Economic growth in the US remains on a steady path, according to a markets-based estimate of the macro trend. The Macro-Markets Risk Index (MMRI) closed at +6.8% yesterday (Mar. 9). The benchmark’s readings so far this year have remained in a tight band of roughly +5% to +10% — a signal for anticipating ongoing economic growth. A decline below 0% in MMRI would indicate that recession risk is elevated; readings above 0% imply that the economy will expand in the near-term future.

MMRI represents a subset of the Economic Trend & Momentum indices (ETI and EMI), a pair of benchmarks that track the economy’s broad trend for signs of major turning points in the business cycle via a diversified set of indicators. (For details about ETI and EMI, see my book on monitoring the business cycle.) Analyzing the market-price components separately offers a real-time approximation of macro conditions, according to the “wisdom of the crowd.” Why look to the capital and commodity markets for insight into the economic trend? Timely signals. Conventional economic reports are published with a time lag. MMRI is intended for use as a supplement for developing real-time perspective until a complete set of data is published for updating the monthly economic profile.

MMRI measures the daily median change of four indicators based on the following calculations;

• US stocks (S&P 500), 250-trading day % change

• Credit spread (BofA ML US High Yield Master II Option-Adjusted Spread), inverted 250-trading day % change

• Treasury yield curve (U.S. 10-Year Treasury yield less 3-Month T-bill yield)

• Oil prices (iPath S&P GSCI Crude Oil Total Return Index ETN (NYSE:OIL)), inverted 250-trading day % change

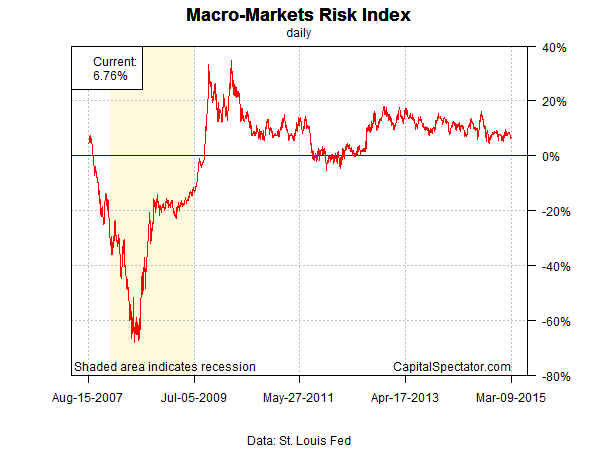

Here’s how MMRI compares on a daily basis since August 2007:

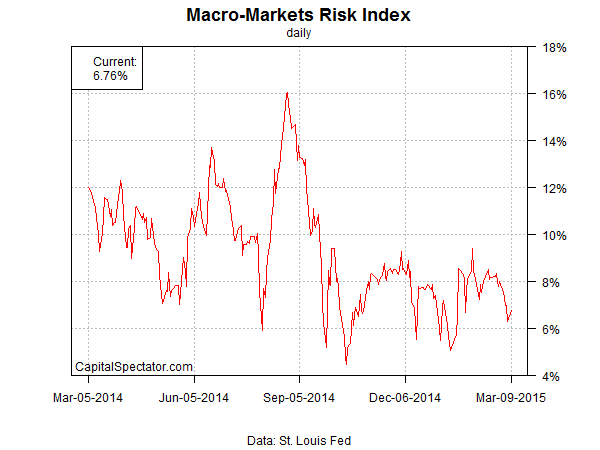

Here’s a closer look at how MMRI compares on a daily basis over the past year: