In late 2014, many investors in the Western gold community decided to invest the booming US stock market. I warned that without QE, the US stock market was turning into a “wet noodle”, and rate hikes could cause a global markets crash, in the September-October time frame.

That crash is essentially underway, on schedule, and the stunning meltdown continued last night in Asia.

Japan’s market tumbled very hard, in spite of promises by the central bank to become even more “accommodative”.

The sad reality is that Japanese QE, like American QE and European QE, is deflationary, because it drives money out of bank accounts and into wildly speculative assets like the stock market, real estate, and junk bonds.

Most of the world’s citizens are amateur investors. When they put their money in the bank, professional investors at the bank loan it to businesses. Mistakes happen, but the process is highly professional and time-tested. When citizens try to take that job on themselves, the errors made can be irreversible.

QE “incentivizes” citizens to pretend they are professional investors, and the amount of wealth destruction that ensues can bring down an empire. The bottom line is that QE empowers government, and destroys citizen wealth.

QE should be banned as a central bank “tool”. It belongs in the garbage can, and Janet Yellen should be applauded for tapering this central bank policy of horror to zero. When she hikes rates and reverses money velocity by doing so, every gold investor in the world should give her a standing ovation.

There was nothing wrong with the private sector when Abe and Kuroda came to power in Japan. Japan has a shrinking population, and so GDP can also be expected to shrink over time, or grow very slowly. Japanese citizens are great savers, and have an aversion to debt. The bottom line is that until Abe and Kuroda arrived on the scene, citizens were ageing with dignity.

In contrast, the Japanese government is soaked in debt, and expansion-oriented. Abe has increased taxes for the ageing population, and the yen has imploded with Kuroda’s dastardly QE program, while making the stock market incredibly unstable. Forcing elderly citizens to invest in risk markets is an act of utter insanity.

India was the only global market able to move substantially higher overnight. The nation’s central bank cut rates by half a point.

Clearly, many analysts don’t believe rate cuts can reverse India’s stock-market swoon, and they are correct.

Gold import duty cuts, not interest-rate cuts, will inspire India’s citizens to work harder and become even more productive than they already are. These “titans of ton” love gold, and rightly so. It’s part of their religion. The bottom line is that when a citizen works hard, and gets richer, they can buy more gold.

Rather than attacking gold, India’s government should promote more imports,because that incentivizes hard work and GDP growth.

What is next, for the price of the Western gold community’s gold? That’s the daily gold chart. Generally speaking, gold has a rough general tendency to sell off in the days ahead of the US jobs report.

The next report is on Friday, and gold is acting exactly as I expected, with a pre-report “textbook decline”. An interesting symmetrical triangle is now in play. A downside breakout would theoretically see gold trade at about $1000. The $950 - $1050 area is massive buy-side support.

What fundamental event could send gold down to that huge buy zone? Well, it’s not a rate hike. A September rate hike in America would have produced a huge gold price rally, based on the potential reversal in money velocity that would have followed. The rate hike didn’t happen, because of the crashing global stock markets.

So, gold remains vulnerable now, until Janet takes the rate hike bull by the horns, and takes action. If there is a fundamental event that could activate a downside breakout from the symmetrical triangle, it’s probably an implosion of a company like Glencore (LONDON:GLEN).

Regardless, there have been a lot of false breakouts in many markets recently. Indian citizen buying and PBOC buying in China could create a double bottom pattern in the $1070 area, rather than a decline to $1000.

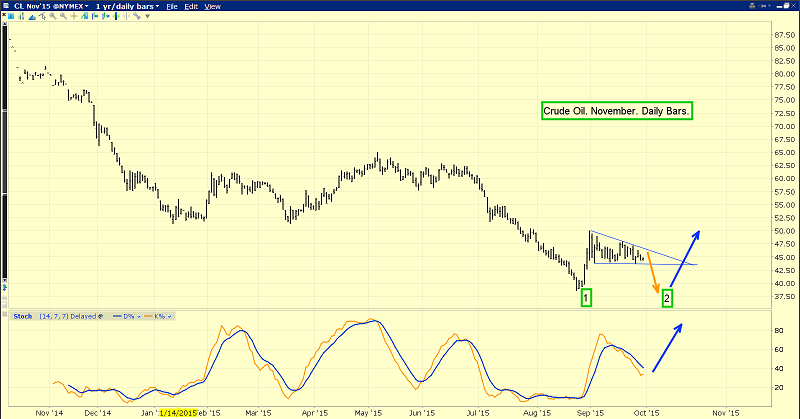

Oil also appears “ripe” to form its own double bottom pattern, and it’s the biggest holding in many commodity indexes, and that’s good news for gold price enthusiasts. This daily oil chart is sporting a small descending triangle formation, which sets up the potential double bottom pattern.

It’s important for gold investors to understand that double bottom patterns tend to occur at major trend turning points, and it’s happened before in the oil market.

In regards to gold stocks, I realize that most investors think this is a “bear market”. They are only partially correct in that outlook. That’s the quarterly bars XAU:gold chart. Gold stocks should be only purchased as an investment that can potentially outperform gold bullion. In that regard, gold stocks have not been in a bear market since 2011, but from 1996! That’s when the Fed forced investors out of bank accounts and into risk markets with rate cuts below the key 8% threshold.

That created a bear market in money velocity, and opened the door to the OTC derivatives nightmare, as banks sought to replace diminishing bank loan profits with “structured products”.

Both the two decade bear market in gold stocks and the structured products horror show will end, when Janet begins hiking rates, and creates a money velocity bull market.

As that happens, the huge bull market in real estate will finally die, and junk bonds will probably implode. The combination of a US money velocity bull market, Chinese PBOC buying to internationalize the yuan, and Indian citizen obsession with gold, means that gold stocks are now on the cusp of not just a bull market, but a bull era!

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?