screener to find high-quality stocks poised to deliver robust profit and revenue growth amid the current climate.

- Monthly: Save 20% and gain the flexibility to invest on a month-to-month basis.

- Yearly: Save a jaw-dropping 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Yearly (Web Special): Save an astonishing 52% and maximize your returns with our exclusive web offer.

Get ready for more volatility, folks, the next major test for the stock market rally is upon us.

Wall Street's second-quarter earnings season unofficially begins on Friday, July 14, when notable names like JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), and UnitedHealth (NYSE:UNH) all report their latest financial results.

The following week sees high-profile companies like Tesla (NASDAQ:TSLA), Netflix (NASDAQ:NFLX), IBM (NYSE:IBM), Bank of America (NYSE:BAC), Goldman Sachs (NYSE: GS), Morgan Stanley (NYSE: MS), Charles Schwab (NYSE:SCHW), American Express (NYSE:AXP), Johnson & Johnson (NYSE:JNJ), and United Airlines (NASDAQ:UAL) report earnings.

The earnings season gathers momentum in the final week of July when the mega-cap tech companies are scheduled to deliver their Q2 updates. Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) are both due on Tuesday, July 25, followed by Meta Platforms (NASDAQ:META) on Wednesday, July 26, and Amazon (NASDAQ:AMZN) on Thursday, July 27. Apple (NASDAQ:AAPL) will be the final ‘FAAMG’ stock to report results on Thursday, Aug. 3.

Investors are bracing for what may be the worst reporting season in three years amid the negative impact of several macroeconomic headwinds.

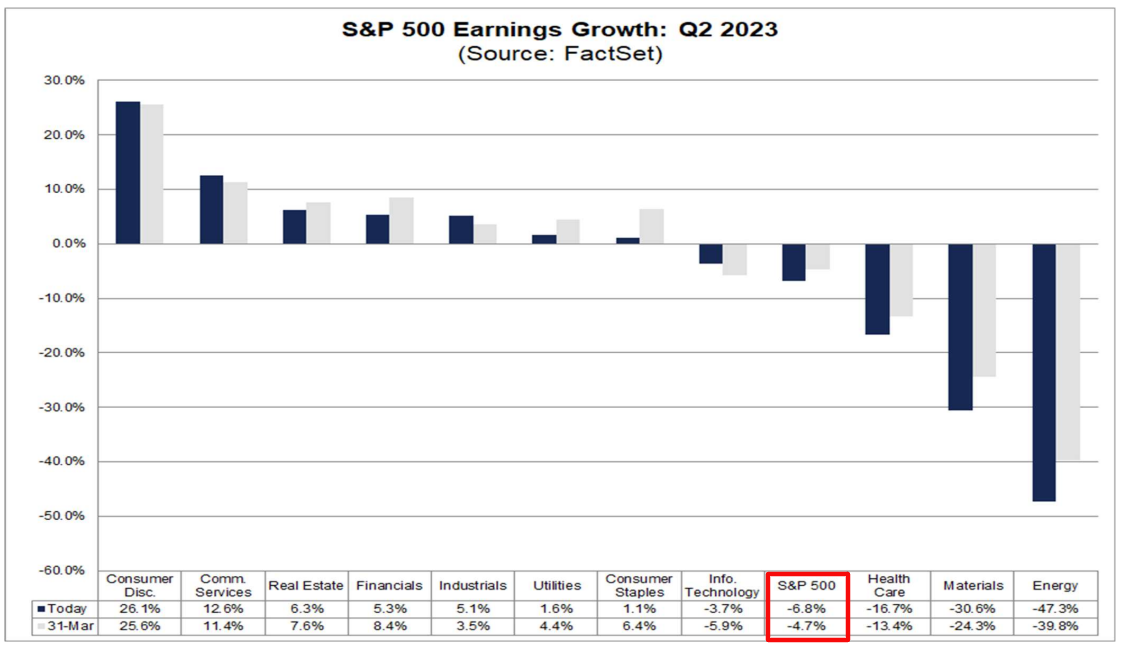

After earnings per share for the S&P 500 fell -2.0% in Q1 2023, earnings are expected to drop -6.8% in Q2 compared to the same period last year, as per data from FactSet.

Source: FactSet

Source: FactSet

If -6.8% is confirmed, that would mark the biggest year-over-year earnings drop reported by the index since the second quarter of 2020 when the economy was reeling from the negative impact of the COVID-19 crisis. It will also mark the third consecutive quarter in which S&P 500 earnings have declined year-over-year.

Seven of the eleven sectors are projected to report y-o-y earnings growth, led by the Consumer Discretionary Sector (NYSE:XLY) and Communication Services Sector (NYSE:XLC) sectors. On the other hand, four sectors are predicted to report a y-o-y decline in earnings, including the Energy Sector (NYSE:XLE), Materials Sector (NYSE:XLB), and Health Care Sector (NYSE:XLV).

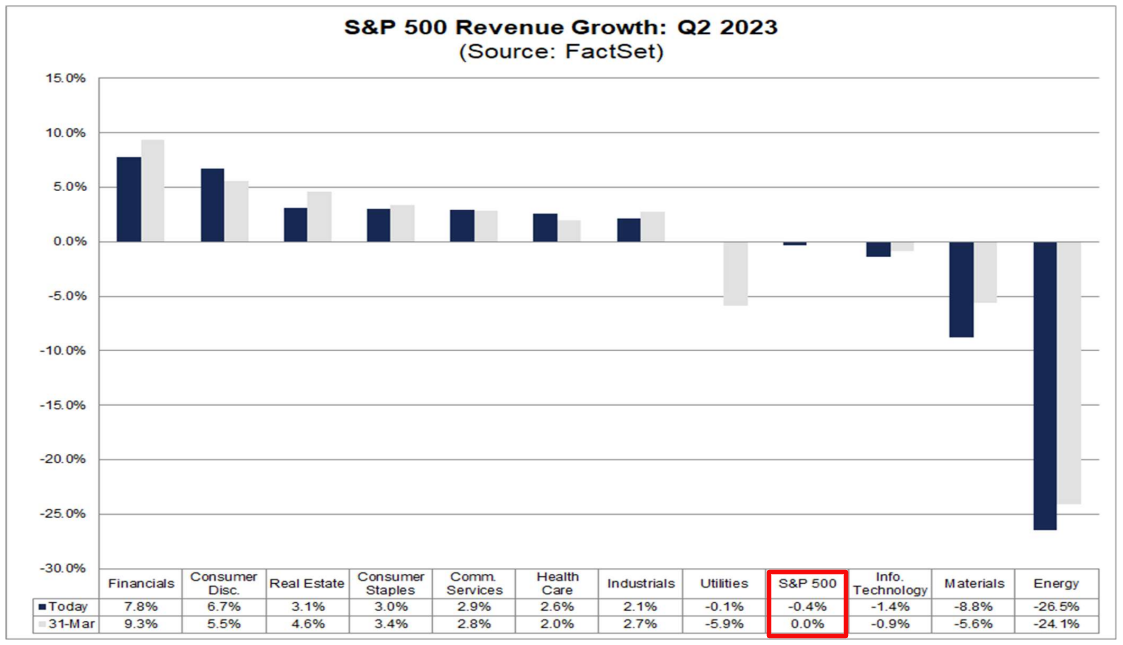

Likewise, revenue expectations are also worrying, with sales growth expected to decrease -0.4% from the same quarter a year earlier.

Source: FactSet

Source: FactSet

If that is, in fact, the reality, FactSet pointed out that it would mark the first time since Q3 2020 that the index reported a year-over-year decline in revenue growth.

Seven sectors are projected to report y-o-y revenue growth, led by the Financials and Consumer Discretionary sectors. In contrast, four sectors are predicted to report a y-o-y decline in revenues, led by the Energy and Materials sectors.

Beyond the top-and-bottom-line numbers, investors will pay close attention to announcements on forward guidance for the year's second half, given the uncertain macroeconomic outlook, which has seen recession fears mount lately.

Other key issues likely to come up will be the health of the U.S. consumer, future hiring plans, and lingering supply-chain concerns.

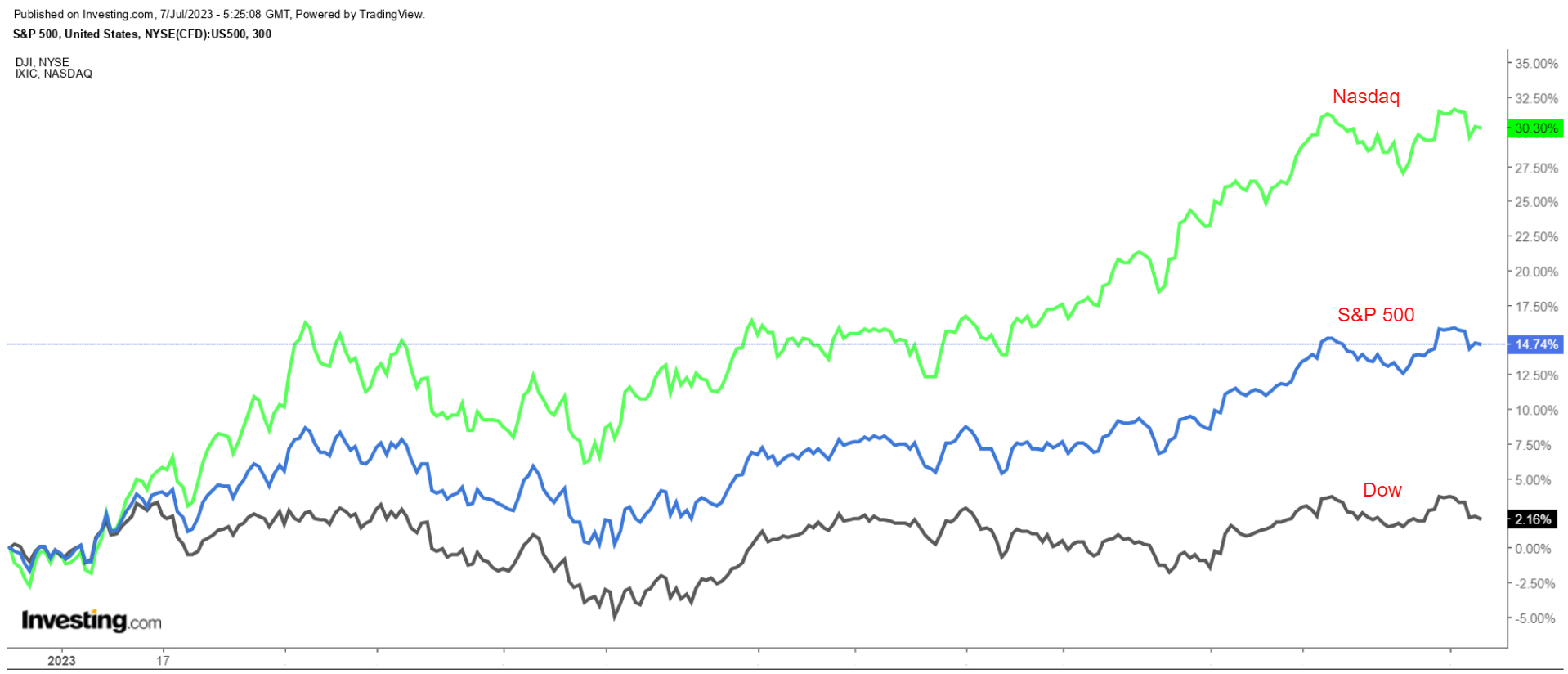

Markets are heading into the Q2 reporting season on a relatively strong footing amid hope and speculation the Federal Reserve will soon end its rate-hike cycle in response to signs of cooling inflation.

The technology-heavy Nasdaq Composite has been the best performer of the three major U.S. indexes by a wide margin thus far in 2023, surging almost 31% thanks to the increased buzz surrounding artificial intelligence and as investors piled back into the battered growth stocks of yesteryear.

Meanwhile, the benchmark S&P 500 index and the blue-chip Dow Jones Industrials Average are up 14.9% and 2.3%, respectively, year-to-date.

These 26 Stocks Are Poised to Deliver +25% Y-o-Y Growth In Both EPS and Revenue

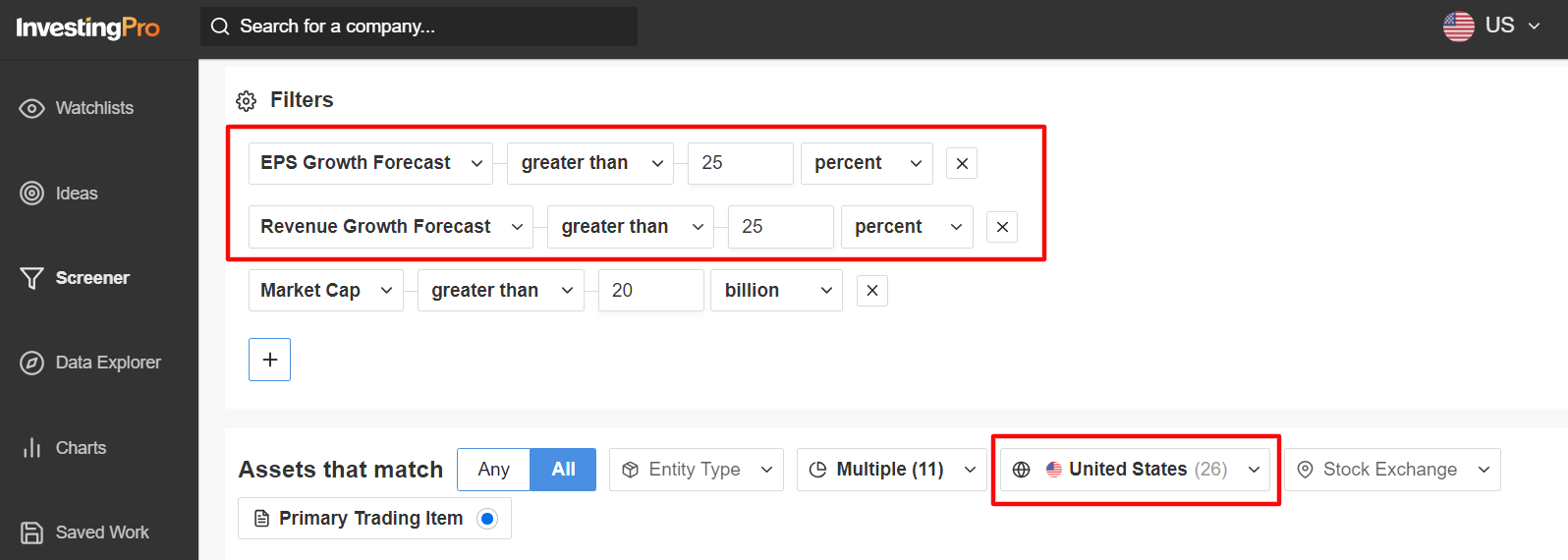

Amid the current backdrop, I used the InvestingPro stock screener to search for companies poised to deliver annualized growth of at least 25% or more in both profit and sales as the second quarter earnings season kicks off.

Source: InvestingPro

Source: InvestingPro

InvestingPro's stock screener is a powerful tool that can assist investors in identifying high-quality stocks with strong potential upside. This tool allows investors to filter through a vast universe of stocks based on specific criteria and parameters.

Some of the notable tech-related names to make the list include Palo Alto Networks (NASDAQ:PANW), CrowdStrike (NASDAQ:CRWD), Nvidia (NASDAQ:NVDA), Atlassian (NASDAQ:TEAM), Zscaler (NASDAQ: ZS), Cloudflare (NYSE:NET), Snowflake (NYSE:SNOW), and Arista Networks (NYSE:ANET).

Meanwhile, Royal Caribbean (NYSE:RCL), Carnival (NYSE:CCL), Las Vegas Sands (NYSE:LVS), DoorDash (NYSE:DASH), and Warner Bros Discovery (NASDAQ:WBD) are a few consumer-sensitive stocks to watch out for that are also projected to deliver upbeat Q2 earnings and revenue growth. Source: InvestingPro

Source: InvestingPro

For the complete list of the 26 stocks that met my criteria, start your free 7-day trial with InvestingPro to unlock must-have insights and data!

If you're already an InvestingPro subscriber, you can view my selections here.

Here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

As part of the InvestingPro Summer Sale, you can now enjoy incredible discounts on our subscription plans for a limited time:

Don't miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, Summer Sale won't last forever!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.