The New Zealand dollar has posted considerable gains on Thursday, trading above the 0.72 level early in North American session. The markets are nervously keeping tabs as Britons votes in the Brexit referendum. There are no New Zealand releases on Thursday. Over in the US, today’s key event is Unemployment Claims, with the indicator expected to drop to 271 thousand. On Friday, the US releases Core Durable Goods Orders.

The New Zealand dollar continues to impress in the month of June, climbing 6.5% in that time. NZD/USD has punched past the 0.72 level on Thursday and is currently trading at its highest level since May 2015. The New Zealand dollar has received a boost from solid New Zealand numbers, as GDP and Current Account both beating their estimates. As well, market sentiment that the UK will vote to remain in the EU has bolstered the New Zealand currency. The RBNZ next meets in August, and if economic indicators continue to perform well, the central bank may be able to avoid cutting interest rates.

All eyes are nervously following the Brexit vote in the UK. After a bitter and hard-fought campaign, millions of Britons are voting on whether the country remains in the EU or exits from the bloc. Most polls continue to show a neck-and-neck race between the Remain and Leave camps, so undecided voters will likely swing the vote and determine the final outcome. However, there is clearly a discrepancy between the polls and the market mood, as market sentiment continues to lean towards a victory by the Remain camp. This sentiment has boosted the pound, which is currently trading at 1.4850, its highest level in 2016. The Remain camp has warned that a vote to leave the EU would damage the UK economy, while the “Leave” vote has tapped into voter dissatisfaction with Brussels, particularly concerning immigration and over-regulation by the EU. The economic stakes are massive, as the UK economy of GBP 2.9 trillion is the fifth largest in the world and number two in Europe, after Germany. A vote to leave the comfort zone of the EU would be a journey into the unknown, with unpredictable economic and political consequences for both the UK and the European Union. If the Remain camp wins, investors would feel more comfortable buying risky assets, such as the New Zealand dollar.

Janet Yellen was cautious and tentative in testimony before Congress this week. She acknowledged that the US economy could face some adversity, saying that “[c]onsiderable uncertainty about the economic outlook remains”. Yellen said that she’s “hopeful that we will see a pickup in growth”, but skeptics might respond that the markets want to see action from the Fed and not just hope. The Fed has clearly been out of sync with the markets, as underscored by the Fed’s statements back in December that it might raise rates in 2016 up to four times. Meanwhile, here we are in June, and there’s no clear indication that the Fed will raise rates at all this year. In her testimony, Yellen said she does not expect the US economy to enter a recession, but if such a scenario did occur, the US would not follow Japan and Europe and adopt negative interest rates. On a more positive note, Yellen said that weak oil prices, low interest rates and stronger wage growth should support consumer spending.

NZD/USD Fundamentals

Sunday (June 26)

- 18:45 New Zealand Trade Balance. Estimate 185M. Actual 358M

Monday (June 27)

- 8:30 US Goods Trade Balance. Estimate -59.5B. Actual -60.6B

- 9:45 US Flash Services PMI. Estimate 52.0

Upcoming Key Events

Tuesday (June 28)

- 8:30 US Final GDP. Estimate 1.0%

- 10:00 US CB Consumer Confidence. Estimate 93.2

*Key releases are highlighted in bold

*All release times are EDT

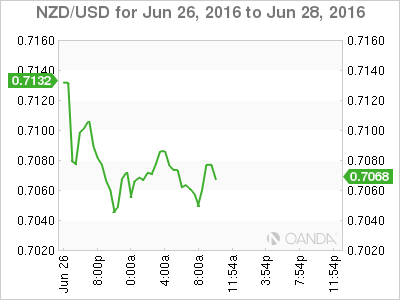

NZD/USD for Monday, June 27, 2016

NZD/USD June 27 at 9:15 EDT

Open: 0.7087 Low: 0.7041 High: 0.7100 Close: 0.7075

NZD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6897 | 0.7011 | 0.7100 | 0.7231 | 0.7319 | 0.7454 |

- NZD/USD was flat in the Asian session and has posted gains in the European session

- 0.7100 has strengthened in support as the NZD/USD continues to move higher

- 0.7231 was tested in resistance earlier and is a weak line. It could break in the North American session

- Current range: 0.7100 to 0.7231

Further levels in both directions:

- Below: 0.7100, 0.7011, and 0.6897

- Above: 0.7231, 0.7319 and 0.7454

OANDA’s Open Positions Ratio

NZD/USD ratio is unchanged on Thursday. Long positions command a majority (58%), indicative of trader bias towards NZD/USD continuing to move towards higher ground.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.