The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday uncertain.

- ES pivot 1962.75. Holding above is bullish.

- Rest of week bias lower technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Right at the open last Friday, ES began knocking on the door of the daily pivot. Then at 0:45 AM, it just took off and that was that. Once again, my conditional call worked (though it doesn't always). Now we move on, as always to another new week.

The technicals

The Dow: On Friday, the Dow gained a handy 123 points to recoup most of Thursday's losses and regain the 17K level. Interestingly though, all this action was outside the rising RTC so that's technically a bearish trigger. Equally importantly, it formed a bearish stochastic crossover. So this big move wasn't necessarily good news. The Dow to me appears to be low on mojo at these levels.

The VIX: Last Thursday night I wasn't willing to commit to anything more than "possibly a move lower" in the VIX on Friday. Turned out to be a good possibility as the VIX cratered 17%, gapping right back down through the 200 day MA and upper BB® it blasted above a day earlier. The net result is a bearish inside harami so in the absence of any overextended indicators, I have to guess the VIX goes lower again Monday. A similar move in VVIX supports this idea.

Market index futures: Tonight all three futures are lower at 12:22 AM EDT with ES down 0.05%. On Friday ES gave us a nominally bullish candle, barely bullish engulfing but unable to crack resistance at 1972.

ES daily pivot: Tonight the ES daily pivot ticks up from 1959.33 to 1962.75. That still leaves ES reasonably above the new pivot so this indicator continues bullish. Indicators have turned lower so there really isn't any clear direction here right now.

Dollar index: I called the dollar lower for Friday and that was just barely wrong as the dollar now seems to be consolidating in the 54.76 area (on USDUPX) floating just above its 200 day MA. But with three dojis in a row, indicators now are showing highly overbought conditions, and a good bearish stochastic crossover in place, I'm going to call it lower once again. Hey, I have to be right sooner or later.

Euro: And the euro is pretty much the mirror image of the dollar with a tall star on Friday and oversold indicators. The new overnight is trading higher outside a short descending RTC so I'll guess we could go higher on Monday.

Transportation: My best hope here last Thursday was for a DCB. Instead, the Trans took off, retracing all of Thursday's losses and then some for a bullish engulfing pattern that closed right on the upper BB. That much is good news, but we still have a strong resistance area around 8390 to breach and after Friday's big 1.28% pop, it's not clear that there remains enough gas in the tank to move much higher on Monday.

Maybe it's the geopolitical news, maybe the dog days of summer are starting to bark, but I'm not getting a good read on things tonight. There's a lot of drifting going on and it's hard to extrapolate from that. So I'm just going to punt and call Monday uncertain. It may be time to gear up for a summer vacation.

ES Fantasy Trader

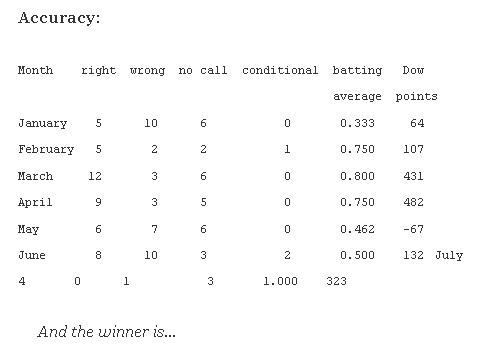

Portfolio stats: the account remains at $113,000 after seven trades in 2014, starting with $100,000. We are now 5 for 7 total, 3 for 3 long, 2 for 3 short, and one push. Tonight we stand aside.