EUR/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR failed to break the 1.1400 handle yesterday due to the worse than expected local macroeconomic data, German’s September inflation kept unchanged at 0.0% from a year before, Monthly CPI fell 0.2% and the Economic sentiment declined during Oct from 12.1 to 1.9 from the ZEW economic survey. Currently testing over 1.14 as of writing.

Technical: Price is pressuring 1.14 offers, while 1.1340/60 supports intraday downside reaction bulls now targets 1.1460 as the next upside objective.

Interbank Flows: Bids 1.1330/50 stops below. Offers 1.1460 Stops above.

Retail Sentiment: Bearish

Trading Take-away: Stay long for 1.15

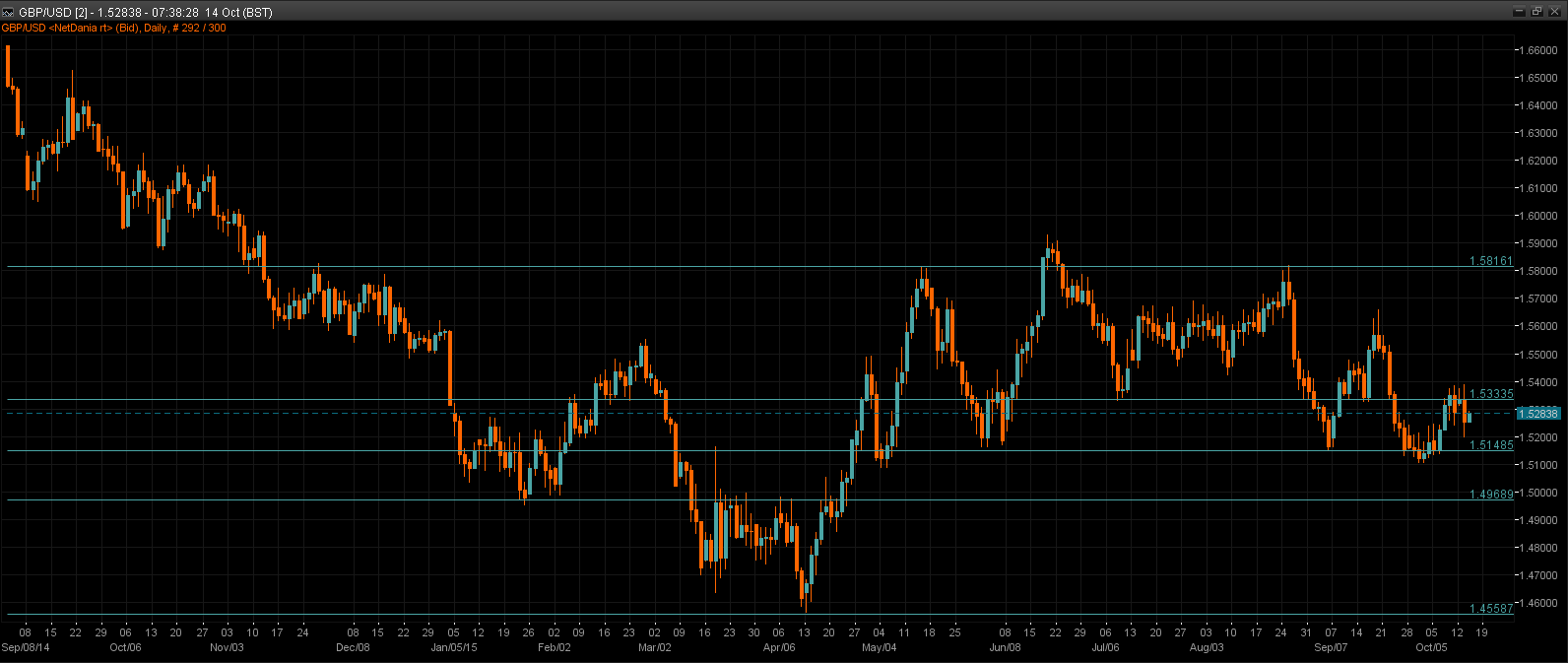

GBP/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Despite an early gain in GBP on the SABMiller (L:SAB) deal, both headline and core CPI from the UK undershot expectations, surprising the markets on the downside. The cable fell sharply from intra-day high of 1.5387 to current level of 1.5250 levels. With a negative reading of CPI figures, the BOE will take a closer look at Average Earnings data and employment reports due today so as to consider when to raise interest rates.

Technical: Sharp reversal from 1.54 supported at 1.52 while 1.53 caps intraday upside reactions expect a retest and breach of 1.5150. A sustained move over 1.53 targets retest of 1.54 en route to 1.55. 1.53 key battle ground today.

Interbank Flows: Bids 1.52 stops below. Offers 1.54 stops above

Retail Sentiment: Bearish to neutral

Trading Take-away: Sidelines for now

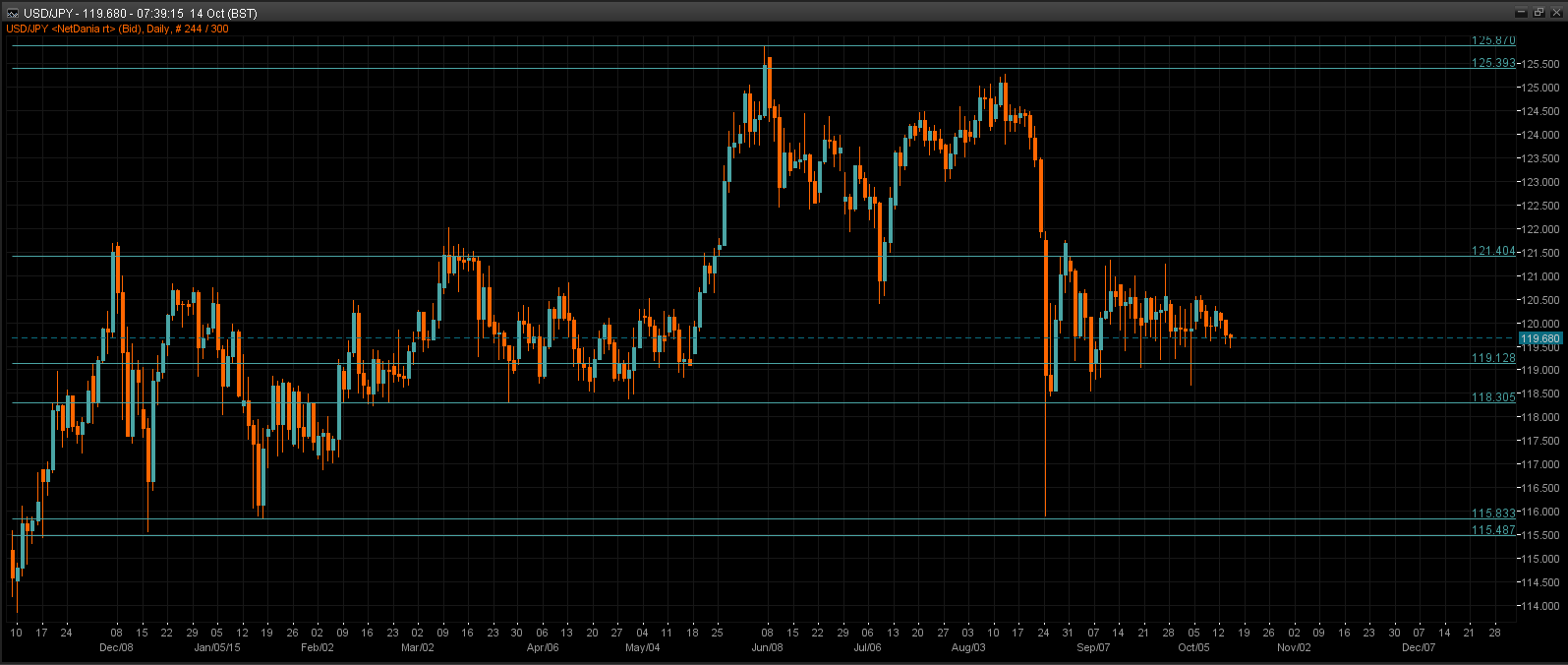

USD/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY rose to 119.53 JPY per USD, its highest since 2 Oct. However, the currency was capped by expectations that the Bank of Japan might announce stimulative measures at the end of this month. Risk sentiment turned down by unsatisfactory China trade data and namely a 20.4% slump in imports, once again raised concerns about global growth. JPY was supported by risk off mood as a result.

Technical: Continues to coil in contracting range, play range 121.50 the offer and 118.50 the bid until broken.

Interbank Flows: Bids 118.50/30 stops below. Offers 121.50 stops above

Retail Sentiment: Neutral to bullish

Trading Take-away: Sidelines for now

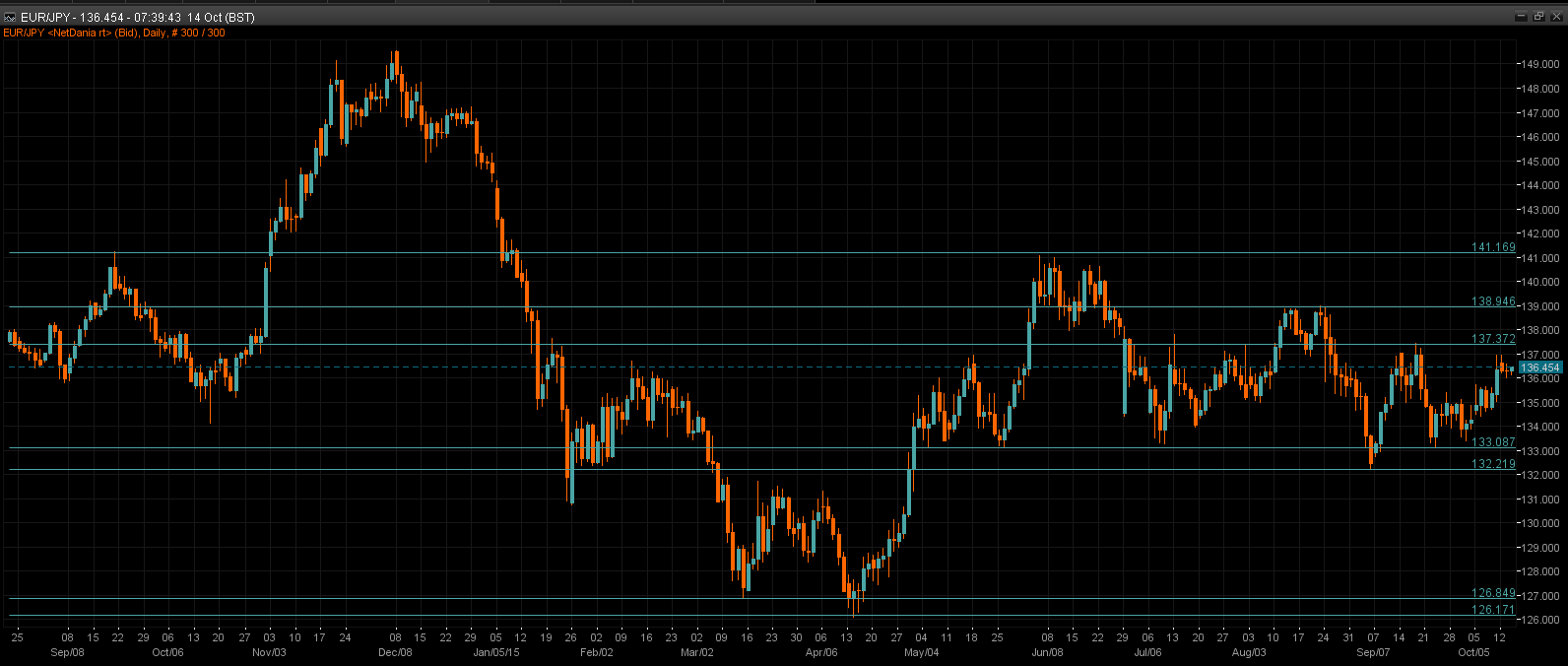

EUR/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Weighed yesterday by softer equities, but still holding in upper end of recent range due to positive EUR cross flows.

Technical: The close above 136 opens a retest of upper end of the recent range and a retest of offers at 137 next. Remain bullish while 135.80/136 supports intraday downside reactions.

Interbank Flows: Bids 135.80 stops below. Offers 137 stops above

Retail Sentiment: Neutral to bearish

Trading Take-away: Sidelines for now

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: The AUD gave up all of its Monday gain on weaker-than-expected Chinese import data. Despite a better reading of overall trade balance data, a twenty percent drop in imports YoY raised market concerns of the strength of the Chinese economy, prompting a sell-off in commodity prices.

Technical: Breach of .7300 support turns near term sentiment neutral. While .7300 caps intraday upside reactions, expect another corrective leg to target pivotal .7040 symmetry support. A breach of .7300 targets a retest of .7400 offers.

Interbank Flows: Bids .7200 stops below. Offers .7400 stops above

Retail Sentiment: Bearish to neutral

Trading Take-away: Sidelines for now

USD/CAD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bullish

Fundamental: CAD weakened against US dollar yesterday, upset by a sharp drop in oil prices and miserable trade figures out of China. Investors worry that the oil market remains oversupplied while the price of crude ended at $46.66 a barrel. The Canadian dollar is highly sensitive to the price of oil, which is a major export for Canada.

Technical: Near term bearish tend remains intact as intraday resistance at 1.3060 contains intraday upside reactions bears target 1.2850 bids as the next downside objective. A breach of 1.3080 opens test of 1.3130/50 offers next.

Interbank Flows: Bids 1.2890 stops below. Offers 1.3060 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines for now