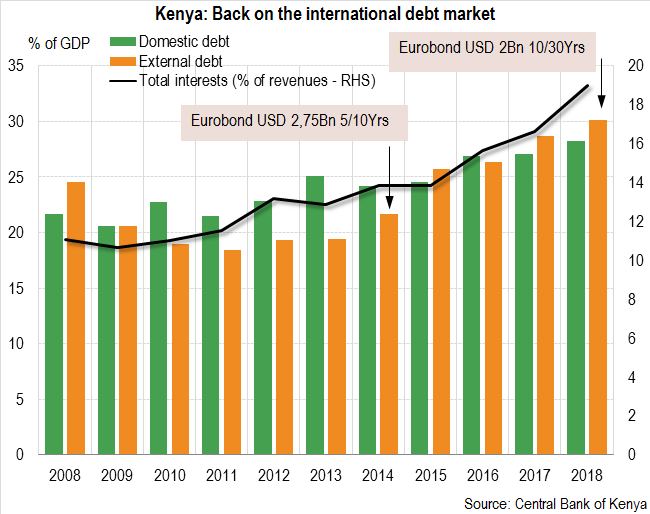

The political appeasements along with several reforms to improve the business climate have allowed a macroeconomic recovery since 2018 in Kenya. However, the fiscal position remains weak: on one side, budget deficits have reached an average of 8% of GDP over the last five years; on the other side, debt interests have attained 21% of estimated revenues in 2018 against 13% in 2014.

Moreover, the increasing tapping of non-concessional external loans is a growing vulnerability: in May, Kenya issued its third Eurobond for an amount of 2.1 billions of dollars, in two tranches with 7-year and 12-year tenors. Country’s repayment ability has lessened and the government has restarted the negotiations with the IMF to obtain a new financing agreement in 2019, after the previous loan’s expiration in 2018. But this will depend on efforts to redress fiscal accounts and remove the rate cap on the banking system.

By Sara CONFALONIERI