As a general rule, the most successful man in life is the man who has the best information

New Carolin Gold Corp (TO:LAD) has acquired an additional 30% ownership in the Ladner gold project. Previously, LAD had a 10% undivided interest in the property that holds the core asset, plus 100% of the lower property that while on strike, does not as yet have a proven asset. The ownership of the property has been problematic for New Carolin for almost 3 years since Century mining went into bankruptcy. The market has punished LAD for a lack of clarity on ownership and specifically for the lack of a direct path to 100% ownership.

The transfer of this additional 30% interest is very significant for LAD shareholders, not just for the significant upgrade in their percentage ownership of the assets on the property (roughly an inferred resource of 750,000 oz at 4.5 g/t gold plus 28,000 inferred oz minimum in the tailings), but also because LAD now has a direct path to delivering on 100% ownership of the property.

LAD has an agreement in place with the receiver to acquire the 100% interest by raising $2 million towards developing the project. A key component of that agreement was the transfer of the 30% interest from Tamarlane to LAD, as the receiver did not directly control that 30%. Now, with the monies raised to date, plus the $200,000 loan facilitating the 30% transfer, Lad is just over one million dollars short of the 2 mil required to transact the further 60%.

Once LAD can claim 100% ownership, they will own the roughly 750,000 oz of inferred gold underground plus the 28,000 + oz in the tailings pond (drilled out on only 60% of the ponds surface). Based on the company raising the funds to complete the acquisition of the further 60 % interest, they should have funds allocated for a 2015 drill program. The management of New Carolin believes that their next drill program will have very meaningful targets that could further enhance the current resource.

Will these new developments be enough to put them in play as an acquisition target or perhaps to be of sufficient interest to financiers willing to put the property back in production? We don't know, but both prospects certainly exist and make this a very compelling story going forward.

There’s also considerable discovery upside left on the property.

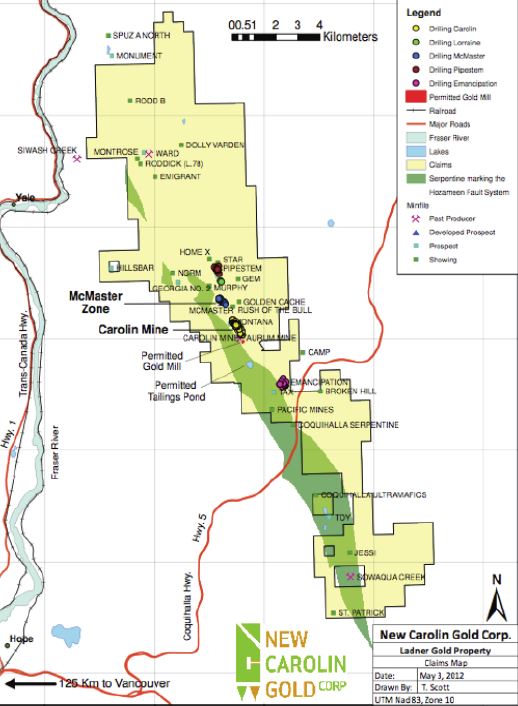

‘The Coquihalla serpentine belt is an elongate, north - northwest trending, steeply dipping ultramafic unit. The belt lies within a major crustal fracture, the Hozameen fault and exceeds 50 kilometers in discontinuous strike length. The serpentine belt reaches its maximum development in the Carolin mine-Coquihalla River area, where it is greater than two kilometers in width. It gradually narrows to the south (Manning Park area) and north (Boston Bar).’ Exploration in B.C. 1989, Ministry of Energy and Mines

New Carolin’s Ladner Gold Property follows the Hozameen fault structure for approximately 28 km and exceeds 144 square kilometers, covering substantially all of the accessible, yet still very underexplored, CGB.

The Ladner Gold Project contains several former underground producing gold mines and numerous gold prospects – more than 30 have been discovered so far. Approximately 11 gold showings have been found within a 2 km stretch north of the Carolin Mine.

A recently completed airborne geophysical survey indicated a major magnetic linear structure that can be traced for over 18 km within the company's claims. All the aforementioned gold prospects occur along this major magnetic anomaly, and there’s several kilometers of untested ground left along the structure to explore.

New Carolin is not only shaping up as a very low risk shot at a prospective near term producer, but also as a company with excellent potential for further discovery. The hair is rapidly coming off of this project.

Let’s get Jim Mustard, mining analyst and vice president of investment, mining and banking at Vancouver-based PI Financial, to bring this into perspective for us.

“The majority of M&A activity is focused on gold and copper projects. Grade is king now. Anything that can be sold as shovel-ready, and that is in a jurisdiction with clear permitting protocols, that is not subject to being derailed, and that has low to modest capital expenditures, will be sold.”

Conclusion

When I first started investing in the junior resource space, I was given some good advice by many people. One pearl of wisdom was this:

They do not come along very often, but many times the best investment is a good project screwed up by poor management. The best return on your money comes from a change of management coming in, taking over a great but screwed up project.

This is exactly the opportunity I believe is being presented by New Carolin.

The former owners went broke in Quebec, and the last management team that had the project were excellent promoters but horrible miners. LAD's 'modern' management teams have, shall we say, lacked the necessary talents, in my opinion, to successfully develop this project.

CEO and president Robert (Bob) Thast and the current BofD is cut from different cloth.

I've said it before, this is, rather was, a tired old play with a lot of hair on it, but that’s history.

Today is a new day. And for that reason, and a whole lot more good things to come, you need to have New Carolin Gold Corp. TSX.V-LAD on your radar screen.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of New Carolin Gold Corp. TSX.V-LAD