Market Brief

It was a quiet session in the FX markets overnight as traders digest the disappointing data from the US and the last statement from the Fed (and China is closed as well). Japan March nationwide inflation (incl. VAT, ex fresh food) was due last night and came in above expectation at 2.2%y/y verse 2% expected while March jobless rate was released at 3.4% verse 3.5% exp. USD/JPY didn’t even react on the news as most market are closed today due to Labour day.

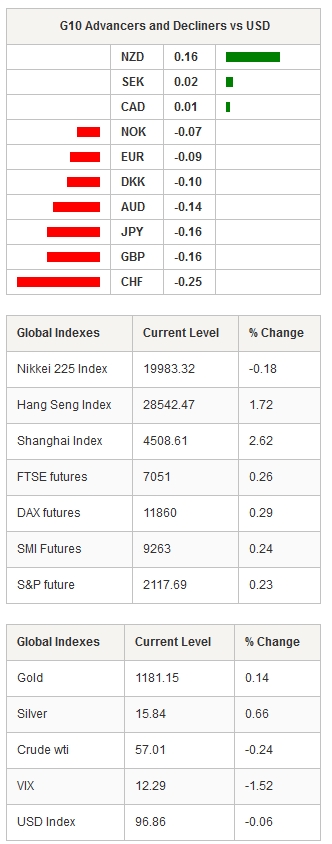

However, Japan is open and the Nikkei 225 is slightly lower by -0.21% to 19,479. Australian shares edges up by 0.43% as the S&P ASX Midcap 50 Resources reaches 5,814. AUD/USD was heavily sold-off over the last two days. The Aussie is back below 0.7938 (high March 24) and is sitting on the 0.7869 support (Fib 38.2% on April rally).

Market will be eying April final read of Michigan consumer sentiment index (exp. 96, prior 95.9), as well as the US ISM manufacturing figures for the month of April. The index is expected at 52 versus 51.5 prior read. A read above 52 would be a welcoming first step to restore market’s confidence in the US economy, indicating that the world’s biggest economy has, in fact, experienced a temporary soft patch in the winter months. EUR/USD didn’t manage to break the 1.1245 resistance (highs from late February and early March) and is currently consolidating around 1.12. The euro should find a strong support at 1.1043 (multi highs). On the upside, the 1.1380 resistance will require more USD-bears to be broke.

In Canada, April manufacturing PMI is due today at 13:30 GMT (prior read 48.9). The index started to pick up last month after a sharp decline from 55.3 last October to 48.37 in February. USD bears failed to push USD/CAD below the strong resistance standing at 1.1985 (low March 2005, bottom of the uptrend channel and consolidation area from early January).

Across the channel, April Markit manufacturing index’s read is due this afternoon and expected at 54.6 (prior 54.4). GBP/USD consolidates around 1.5340. The sterling should find some support at 1.5175 (Fib 61.8% on Feb-April sell-off) while the next resistance stands at 1.5552 (high from February 26).

Most European markets are closed today, we do not expect much action. However, New York and London are open and it is therefore worth monitoring the release of US and UK data.

Today's CalendarEstimatesPreviousCountry / GMT UK Mar Net Consumer Credit 0.8B 0.7B GBP / 08:30 UK Mar Net Lending Sec. on Dwellings 1.8B 1.7B GBP / 08:30 UK Mar Mortgage Approvals 62.5K 61.8K GBP / 08:30 UK Mar Money Supply M4 MoM - -0.20% GBP / 08:30 UK Mar M4 Money Supply YoY - -3.20% GBP / 08:30 UK Mar M4 Ex IOFCs 3M (NYSE:MMM) Annualised 2.20% 5.00% GBP / 08:30 UK Apr Markit UK PMI Manufacturing SA 54.6 54.4 GBP / 08:30 CA Apr RBC Canadian Manufacturing PMI - 48.9 CAD / 13:30 US Apr F Markit US Manufacturing PMI 54.2 54.2 USD / 13:45 US Mar Construction Spending MoM 0.50% -0.10% USD / 14:00 US Apr ISM Manufacturing 52 51.5 USD / 14:00 US Apr ISM Prices Paid 42 39 USD / 14:00 US Apr F U. of Mich. Sentiment 96 95.9 USD / 14:00 US Apr F U. of Mich. Current Conditions - 108.2 USD / 14:00 US Apr F U. of Mich. Expectations - 88 USD / 14:00 US Apr F U. of Mich. 1 Yr Inflation - 2.50% USD / 14:00 US Apr F U. of Mich. 5-10 Yr Inflation - 2.60% USD / 14:00 AU 4Q CBA/HIA House Affordability - 96.2 AUD / 22:00

Currency Tech

EUR/USD

R 2: 1.1450

R 1: 1.1380

CURRENT: 1.1240

S 1: 1.0900

S 2: 1.0521

GBP/USD

R 2: 1.5600

R 1: 1.5560

CURRENT: 1.5346

S 1: 1.4943

S 2: 1.4750

USD/JPY

R 2: 121.52

R 1: 120.18

CURRENT: 119.77

S 1: 118.33

S 2: 117.95

USD/CHF

R 2: 0.9948

R 1: 0.9754

CURRENT: 0.9317

S 1: 0.9481

S 2: 0.9450