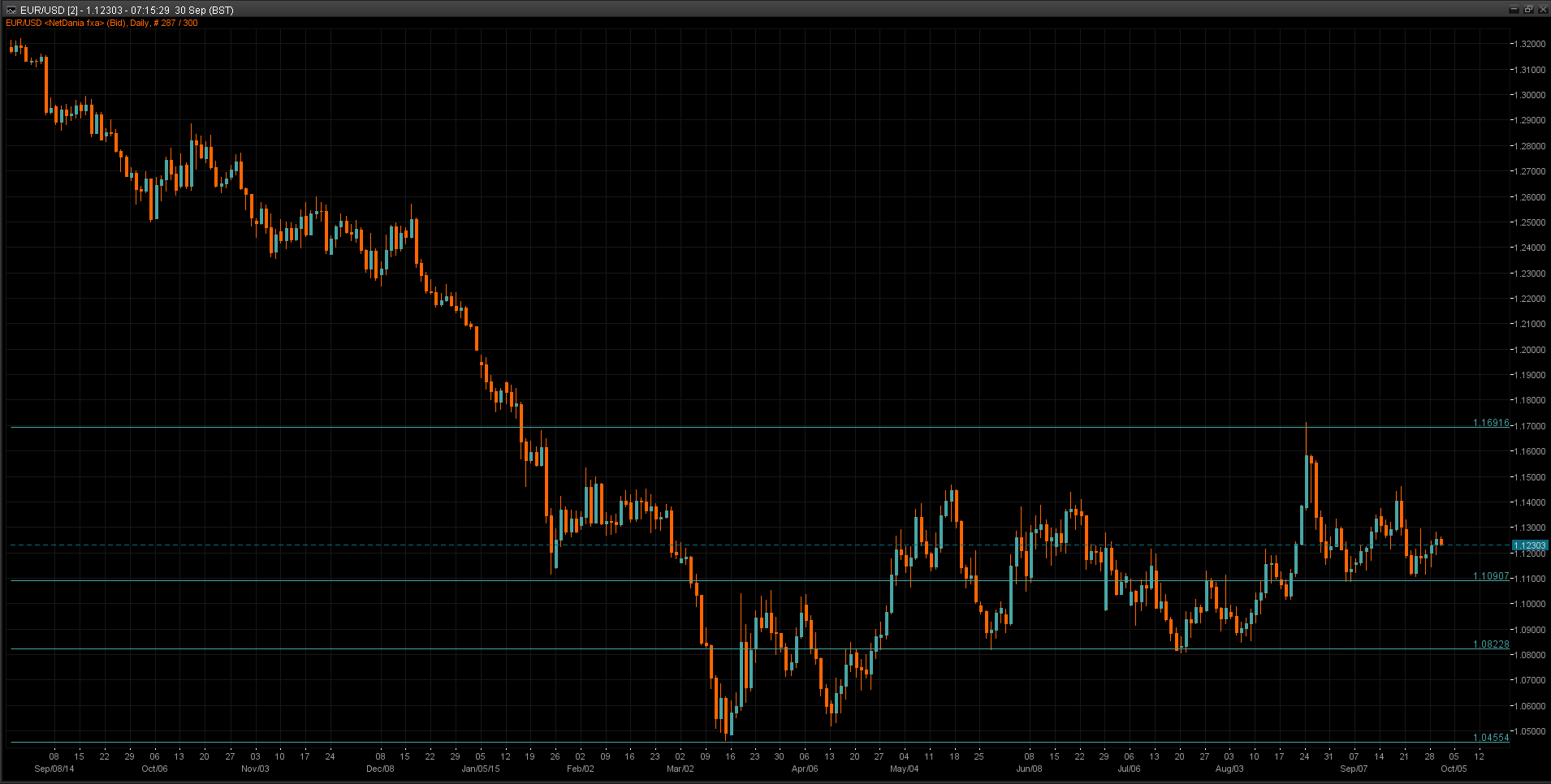

EUR/USD Outlook

Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR/USD weakened in European trading as September CPI showed the eurozone had dipped into deflation ( -0.1%) whilst core CPI came in unchanged at 0.9%. Players are now anticipating further ECB action with European equity markets benefiting from this anticipation.

Technical: While 1.12 contains intraday downside reactions, near term focus is on upper end of recent range, bulls now target stops above the 1.13 handle. A sustained breach of 1.12 sets up a retest of bids below the 1.11 handle

- Interbank Flows: Bids 1.12/1.1180, 1.1150/30 stops below. Offers 1.1310/30 1.1380 Stops above.

- Retail Sentiment: Neutral

- Trading Take-away: Sidelines. Caution around month/quarter end volatility today.

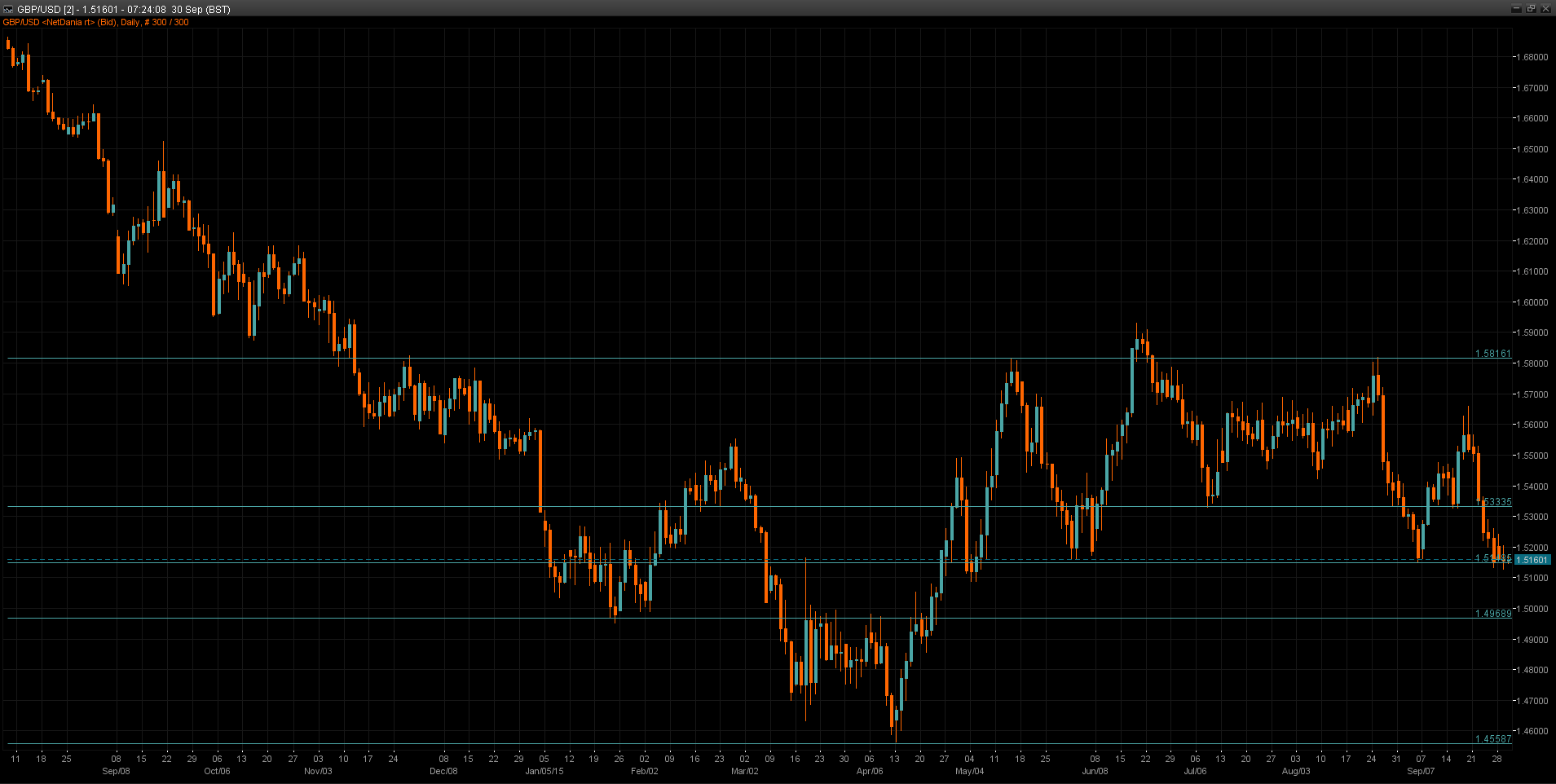

GBP/USD Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Sterling saw a sharp recovery in European trading as data showed the UK Current Account Deficit reduced significantly in the 3 months leading into June falling to £16.8 Billion from the expected £22.3 Billion

Technical: Currently testing 1.52 handle resistance. While 1.5250 caps intraday upside reactions expect stops below 1.5150 to be pressured as 1.50 psychological support is targeted next.

- Interbank Flows: Bids 1.5130/10 stops below Offers 1.5250/1.53 stops above.

- Retail Sentiment: Bullish

- Trading Take-away: Sell pullbacks against 1.5250 targeting 1.50. Caution around month/quarter end volatility today.

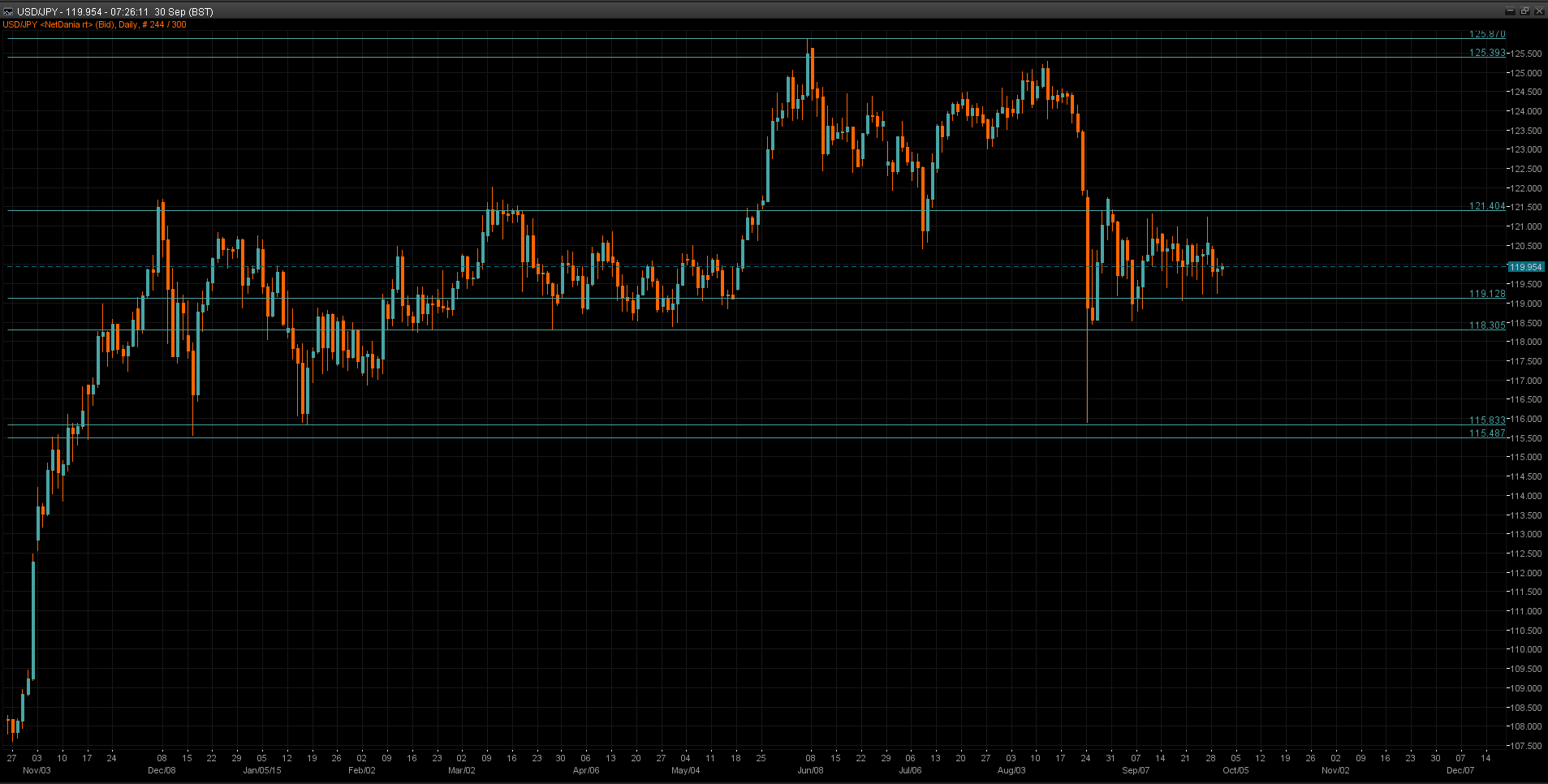

USD/JPY Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The Japanese yen weakened over the European session following comments made by one of Japanese PM Abe’s closest advisers that “Japan needs more economic stimulus to stave off a serious shock from China”.

Technical: Sharp reversal from test of the upper end of the recent range sees price retesting range support towards 119 where buyers emerge. Failure below 119 opens test of stops below the September low of 118.58 next. Likely range bound trade persists ahead of Friday’s NFP release.

- Interbank Flows: Bids 119/118.80, 118.50/30 stops below. Offers 120.50/80 stops above.

- Retail Sentiment: Bullish

- Trading Take-away: Sidelines for now.

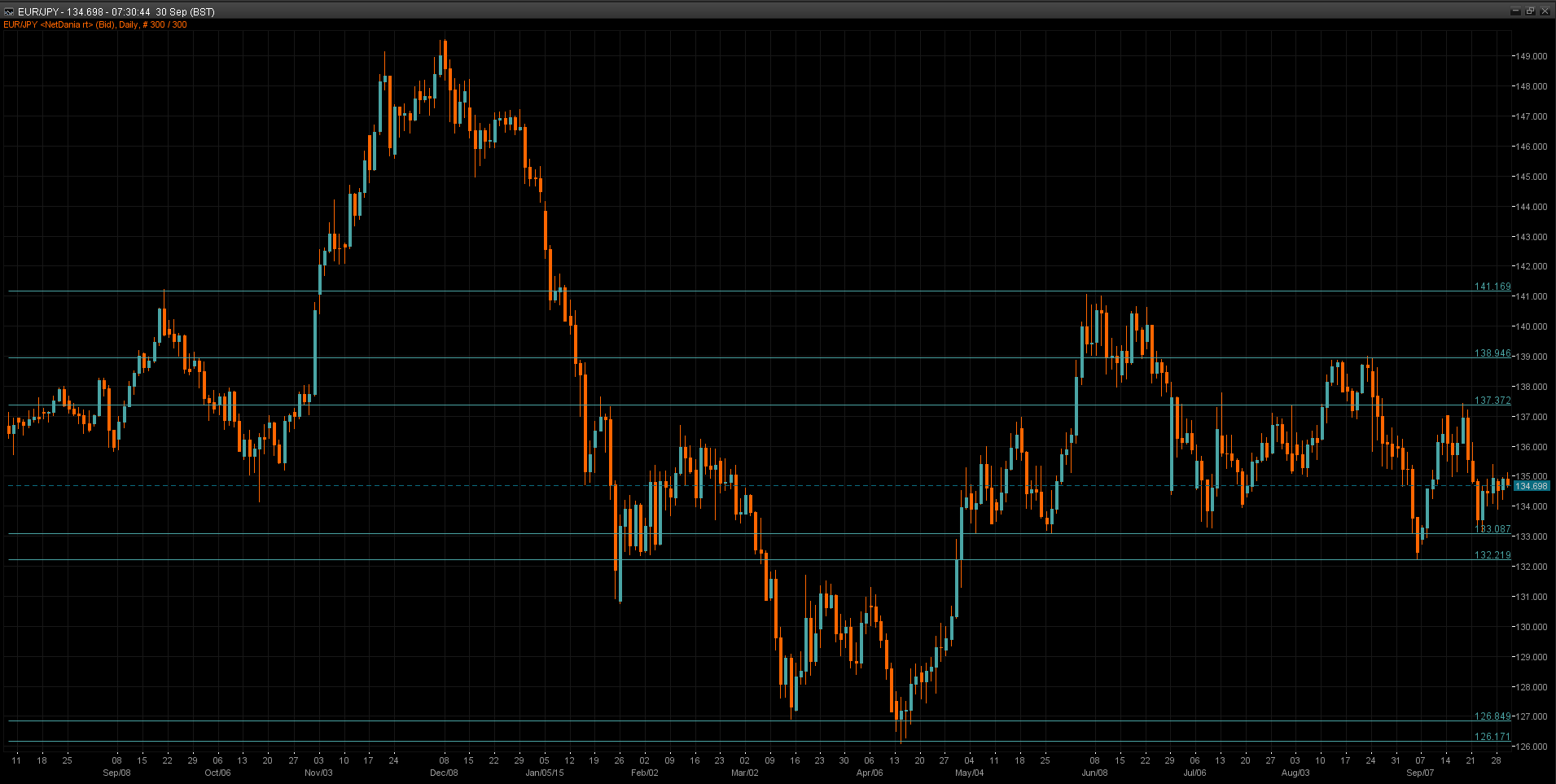

EUR/JPY Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental:Weak eurozone inflation data saw EUR/JPY retreating from its European sessions highs as price continues to be confined by cross flows, capped on the upside by a risk off JPY bid and supported on the downside buy the euro’s recovery above 1.12.

Technical: 135 offers continue to contain the upside reactions suggesting a rotation back to 132 through interim support at 134. A close above 135 opens a retest of upper end of the recent range and a retest of offers at 137 next.

- Interbank Flows: Bids 133.80/50 stops below. Offers 135.10/30. 135.50 stops above.

- Retail Sentiment: Neutral

- Trading Take-away: Sidelines for now.

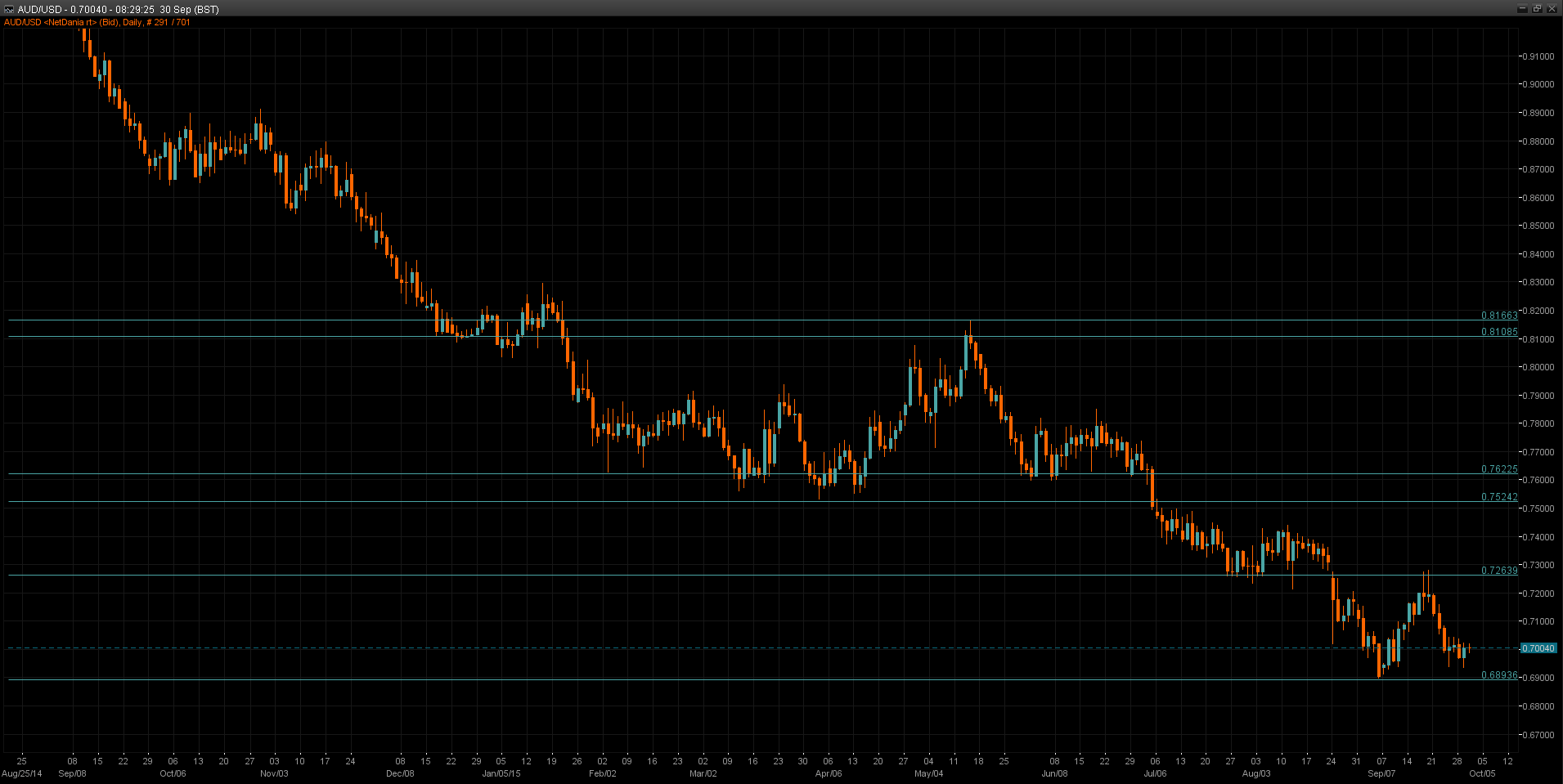

AUD/USD Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The Australian dollar regained some ground over European trading making its way back up to yesterday’s highs as AUD shorts see some reduction heading in to the NFP’s.

Technical: Price remains range-bound at lows for now though downside pressure persists, with stops below year to date lows of .6893 remaining vulnerable. While offers at .71 cap upside attempts bears targets new lows

- Interbank Flows: Bids .6850 stops below. Offers .7080/.7100 stops above.

- Retail Sentiment: Bullish

- Trading Take-away: Sidelines for now.

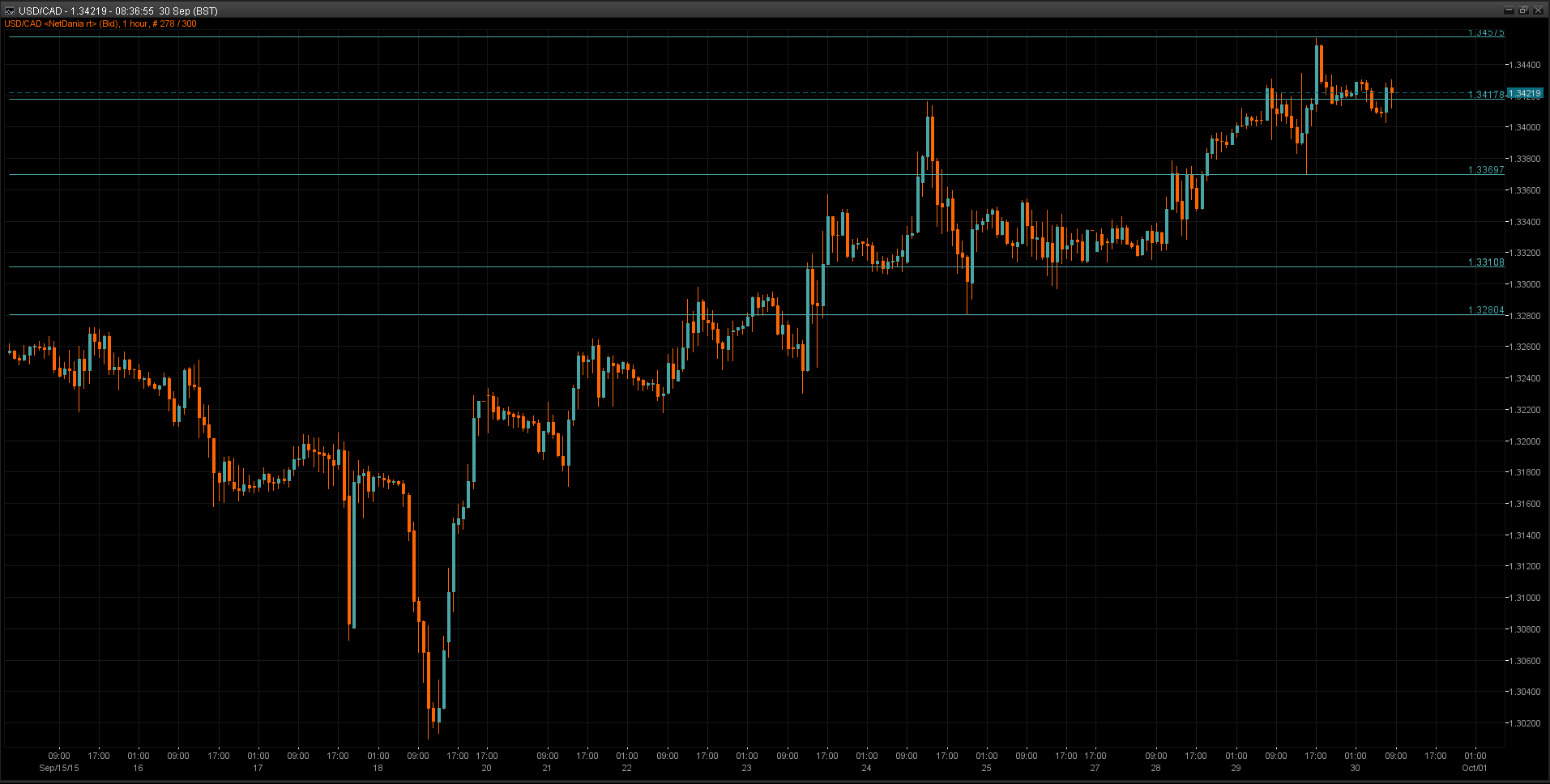

USD/CAD Outlook

Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: The Canadian dollar saw some reprieve over European trading as commodity currencies saw a light bid. Oil prices remain range-bound. Canadian GDP is the headline data for the session expected to show a slight improvement (0.7% expected vs 0.6% previous).

Technical: New highs for 2015 highs and for the past decade. While 1.34 supports intraday downside reactions expect new trend highs en route to test projected ascending trend line resistance at 138 next.

- Interbank Flows: Bids 1.33 stops below. Offers 1.35 stops above.

- Retail Sentiment: Bearish

- Trading Take-away: Sidelines for now.