Last week, see here, we used the Elliott Wave Principle (EWP) to determine where the Nasdaq 100 could potentially top.

We expected,

“the orange W-3, 4, 5 sequences to complete over the next few hours/days to ideally the above-mentioned extension [red W-c/iii = 1.618x a/i extension at $15170+/-5, which is close to the 76.40% retrace of the 2021 all-time high to the 2022 low.].”

And we warned,

“note we are now talking about the most minor and most likely final wave of the rally since the late April low. So, risk management is prudent at this stage. Once the orange W-5 completes, the red W-iv? will likely kick in, bringing the price of the NDX back to ideally $14230, akin to the green waves 3 and 4 we discussed. Then another red W-v to ideally $15565+/-75 should commence.”

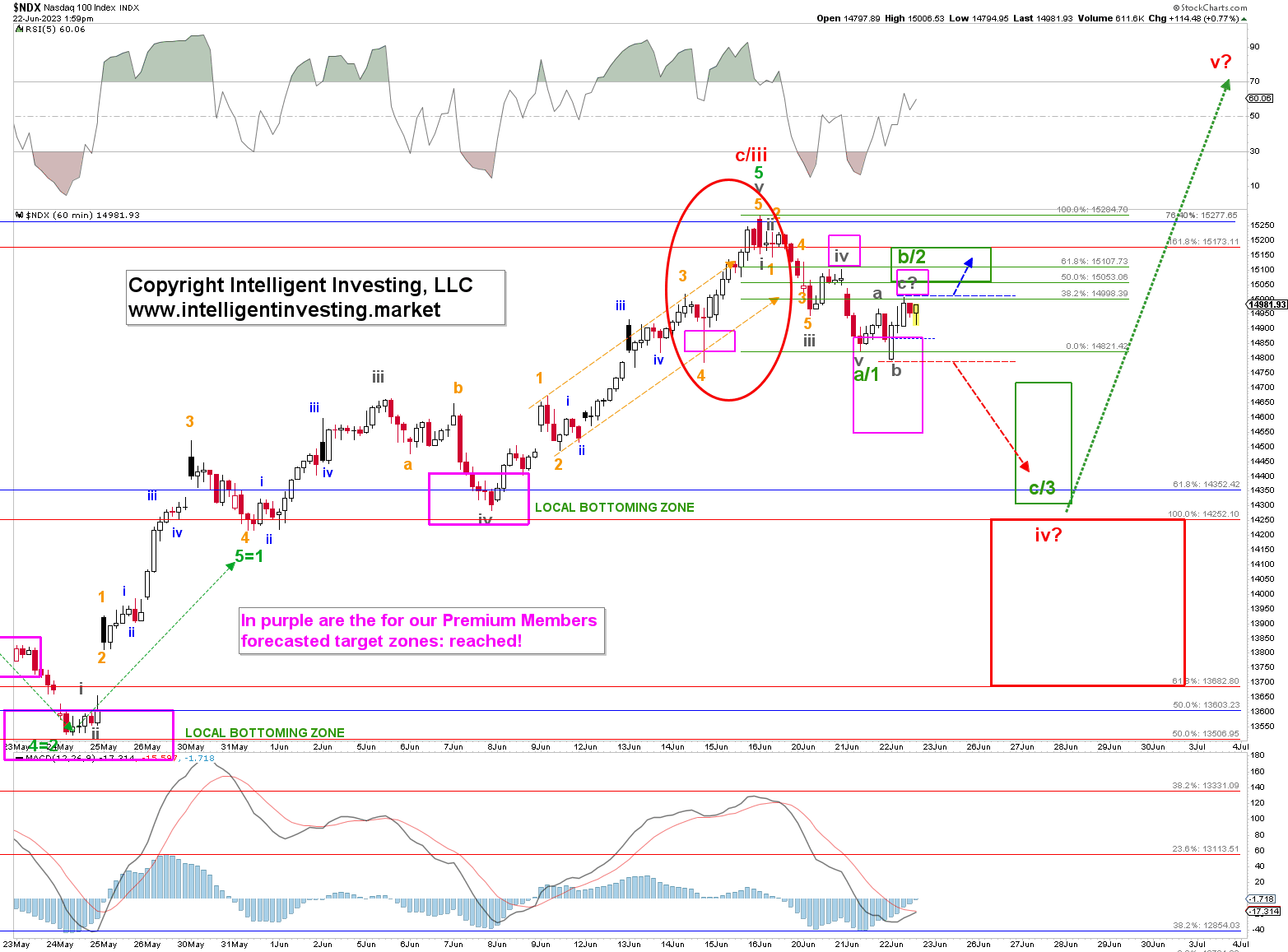

Fast forward, and the index peaked last Friday at the open at $15284 after completing the orange W-3, 4, and 5 sequences. See the red circle in the hourly chart in Figure 1 below.

Figure 1. Nasdaq 100 hourly resolution chart.

Our top target was only off by 0.65%, and now we are looking for the NDX to complete its correction between ideally $14250-14350 with a possibility of going as low as $13685. The former price target zone is where the green W-c/3 target zone gets close to the blue 61.80% level, and the red W-iv? target zone. Thus, there’s good confluence in that region, which is often a magnet for the market, like where last week’s top occurred.

The market is in a corrective phase and should be in a counter-trend rally: green W-b/2. If the index drops below today’s low, this wave has likely already ended as there are technically enough scribbles (grey W-a, -b, and -c) in place to consider it complete: dotted red arrow. We will then look for the green W-c/3. But, corrections of corrections are often the most complicated price structures, so we can allow for another small rally towards the $15050-15150 zone first before W-c/3 commences: blue dotted arrow.

Regardless of where precisely the green W-b/2 will top, we anticipated another leg lower, which should present us with a low-risk buying opportunity for the red W-v to ideally $15565+/-75 (green dotted arrow).

At this stage, we cannot narrow the green W-c/3 target zone more than shown because we do not know yet if the green W-b/2 has topped and what the relationship between W-a/1 and W-c/3 will be. Or in other words, we cannot look around two corners at once, although we have a reasonably good idea of what should lie around that 2nd corner.

Lastly, if we see five green waves lower -why we labelled the current price action green W-a/1, b/2, c/3 because there’s always a possibility of a W-4 and W-5- there will be no red W-v to $1565+/-75.