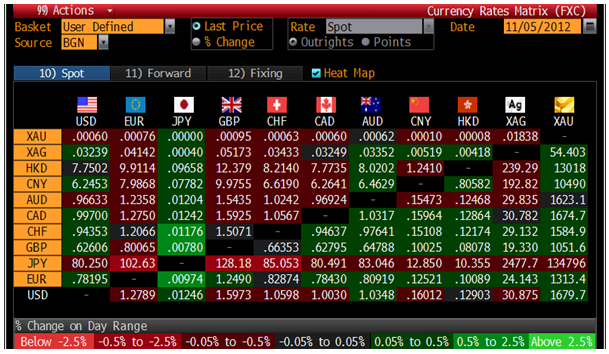

Today’s AM fix was USD 1,679.00, EUR 1,313.05, and GBP 1,050.82 per ounce.

Friday’s AM fix was USD 1,708.25, EUR 1,325.77, and GBP 1,061.29 per ounce.

Gold dropped $35.70 or 2.08% in New York on Friday and closed at $1,678.00. Silver hit a low of $30.789 and finished with a loss of 4.01%. Gold and silver were down nearly 2% and 3% on the week.

Gold edged up a bit on Monday, limiting the fall after the better than expected US jobs number sent the yellow metal downward to a two-month low.

If the US Fed doesn’t need to embark on more stimulus measures this may limit the yellow metal’s appeal with investors who see continuous money printing by central banks as increasing inflation and debasing currencies.

The US dollar limited gold’s rebound as it hit its highest in 2 months as investors parked money there before the US election.

This week there is an ECB policy meeting on November 8th and also a key gathering of the Chinese Communist Party.

US Economic highlights include ISM Services at 15:00 GMT today. Wednesday’s data is Consumer Credit, Thursday Initial Jobless Claims and the Trade Balance and Friday Export and Import Prices, Michigan Sentiment, and Wholesale Inventories are published.

Turkey’s trade deficit has been shrinking and the country has enjoyed the best bond rally in the emerging markets this year due in part to the contributions of airline passengers transporting gold in their baggage.

Statistics from Istanbul’s 2 main airports show $1.4 billion of precious metals were registered for export in September.

Iran is Turkey’s largest oil supplier and Turkey has been paying for the oil not only with liras but also with gold bullion. Turkey exported $11.7 billion of gold and precious metals since March, when Iran was barred from the Society for Worldwide Interbank Financial Telecommunication, (Swift) making it nearly impossible for Iran to complete large international fund transfers. Of the $11.7 billion, $10.2 billion or 90% was to Iran and the United Arab Emirates, according to data on Turkey’s state statistics agency’s website.

Turkey’s current account deficit is second in the world at $77.1 billion or 10% of GDP while the US currently holds the top spot.

The problem with Turkey switching from a net importer to a net exporter of gold bullion this year is that the foreign trade data is misrepresented. Turkey’s use of precious metals is a key factor to help turn around its nation’s current junk bond rating status.

We mentioned before, the government’s efforts to move the $302 billion in privately held gold, into government banks to increase the money supply in the economy.

“October data will be very critical” as the US urged Turkey not to export gold to Iran or the UAE, “which means indirectly to Iran,” Ozgur Altug, chief economist at BGC Partners in Istanbul, said in an e-mailed report yesterday.

The increase in precious metal exports accounted for three quarters of the 14% one-year gain in total exports in the first nine months, Gulay Girgin, chief economist at Oyak Securities in Istanbul, said in an e-mailed report yesterday.

“If you look at Turkey’s trade figures without gold, it doesn’t look that great,” Gizem Oztok Altinsac, an economist at Garanti Yatirim, the investment unit for Turkey’s biggest bank, said by phone yesterday. “I think the analysts are paying a lot of attention to this, but at the end of the day, the bottom line is the current-account deficit, and that’s getting better.”

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Positive US Jobs Numbers Send Gold Down To Two-Month Low

Published 11/06/2012, 12:14 AM

Updated 07/09/2023, 06:31 AM

Positive US Jobs Numbers Send Gold Down To Two-Month Low

Gold And Silver Worth $1.4 Billion Carried In Baggage From Turkey To Iran, UAE And Middle East In September

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.