The Canadian dollar has been edging lower over the past few weeks despite stronger than expected job growth as the Canadian economy continues to adjust to a decline in oil prices. While The Bank of Canada expects growth to return in Q4, the economy still has a considerable way to go before it reaches self-sustaining growth. In contrast, the Fed appears hell bent on beginning the interest rate normalization process in December. This should drive the dollar higher, and if oil prices continue to decline, the Loonie will continue to trade under pressure.

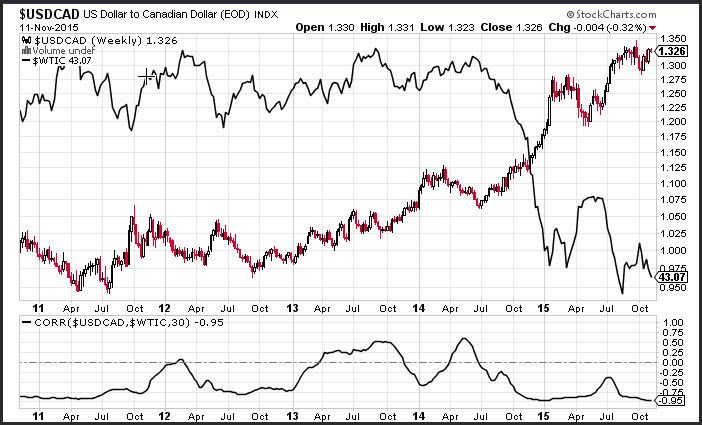

The 2-year yields differential between the U.S. and Canada bottomed out in August, as global growth concerns took center stage. When these concerns subsided the downside risks to Canada's growth were trimmed allowing the 2-year yield to rise, in tandem with U.S. yields. Stronger than expected jobs growth in Canada and the U.S. kept rates nearly lock stepped. It appears that the Canadian dollar is inversely correlated with the price of WTI crude oil which might be more of a driving factor than its interest rate differential with the U.S. The chart below shows the USD/CAD and WTI prices over the past 5-years. Although the rolling 30-week correlation oscillates, it reflects a negative reading most of the time and the current print of -0.95 means that the moves are nearly perfectly inversely correlated.

That means as the price of oil moves lower by 1%, the USD/CAD will move higher by approximately 0.95%. The correlation coefficient measures the change in the performance between two or more assets, and reflects how well these performances move in tandem with one another.

As the dollar continues to gain traction with higher yields against most major currencies, oil prices might continue to face headwinds. This could have a dual negative effect on the USD/CAD and push the current pair to multi-year highs.