Neither palladium or platinum had a good start of the year. Within the first three weeks, palladium prices have fallen 17%, hitting a new five-year low.

Palladium hits a five-year low. Source: @StockCharts.com.

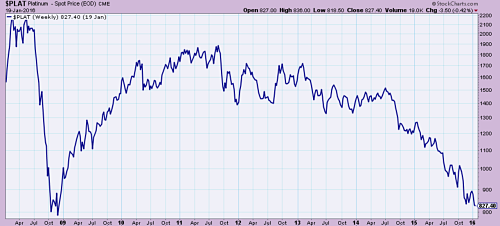

Platinum prices are not performing any better. The precious metal is down 7% so far in January and it’s at the lowest levels in seven years, just above the lows of 2009.

Platinum hits a seven-year low. Source: @StockCharts.com.

Car Sales Didn’t Help

Auto sales in US hit a new high in 2015, with sales topping 17 million units. In Europe, where diesel powered cars dominate the market, vehicle sales were also strong, growing by 9.3% in 2015 to 13.7 million vehicles. Lower oil prices in 2015 helped the increase in car sales, but it still didn’t move the needle for catalysts such as platinum and palladium.

Meanwhile, China, with the largest vehicle market in the world at 24.6 million vehicles sold in 2015, saw a 4.7% rise year-on-year in auto sales, marking another all-time high.

Chinese Car Sales Not All That They Seem

Despite China’s vehicle sales hitting a new record in 2015, the world’s biggest car market decelerated in 2015. The annual growth rate in 2014 was almost 10%. Moreover, Chinese market grew thanks to a strong last quarter, which came from a 50% tax cut for small cars, serving as a stimulus measure rather than a sustainable longer-term demand increase. If it wasn’t because of those inflated numbers, China’s auto market would have probably seen its first down year in 2015.

Palladium and Platinum: Victims of China’s Market Slump

The recent stock market selloff in China, which caused global tumult, is what’s really hurting palladium and platinum. A strong dollar is not helping matters, either. Despite analysts calling again for deficits in palladium and platinum markets this year, it’s hard to imagine these two metals rising while China keeps driving everything down.