In the FT this weekend, Prasenjit Basu writes that China’s crisis is coming — the only question is how big it will be.

…financial crisis in China has become inevitable. If it happens soon, its effects can be contained. But, if policy makers use further doses of stimulus to postpone the day of reckoning, a severe collapse will become unavoidable within a few years.

The country is in the middle of by far the largest monetary expansion in history. On one widely used measure, M2, its money supply has tripled in the past six years, an expansion four times as large as that of the US over the same period…

…China’s economy is in an unbalanced state. It can stay that way for some time – but the longer it does, the worse the eventual outcome will be. The industrial sector is already plagued by falling prices. To avert a wider deflationary spiral, the country needs to wean itself off the false cure of perpetual policy stimulus.

We’re bemused by this perspective.

On the one hand — “duh.” Virtually everything we know about financial history and long-run economics says that policies of artificial growth, overlaid with serious corruption and capital misallocation, aren’t sustainable. Then too you have stories like these:

- Huge strike in southern China over more than just wage demands (Economist)

- Middle-class now fleeing China as well as the rich (Economist)

- Chinese replace Russians as top foreign apartment buyers in Manhattan (Reuters)

At some point — we know not when — there is going to be a huge mess. But the trader in us shrugs and says “Meh. Where’s the opportunity?”

It’s hard to get excited about the downside of China… when one remembers Japan.

Shorting Japanese Government Bonds (Japan Govt. Bonds) was supposed to be a slam-dunk. The whole impossible Japan debt structure (200% of GDP etc blah blah) was supposed to have imploded something like, what, ten years ago? Twenty?

Shorting JGBs thus became known as the “widowmaker trade” because so many traders lost their butts on something that HAD to happen, that was so compelling and just around the corner. (Oops…)

But predictions of doom are lower probability in the real world simply by their nature. It’s sort of like going to the doctor and testing positive for an extremely rare disease. If the actual statistical occurrence of the disease is, say, one out of 10,000 people, then you have to probability-adjust for a greater likelihood the test gave a false positive. (The standard margin of error on the test, as a percentage, is magnified by real-world rarity of occurrence, something that many doctors frighteningly don’t understand.)

At any rate, we see China as fraught with real and serious problems. But, as with Japan, they are more “slow crisis” problems than issues of immediate blow-up.

The idea that China will “dominate” the 21st century, and strike fear into the hearts of American capitalists the way Japan did in the 1980s, seems laughable. There will be too many fires for China to put out — to many creeping problems to manage. As for a dramatic result though? Probably not.

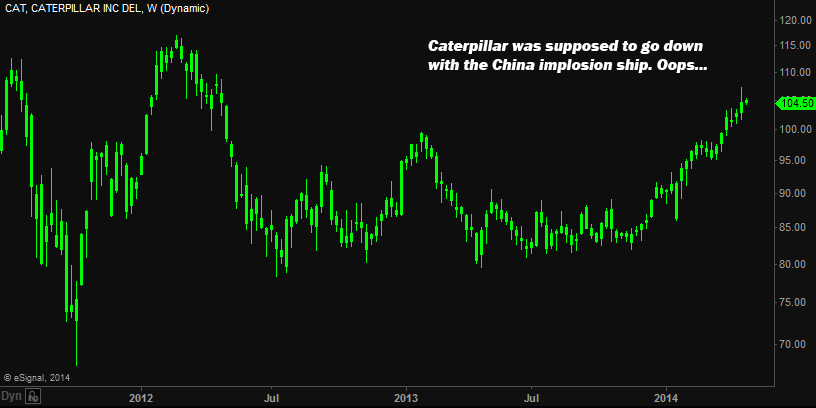

If China serves as a widowmaker for bearish macro guys, it could be through vehicles like Caterpillar Inc (NYSE:CAT). Stuff that was supposed to have imploded a long time ago via “obvious” tie-ins to the China implosion thesis, but nope.

China itself, and the confounding nature of “the China trade,” is yet another reason to emphasize respect for probability and price. If China really does implode — and it could, for reasons we listed in detail some time back — we will be Johnny-On-The-Spot. But price will give us a heads up if that happens.

Until then, take doom calls with a grain of salt (or maybe a whole shaker).