Talking Points:

- US Dollar Corrected Lower in Overnight Trade, Loonie in the Lead

- Ruble Bounce on Surprise Russia Interest Rate Hike Unlikely to Last

- UK CPI May Weigh on British Pound, Euro to Look Past PMI Data

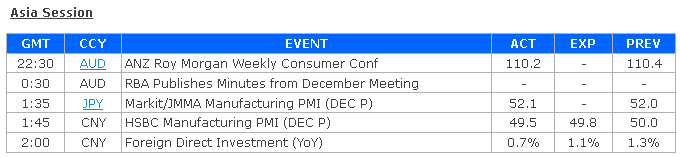

The US Dollar corrected lower in overnight trade having edged higher in the preceding 24 hours. The Canadian Dollar proved best-supported on the session, rising as much as percent, having proven weakest among the majors with a 0.76 percent loss against the greenback yesterday. That decline came against a backdrop of sinking crude oil prices, which BOC Governor Stephen Poloz linked to possibly delaying interest rate hikes in comments made last week. The Japanese Yen outperformed as Asian stocks declined, boosting demand for the haven-linked currency.

The Central Bank of Russia surprised the markets by issuing a surprise 650 basis point interest rate hike. While the outcome sent the initially Ruble higher, gains seem likely to be limited. Russia’s current predicament looks increasingly similar to the country’s 1998 financial crisis. Then too, the central bank tried to fight a falling exchange rate with aggressive interest rate hikes. This proved fruitless, eventually resulting in a sovereign default and RUB devaluation. Fears of the same this time around may prove to fuel risk aversion in the days ahead, driving continued Yen gains while punishing EM and higher-yielding currencies.

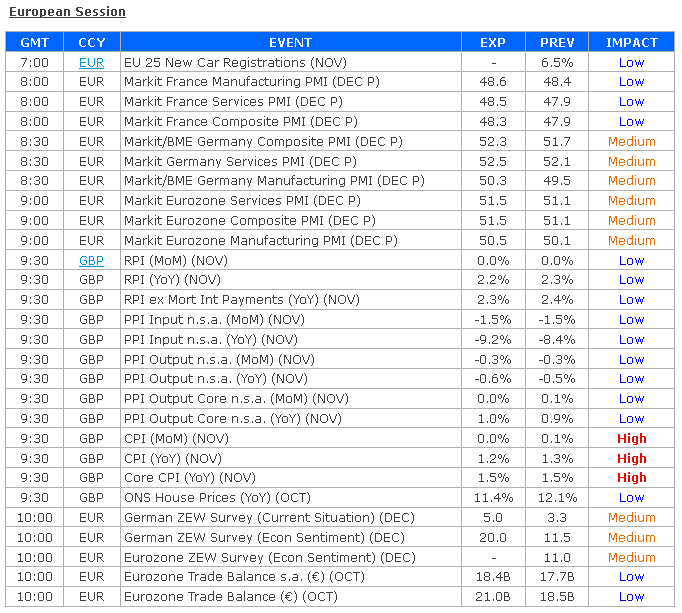

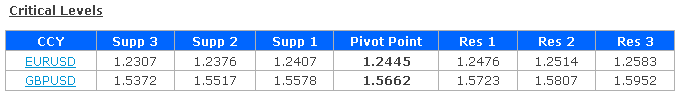

November’s UK CPI report headlines the economic calendar in European hours. The benchmark year-on-year inflation rate is expected to tick lower to 1.2 percent, matching the five-year low set in September. A soft result may weigh on Bank of England interest rate hike expectations, pressuring the British Pound downward. Futures pricing reflects bets a 25bps increase in the benchmark lending rate in the fourth quarter of 2015.

The preliminary set of December’s Eurozone PMI figures is likewise due to cross the wires. The region-wide composite index is set to show the pace of manufacturing- and service-sector activity growth modestly accelerated compared with November. On balance, anything shy of a major deviation from consensus forecasts seems unlikely to spur significant Euro volatility considering the limited implications of such an outcome for the near-term ECB policy outlook.

While a marginally upbeat result is unlikely to moderate the markets’ overtly dovish view of the European monetary authority, a somewhat softer result will almost certainly not hasten the arrival of additional accommodation. Indeed, Mario Draghi and company have seemingly made it plain that they intend to wait at least through the end of the first quarter to assess the efficacy of existing easing before delivering added support (potentially in the form of “sovereign QE”).