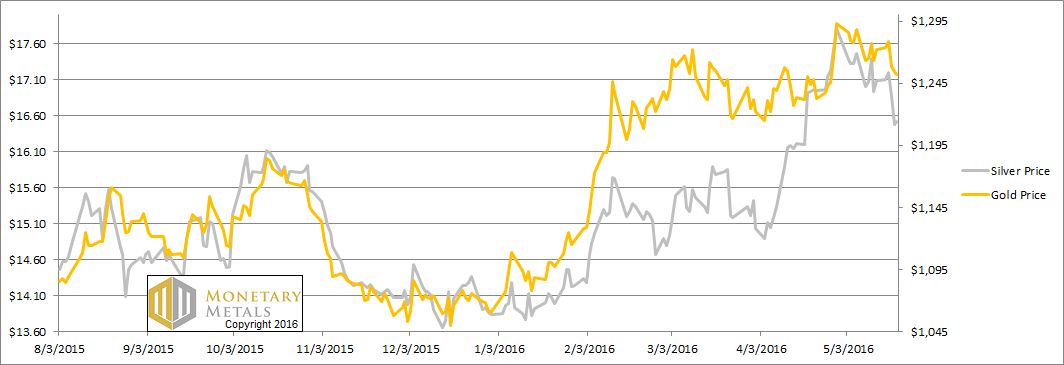

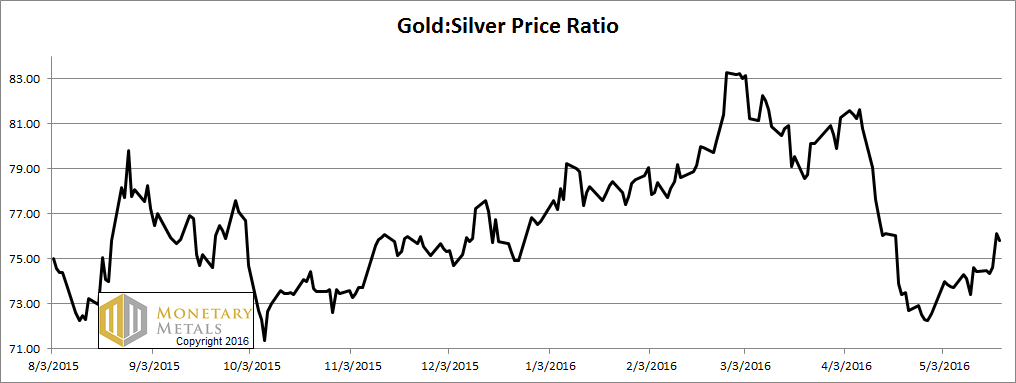

The price of gold moved down about twenty Federal Reserve Notes, and the price of silver dropped $0.57. The big news is that the gold-silver ratio moved up about 1.5. We hate to say “we told you so,” well, OK. Actually… sometimes there’s a certain je ne said quoi about gloating.

*Achem*

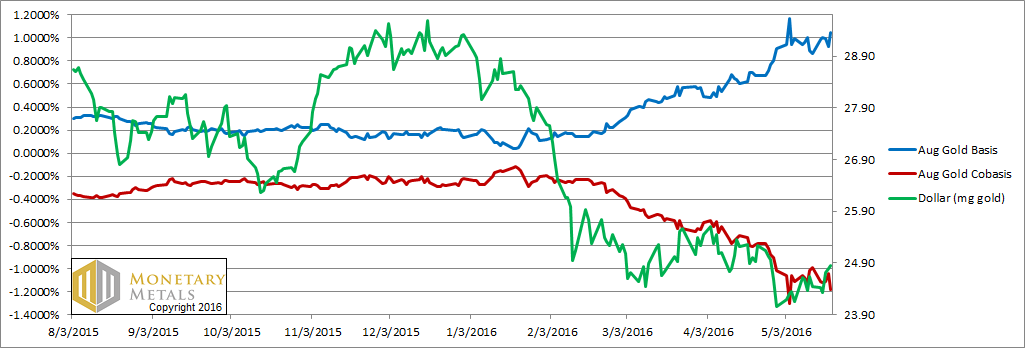

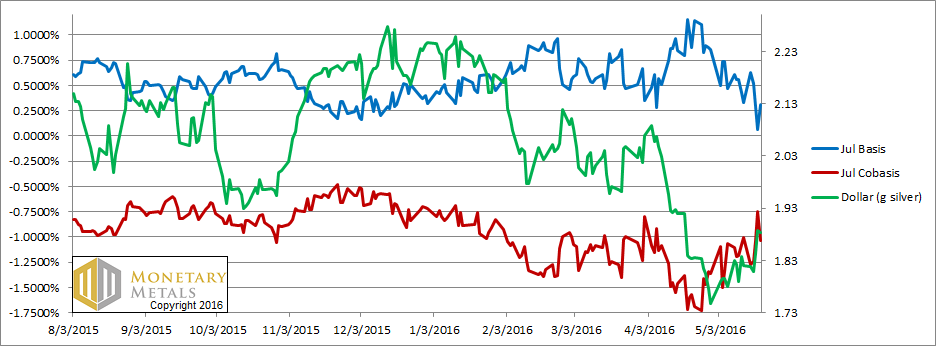

In all seriousness, the dollar is going up. We measure it in gold, or alternatively in silver. In gold, the dollar rose 0.4mg gold to 24.84. In silver, it was up 60mg to 1.88g silver. We do not think that the dollar can be measured in terms of its derivatives such as euro, pound, etc. for the many of the same reason that the gold can’t be measured in terms of its derivative, the dollar.

Why is the dollar going up? It’s the debtors that give value to a debt-based currency (not the quantity). Right now, debtors are feeling the pressure. Meanwhile, most mainstream speculators are looking at price charts and they want all-in on the dollar (most would look at this as avoiding gold exposure).

Let’s take a look at the supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

The Prices of Gold and Silver

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was up significantly this week.

The Ratio of the Gold Price to the Silver Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

You can see it clearly on this chart. As of this month, the price of the dollar (i.e. price of gold is falling) is rising but the scarcity of gold is falling.

Our calculated fundamental price of gold is around $1,170.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, the cobasis is actually down for the week despite a large rise in the dollar (i.e. fall in the price of silver). This is despite the lopsided pressure on the July contract (it happens earlier in silver than it does in gold). In farther-out contracts, the silver cobasis is lower.

It is worth emphasizing that the silver cobasis dropped on Friday to around the same level as Wednesday, despite the price being 35 cents lower.

Our calculated fundamental price of silver now has a 13 handle on it.